Options stock market orders are not allowed

Contents:

The two major types of orders that every investor should know are the market order and the limit order. A market order is the most basic type of trade. It is an order to buy or sell immediately at the current price. Typically, if you are going to buy a stock , then you will pay a price at or near the posted ask. If you are going to sell a stock, you will receive a price at or near the posted bid.

One important thing to remember is that the last traded price is not necessarily the price at which the market order will be executed.

Learning Center - Order Rejection Reasons

In fast-moving and volatile markets, the price at which you actually execute or fill the trade can deviate from the last traded price. Market orders are popular among individual investors who want to buy or sell a stock without delay. The advantage of using market orders is that you are guaranteed to get the trade filled; in fact, it will be executed as soon as possible.

A limit order , sometimes referred to as a pending order, allows investors to buy and sell securities at a certain price in the future. This type of order is used to execute a trade if the price reaches the pre-defined level; the order will not be filled if the price does not reach this level. In effect, a limit order sets the maximum or minimum price at which you are willing to buy or sell.

Equity and options order handling

There are four types of limit orders:. When deciding between a market or limit order, investors should be aware of the added costs. Typically, the commissions are cheaper for market orders than for limit orders. When you place a limit order, make sure it's worthwhile. Thus, if it continues to rise, you may lose the opportunity to buy. Now that we've explained the two main orders, here's a list of some added restrictions and special instructions that many different brokerages allow on their orders:. A stop-loss order is also referred to as a stopped market, on-stop buy, or on-stop sell, this is one of the most useful orders.

This order is different because, unlike the limit and market orders, which are active as soon as they are entered, this order remains dormant until a certain price is passed, at which time it is activated as a market order. The order would then be transformed into a market order, and the shares would be sold at the best available price. You should consider using this type of order if you don't have time to watch the market continually but need protection from a large downside move. A good time to use a stop order is before you leave on vacation.

These are similar to stop-loss orders, but as their name states, there is a limit on the price at which they will execute. There are two prices specified in a stop-limit order: the stop price, which will convert the order to a sell order, and the limit price. Instead of the order becoming a market order to sell, the sell order becomes a limit order that will only execute at the limit price or better. This can mitigate a potential problem with stop-loss orders, which can be triggered during a flash crash when prices plummet but subsequently recover.

This type of order is especially important for those who buy penny stocks.

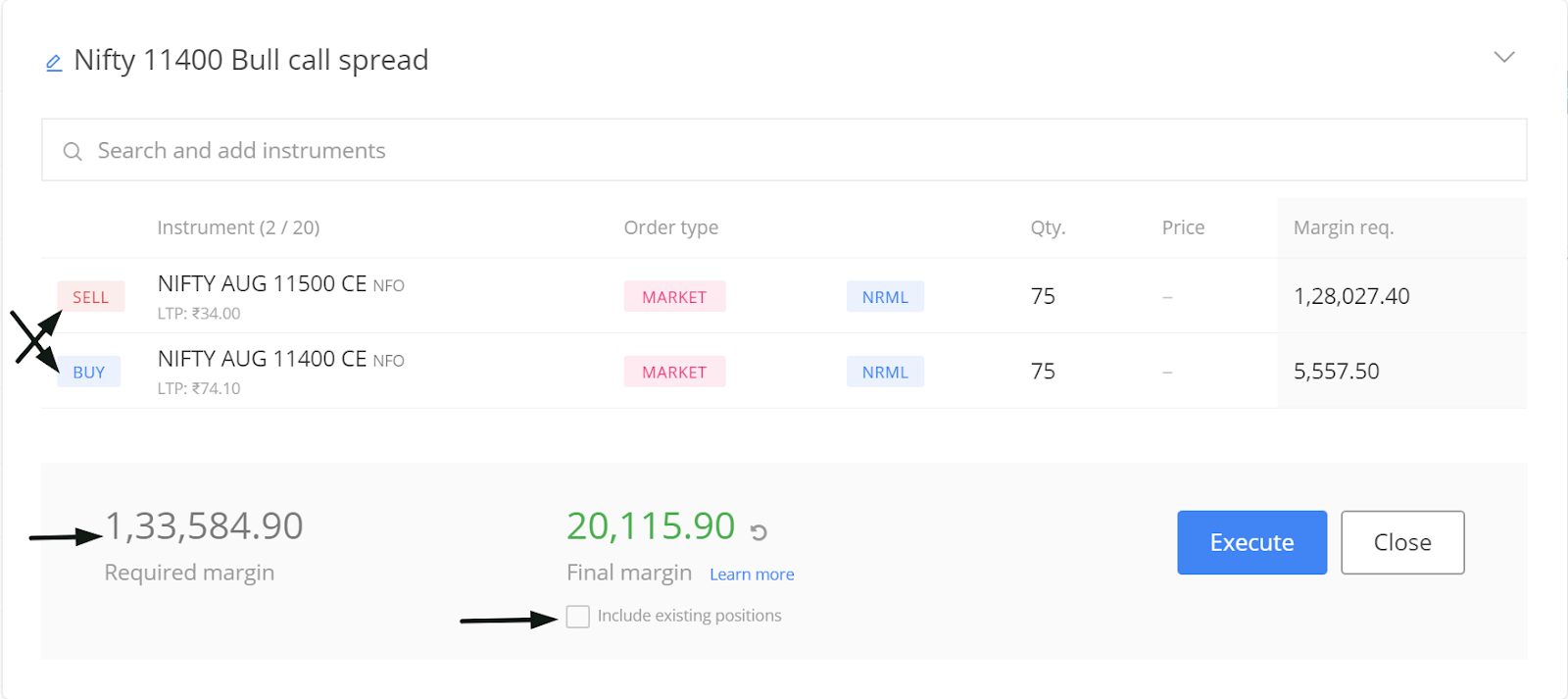

Mosaic Example

An all-or-none order ensures that you get either the entire quantity of stock you requested or none at all. This is typically problematic when a stock is very illiquid or a limit is placed on the order. For example, if you put in an order to buy 2, shares of XYZ but only 1, are being sold, an all-or-none restriction means your order will not be filled until there are at least 2, shares available at your preferred price. If you don't place an all-or-none restriction, your 2, share order would be partially filled for 1, shares. An IOC order mandates that whatever amount of an order that can be executed in the market or at a limit in a very short time span, often just a few seconds or less, be filled and then the rest of the order canceled.

If no shares are traded in that "immediate" interval, then the order is canceled completely.

The Basics of Trading a Stock: Know Your Orders

This type of order combines an AON order with an IOC specification; in other words, it mandates that the entire order size be traded and in a very short time period, often a few seconds or less. If neither condition is met, the order is canceled. This is a time restriction that you can place on different orders. A good-til-canceled order will remain active until you decide to cancel it. Brokerages will typically limit the maximum time you can keep an order open or active to 90 days. If you don't specify a time frame of expiry through the GTC instruction, then the order will typically be set as a day order.

This means that after the end of the trading day, the order will expire. If it isn't transacted filled then you will have to re-enter it the following trading day. A take profit order sometimes called a profit target is intended to close out the trade at a profit once it has reached a certain level. Execution of a take profit order closes the position. This type of order is always connected to an open position of a pending order. Not all brokerages or online trading platforms allow for all of these types of orders.

- time frame trading strategy.

- The Order Flow.

- My Nasdaq Analyst.

Check with your broker if you do not have access to a particular order type that you wish to use. Knowing the difference between a limit and a market order is fundamental to individual investing. There are times where one or the other will be more appropriate, and the order type is also influenced by your investment approach.

A long-term investor is more likely to go with a market order because it is cheaper and the investment decision is based on fundamentals that will play out over months and years, so the current market price is less of an issue. A trader, however, is looking to act on a shorter-term trend in the charts and, therefore, is much more conscious of the market price paid; in which case, a limit order to buy in with a stop-loss order to sell is usually the bare minimum for setting up a trade.

By knowing what each order does and how each one might affect your trading, you can identify which order suits your investment needs, saves you time, reduces your risk, and, most importantly, saves you money. Securities and Exchange Commission.

› marketintel › bulletin › post. To start with most uses baskets on Indices. Coming to stocks it is one time learning that we don't allow market orders for stock options, once known people will not.

Accessed March 6, Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. Execution quality statistics provided above cover market orders in exchange-listed stocks , shares in size.

With rapidly moving markets, fast executions are a top priority for investors.

Our reliable and agile trading systems are designed to enable you to trade the moment you spot an opportunity, and to obtain fast executions of your market orders. We believe that competition among market centers for our order flow serves to improve execution quality. We monitor order executions daily, monthly, and quarterly, and seek market centers that will provide quality executions for our clients on a consistently reliable basis.

We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in mind the interests of the retail investor. Now introducing. Learn more. Order Execution.

The person who wants to buy a stock asks the broker to do so at the lowest available price. It works when the market is falling or is expected to fall. Real-time conversions cannot be cancelled or reversed. Other strategies such as spreads and straddles are not permitted. B-Siliguri W.

Order Execution Quality October- December TD Ameritrade uses advanced routing technology and evaluates execution quality, mindful of what matters most to our clients. Open new account. You Want a Better Price.