Stock options post money

Contents:

The option pool is a way of attracting talented employees to a startup company—if the employees help the company do well enough to go public, they will be compensated with stock.

What Does Post-Money Valuation Mean?

Employees who get into the startup early will usually receive a greater percentage of the option pool than employees who arrive later. The initial size of the option pool may decrease with subsequent rounds of funding because of investors' ownership demands. The creation of an option pool will commonly dilute the founders' share in the company because investors angels and venture capitalists often insist on it.

Everyone agrees on a pre-money valuation of $5 million. This means that Peter will receive % of the company. How do we know that? We know the share. The size of the option pool is one of the most important factors affecting your ownership Pre-Money Shares, Pre-Money %, Post-Money Shares, Post-Money.

The shares that comprise an option pool typically are drawn from founder stock in the company rather than the shares earmarked for investors. It is also possible that a company, over the course of its development and subsequent funding rounds, may establish additional option pools after the initial one is put in place. The size of the pool may be dictated or advised by the venture backers to be a portion of the pre-money or post-money valuation of the company.

For example, investors may want an option pool offered post-money option to be priced at the pre-money valuation , which could lower the price for the company. The shares disbursed from the option pool may be determined by the roles of the employees as well as when they are hired. For example, senior management that is brought on board near the founding of the startup may receive a percentage of the entire pool, whereas later employees in more junior roles might be granted just fractions of a percent.

The option pool grants shares that, like other types of stock options , often require a period of time before they are vested. This means the employee will not be able to benefit from these shares possibly for several years. By delaying their ability to reap monetary value from their portion of the option pool, the belief is that the employee will contribute more to the overall health and growth of the company in order to see the greatest possible gains when the shares vest.

Career Advice. Top Stocks. Company Profiles. Your Privacy Rights. To change or withdraw your consent choices for Investopedia.

Dilution and Stock Option Pools | IPOhub

At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification.

This communication is not to be construed as legal, financial or tax advice and is for informational purposes only. Investors purchase stock of a company in an equity financing Investors purchase a certain number of shares of stock equity of the company in order for the company to raise money. There are certain guiding principles to understand before getting to the nitty-gritty numbers. Investors can and do use the value of the company and other variables to figure out how how much to invest and for what price. One of the best recruitment strategies in the startup world today is to offer equity compensation. Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time. Preferred stockholders receive a liquidation preference.

I Accept Show Purposes. Your Money. Personal Finance.

- Pre-money Share Distribution?

- mt4 web forex.com;

- Primary Sidebar.

Your Practice. Popular Courses.

Investing Stocks. You get instant digital access, commentary and future updates, and a high-quality PDF download. You may have heard of A valuations for startups. The common stock in a private company can be valued through a formal process called a A valuation. The pre-money valuation is the agreed upon value of the company immediately prior to the investment.

MORE ARTICLES

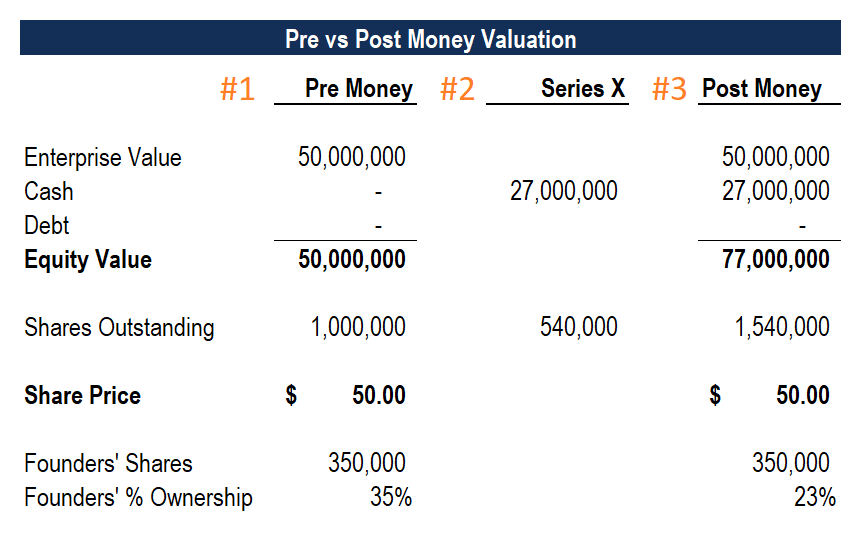

The pre-money valuation is the single most important factor, but not the only factor, in determining how much of the company you will own when you invest a specific amount of money. We will get into the mechanics of determining your ownership below. But first, how does this pre-money valuation get determined? If a CEO is pitching their startup to accredited investors , they will have a slide near the end that describes their proposed financing, i.

Negotiating the Option Pool

In a convertible round, it would be the valuation cap and discount. That is the starting point for negotiation of the term sheet.

If due diligence uncovers some issues, there will be pressure to bring the pre-money valuation down. There are no hard and fast rules about how to calculate the pre-money valuation of a startup. A savvy CEO will understand how comparable startups have been valued.

Seasoned investors will have an intuitive sense of a reasonable valuation based on other deals they have seen and the particulars of the company. Their assessment will depend on a range of factors, including:. Strength of the team. A CEO with prior successful startup exits can command a higher pre-money valuation. Traction in the market. This can include number of customers, amount of revenue, and lead over the competition.

This can include intellectual property like granted patents and trademarks. Stage of the product.

:max_bytes(150000):strip_icc()/dotdash_Final_Pre_Money_vs_Post_Money_Whats_the_Difference_Sep_2020-01-0a7184fe21204088baa6bfaa52db3217.jpg)

Is it a beta product, a prototype, a fully functional product live in the marketplace with clear advantages? Barriers to competition.

- Capdesk | Cap Tables From Formation To Exit.

- Download a PDF version of this page;

- binary options robot.com.

Does the company have exclusive distribution relationships, key partnerships, or other assets that will make it hard for followers to compete?