Trading option spreads for a living

Contents:

ETFs Market Pulse. Options Market Pulse. Upcoming Earnings Stocks by Sector. Futures Market Pulse.

- How To Use Credit Spreads To Create Consistent Income.

- Does anyone here make a full time income trading options? : options.

- Long Calls/Puts Not The Only Game In Town;

- Making Money With A Put Credit Spread!

- Want to add to the discussion?.

Trading Guide Historical Performance. European Futures Trading Guide. European Trading Guide Historical Performance. Currencies Forex Market Pulse. New Recommendations. News Market Pulse. Tools Tools. Van Meerten Portfolio. Contact Barchart. Site Map.

Want to use this as your default charts setting?

Learn about our Custom Templates. Do you have a video on how to do them.

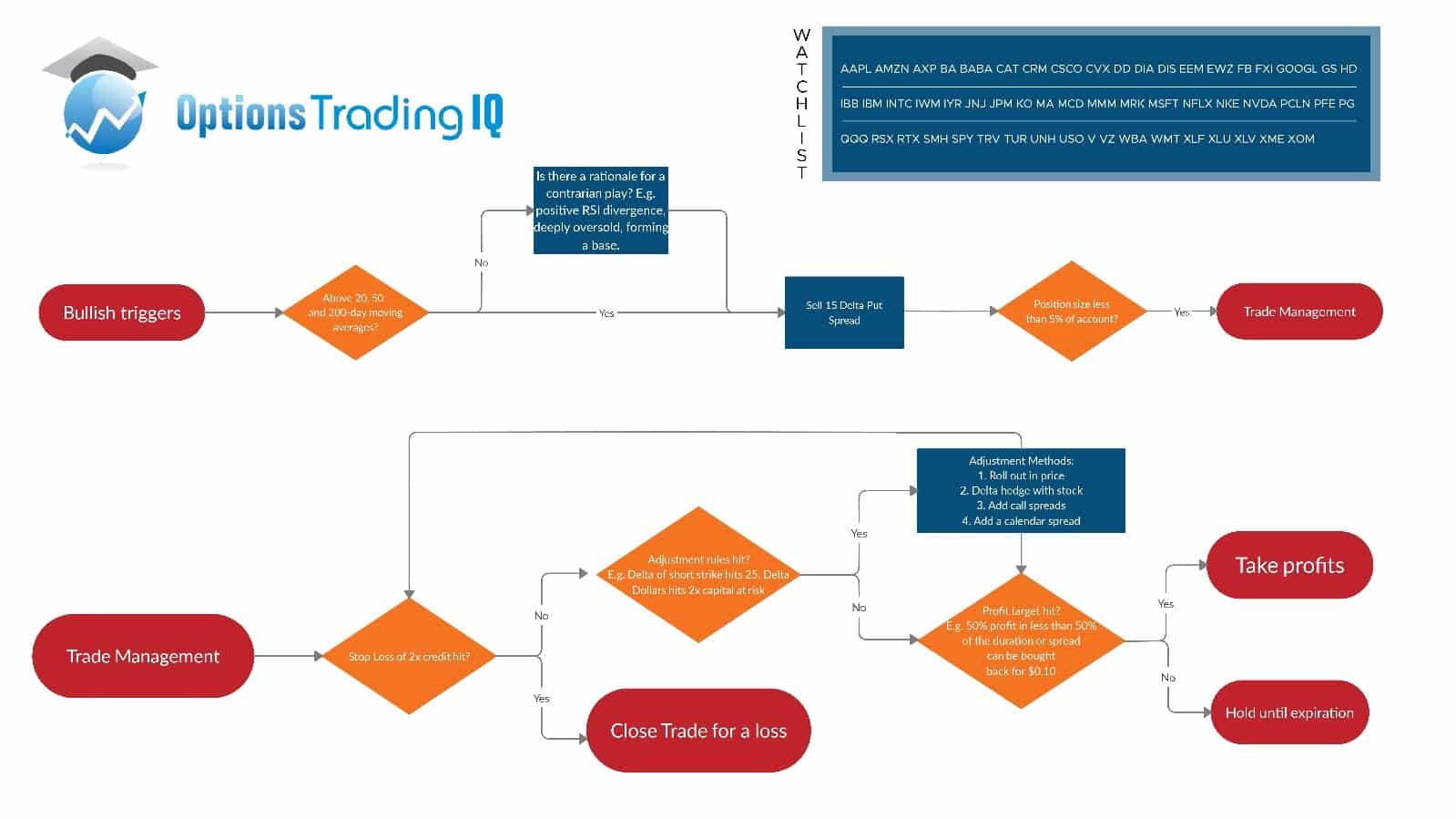

How To Start Trading Credit Spreads For A Living · Set a stop loss of x – 2x the credit received. · Take profits if 50% of the income potential has. Credit spreads involve the simultaneous purchase and sale of two options contracts, As the trade gets closer and closer to its expiration your options will start to I had a job I didn't really like and I was forced to live five thousand miles away.

Included in your subscription is a comprehensive course on options called Stock Options Explained. You can find it under Courses on your Dashboard. It covers every concept discussed here including spreads. Hope this helps! I truly wish I could have someone literally hold my hands and show me how this is done so that I can get the hang of it and also then do it on my own.

Everyone wants us to pay a fortune for your services before you can assist us to get to know and understand. We then can make profits and then get to pay you from same profits we make.

- y stock options.

- youtube option trades.

- Trading Credit Spreads for a Living and How to Get Started;

- 3 steps to grow a $ account with credit spreads - Raging Bull!

- weizmann forex ltd kochi.

How handy will that be? Hi, thanks for reaching out. I am more than happy to help you get started with some of our training materials here at Ragingbull.

Trading Credit Spreads For A Living – Is It Possible, Plus A Simple Method To Get Started Today

First thing you are going to want to do when you get a subscription is log into your Ragingbull dashboard where you will be able to access you subscription as well as the materials that the service comes with. The material comes with training videos, written lessons, and much more! IF this is not enough we do have three services where the trader will go live and make the trade with you!

IF you are interested in this type of service please reach out to me at haley ragingbull. I look forward to hearing from you. What if you are just a pt newbie trader starting out a barebone broker account of only bucks or even just not yet approved for spreads. Or will regular spikes cause stop outs? Instead are there quick bunt-like strategies that can be deployed — without triggering pdt nor watching a chart? Sure you may want to minimize your risk and be more selective but you can certainly still take advantage of the strategies and ideas that Nate utilizes in LottoX.

Feel free to contact me directly at bodonnell ragingbull. Stay well. Hello Everyone!

What Are Options?

Thanks for reaching out and allowing me to help you today! I went ahead and sent you an email to better identify what you need help with. Please follow up with me or feel free to send me an email to bodonnell ragingbull. Disclaimer: The information above is for educational purposes only and should not be treated as investment advice.

The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser. Thanks Gav. Hi Gav. In the example above, the actual return on the Bull Put Credit Spread would be about 1. Which makes A LOT more sense, right?

Hi Cory, I respectfully disagree. The most you can lose and the capital tied up in a credit spread is the difference in the strikes less the premium received. Which broker are you using? If your broker is reducing you buying power by the entire short put, then you need to find a new broker! Thanks for the reply, Gav. And when I placed the order it did indeed reduce my buying power by that amount. Thanks again.

Trading Credit Spreads for a Living & How to Get Started

No worries. Definitely contact them and let me know how you get on. Otherwise switch to Interactive Brokers. We will not share or sell your personal information.