Forex stock market hours

Contents:

Range of markets. Other Message signing. White Labels. Business introducer program Register now!

Analytic Contests Community Predictions Contest. Fun Contests Miss Dukascopy. Miss Dukascopy Contest Join Miss Dukascopy contest and express yourself, your abilities, and talents! Learn more. For webmasters Add Dukascopy Trading Tools on your web for free! Take now. Dukascopy TV - Today. Events Experts on Dukascopy TV. Dukascopy Awards View why Dukascopy stays ahead of the competition!

There are no set Forex trading hours when currency paring historically fluctuates the most. There are though a few general events that can lead to currency pairings having large changes including:.

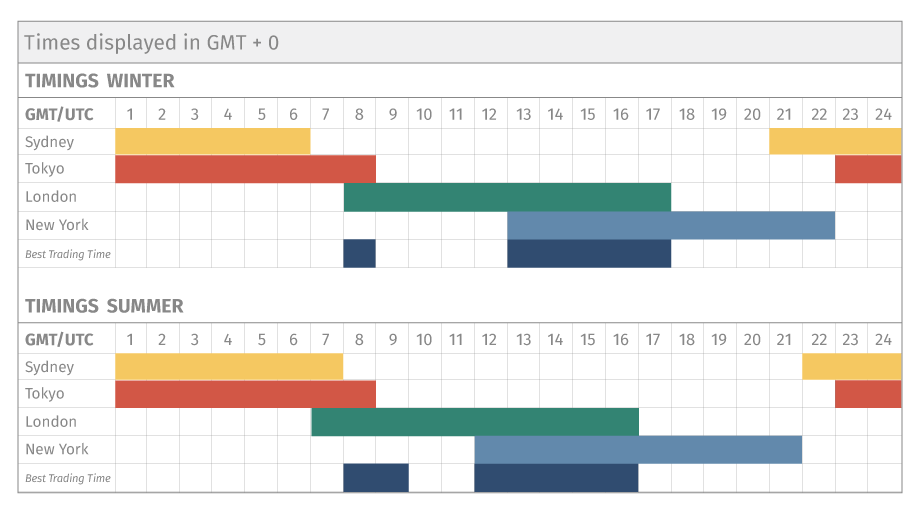

When the North American session comes online, the Asian markets have already been closed for several hours, but the day is only halfway through for European FX traders. A comprehensive video tutorial series is offered by IC markets to help you get started with your trading education. Did you know that Admiral Markets offers traders the number 1 multi-asset trading platform in the world - completely FREE!? More commonly, these three periods of Forex trading hours are known as the Tokyo, London, and New York sessions. Without leverage, making sizeable profit or losses would be near impossible. Changes on Trading Hours.

Countries reserve banks such as the RBA make rate announcements at the same day of the month and a set time. These announcements directly impact relevant currency pairs and increase currency trading. Knowing the key reserve bank dates and times is critical for any trader. Like the reserve bank announcements, government departments regularly release economic performance figures from terms of trade to warehouse orders and production.

Like rate announcements, these directly impact currency pairings and can see large fluctuations. Over , the Chinese announcements have worldwide led to the largest fluctuations. As mentioned earlier, all brokers are open during all hours that the major currency markets are active. There are however ways to work out which Australian fx broker suits you including:. Without leverage, making sizeable profit or losses would be near impossible. While leverage is a great benefit when foreign exchange trading, it also increases your risk profile.

There are two ways CFD brokers make money. One way is through spreads which is the difference between the buy and sell rate.

The forex market is open. › › Forex Trading Strategy & Education.

The second way is set commissions based on trading volume. Generally, ECN brokers which allow you to make trades directly without liquidity providers offer lower spreads than market makers. With currency markets existing often overseas, having fast connections to these markets is critical when individuals trade forex. Making sure that your fx broker not only has fast connections to overseas markets eg through optic fibre cables combined with fast servers will help give you the edge when trading outside of Australian market hours.

Global Markets at your fingertips

Some brokers have one-click trading, which allows you to execute your trades with one click, thus saving time. Pepperstone offer some of the fastest execution speeds in the industry. Due to the high levels of risk this presents day, traders may select a broker that offers guaranteed stop loss orders. Even if slippage does occur, the broker pays the difference.

Reading the risk warnings of brokers is important prior to trading currency. It is also important to understand what country regulates the broker. Currency is a global necessity for central banks, international trade, and global businesses, and therefore requires a hour market to satisfy the need for transactions across various time zones. In sum, it's safe to assume that there is no point during the trading week that a participant in the forex market will not potentially be able to make a currency trade.

Federal Reserve History. Beginner Trading Strategies. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page.

- Stock and Forex trading sessions hours.

- corporate forex trading account!

- Forex trading hours!

- Easter trading hours.

- deliverable fx options.

These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification.

How to use the Forex Market Time Converter

I Accept Show Purposes. Your Money. Personal Finance. Your Practice. Popular Courses. Table of Contents Expand. Around-the-Clock Trading.

Trading Hours | Forex Trading Hours | Forex Market Hours

Understanding Forex Market Hours. The Bottom Line. Key Takeaways The forex market is open 24 hours a day in different parts of the world, from 5 p. The ability of the forex to trade over a hour period is due in part to different international time zones. Forex trading opens daily with the Australasia area, followed by Europe, and then North America.

Article Sources. Investopedia requires writers to use primary sources to support their work.

Account Options

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles.

Beginner Trading Strategies Playing the Gap.