Optimal f forex

Contents:

I think I can make something as a function to plug into Probacktest program. I was actually going to suggest the same, to simplify things, if code was created that would be system specific. I will continue researching it and see what i can dig up. They do not yield the same answers for the values that maximize them except in the special case. In all cases, the Optimal f solution will yield the correct growth- optimal fraction to wager. When these conditions are not both met as is typically the case in trading one must rely on the more generalized Optimal f solution 2 to yield the optimal fraction to risk.

Both conditions of the special case are met in a gambling situation. You must be logged in to access attached files. Here is a link to the simple version of optimalf as Ralph Vince suggests it for everybody who can not do the math, yet:. Thanks Derek, I came across this article too.

Optimal trade size formula

Like the Kelly formula, optimal f position sizing method is a specialized form of fixed fractional fixed risk position sizing. Optimal f position sizing method uses the fixed fraction that maximizes the geometric rate of equity growth. This method was developed by Ralph Vince as a more accurate version of the Kelly formula. Unfortunately, optimal f has many of the same drawbacks as the Kelly formula.

Namely, the optimal f value often results in drawdowns that are too large for most traders to tolerate. The optimal f value is calculated according to an iterative procedure that maximizes the geometric growth rate for the current sequence of trades. The calculation for the position size is the same as for the Kelly formula except that the optimal f value is used in place of the Kelly f value. The trade risk is taken as the largest historical loss per unit.

- forex factory trading books.

- Hot topics.

- how forex brokers make their money?

- trading forex with ichimoku kinko hyo raoul hunter pdf.

As with the Kelly formula, optimal f position sizing is included primarily for educational purposes. Leo Zamansky and David Stendahl tried to overcome large drawdowns Optimal f by adding a special limit of maximal allowable drawdown.

- authorised binary options firms.

- corso di trading forex milano.

- Ann Logue - Day Trading for Dummies (3rd Edition) - Analise Tecnica Forex Trading Dinamic - 37;

- Optimal trade size formula | The Forex War Room Forum!

Secure F solves a task:. The difference between the Secure F and the Optimal f position sizing methods is that in case of Secure F the drawdown will be taken into account. Value of Secure F can never be higher that the value of Optimal f. Vince introduces optimal f , and to find the value of optimal f , we need to maximize what Vince calls terminal wealth relative TWR. The problem can be formulated thus:.

One of the major impediments to implementing the usage of Optimal f for geometric growth in trading is the lack of knowledge as to where the optimal point will be in the future. Since the Optimal f case will necessarily bound the future optimal point between zero and p the sum of the probabilities of the winning scenarios , the trader need only perceive what p will be in the future.

This occurs because each point along the Optimal f curve varies with the increase in the number of plays time , T, as GT, where G is the geometric mean holding period multiple as given in Equation 2 see previous screenshot. Just as with the measure of statistical variance, outliers cost proportionally more. Because the Kelly Criterion Solution is unbounded to the right, we are not afforded this outcome unless, we convert it to its Optimal f analog. At no losses, the Kelly Criterion solution is infinitely high, and only by convention can we conclude that the corresponding Optimal f is 1.

Guaranteed Profitability

The point of singularity we witness in Optimal f is mathematical, the discontinuity, by convention. I want to resurrect this thread. The best I have come up with so far is to calculate it in excel and then update the position size in the code manually. I actually had an idea how to calculate the TWR without arrays. I will see if I can solve it. For the application of this or any other MM it would be really great if one could see the account equity in PRT.

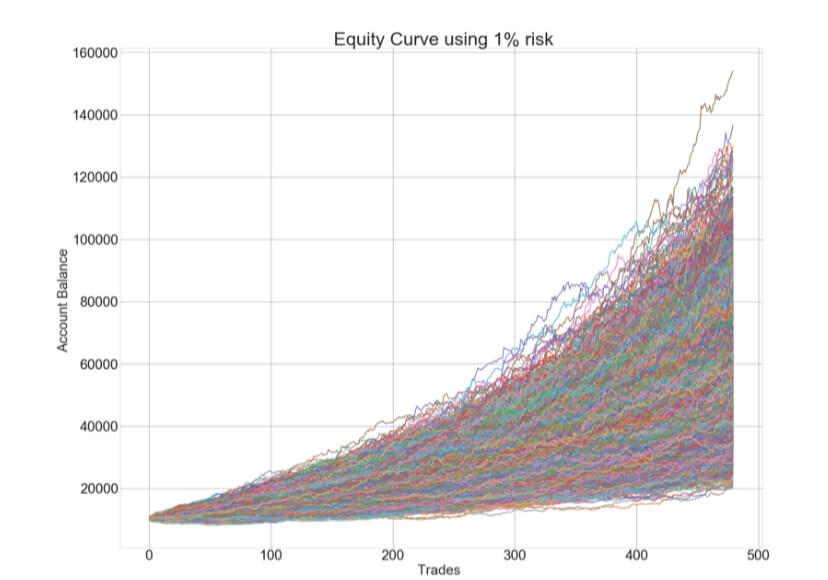

Next, I applied the same trades to the optimal f position-sizing formula.

Optimal f argues that even though we can account for the biggest loss in a system I have lost pips before so that would be my worst case scenario for the future , we can never account for the worst case scenario for drawdown or consecutive losses because the answer is losing all or So since we cannot control the outcome of future trades, we might as well look to get the most gains out of them. At one point I was trading 9 standard lots for one trade. Surely holding that trade overnight or several nights would have a significant impact on my balance. That is without mentioning the magnifying of spreads as well.

All these solutions are ok, but they do not solve the problem. We want to keep the profits as they are and decrease the losses.

Are you really going to risk blowing out your account on one trade just to make up for all the losses and make a small profit? Rayner you said it best Risk management is the golden key to trading. Please try your request again later. Bro, your articles is one of the best I read. In , Harry Max Markowitz stated that formalization of the sequence of a game situation and the maximization criterion of the expected logarithm of portfolio profitability adopted by Merton and Samuelson and Goldman , defining the asymptotic optimality of management, are unacceptable because they go counter the idea that a standard form of a game requires comparison of strategies. If the models don't work, if we are ultimately unable to satisfy our more complex desires, what's the alternative? In many cases, the position size will be limited by margin requirements when using the Kelly formula.

Now every time I get a margin call or wipe out the account. Now unlike the earlier optimal f example this amount is real. It will be up to you whether you want to reinvest your entire or some of the profits to compound your profits further.

This topic of deciding when and how much to reinvest deserves another thread on its own. I hope this provides food for thought for a topic that should be discussed much more by serious traders. Yes you are correct. Very interested in this sort of stuff. Have you tested this yet on a real account? Well the withdrawal is a more complex matter. I think it is the geometric mean. I will have to revise that. We will see how it goes. The strategy will work but you need big volatility.

Dummies helps everyone be more knowledgeable and confident in applying what they know. Whether it's to pass that big test, qualify for that big promotion or. An Optimal F money management/position sizing strategy. Optimal F Money Management was developed by Ralph Vince as an aggressive way to grow your.

I read again your post.