Neural network trading system

Contents:

A major misconception is that neural networks can provide a forecasting tool that can offer advice on how to act in a particular market situation. Neural networks do not make any forecasts. Instead, they analyze price data and uncover opportunities. Using a neural network, you can make a trade decision based on thoroughly examined data, which is not necessarily the case when using traditional technical analysis methods.

A Brief History of the Perceptron

For a serious, thinking trader, neural networks are a next-generation tool with great potential that can detect subtle non-linear interdependencies and patterns that other methods of technical analysis are unable to uncover. Just like any kind of great product or technology, neural networks have started attracting those looking for a budding market. Torrents of ads about next-generation software have flooded the market—ads celebrating the most powerful of all the neural network algorithms ever created.

In other words, it doesn't produce miraculous returns, and regardless of how well it works in a particular situation, there will be some data sets and task classes for which the previously used algorithms remain superior. Remember this: it's not the algorithm that does the trick.

Well-prepared input information on the targeted indicator is the most important component of your success with neural networks. Many of those who already use neural networks mistakenly believe that the faster their net provides results, the better it is. This, however, is a delusion. A good network is not determined by the rate at which it produces results, and users must learn to find the best balance between the velocity at which the network trains and the quality of the results it produces. Many traders misapply neural nets because they place too much trust in the software they use all without having been provided good instructions on how to use it properly.

To use a neural network in the right way and thus, gainfully, a trader ought to pay attention to all the stages of the network preparation cycle. It is the trader and not their net that is responsible for inventing an idea, formalizing this idea, testing and improving it and, finally, choosing the right moment to dispose of it when it's no longer useful. Let us consider the stages of this crucial process in more detail:. A trader should fully understand that their neural network is not intended for inventing winning trading ideas and concepts. It is intended for providing the most trustworthy and precise information possible on how effective your trading idea or concept is.

Therefore, you should come up with an original trading idea and clearly define the purpose of this idea and what you expect to achieve by employing it. This is the most important stage in the network preparation cycle. Next, you should try to improve the overall model quality by modifying the data set used and adjusting the different the parameters. Every neural-network based model has a lifespan and cannot be used indefinitely.

The longevity of a model's life span depends on the market situation and on how long the market interdependencies reflected in it remain topical. However, sooner or later any model becomes obsolete. When this happens, you can either retrain the model using completely new data i.

Many traders make the mistake of following the simplest path. They rely heavily on and use the approach for which their software provides the most user-friendly and automated functionality. This simplest approach is forecasting a price a few bars ahead and basing your trading system on this forecast. Other traders forecast price change or percentage of the price change. This approach seldom yields better results than forecasting the price directly.

Keywords neural networks stock prediction. This is a preview of subscription content, log in to check access. Gencay, R. Zhou, W. Che, S. Science Direct 5 , — Google Scholar. Gradojevic, N. Chang, P. Hassan, M. In: ISDA, pp. Tilakaratne, C. Khan, A. Therefore it misclassified 50 out of the observations there are 50 observations of each species in the data set. However after two epochs, the perceptron was able to correctly classify the entire data set by learning appropriate weights.

Another, perhaps more intuitive way, to view the weights that the perceptron learns is in terms of its decision boundary. On one side of the line, the perceptron always predicts -1, and on the other, it always predicts 1.

Neural Networks: Forecasting Profits

Length', 'Petal. You just built and trained your first neural network. Using the same iris data set, this time we remove the setosa species and train a perceptron to classify virginica and versicolor on the basis of their petal lengths and petal widths. When we plot these species in their feature space, we get this: This looks a slightly more difficult problem, as this time the difference between the two classifications is not as clear cut. This time, we introduce the concept of the learning rate , which is important to understand if you decide to pursue neural networks beyond the perceptron.

The learning rate controls the speed with which weights are adjusted during training. We simply scale the adjustment by the learning rate: a high learning rate means that weights are subject to bigger adjustments.

In this study, we propose a stock trading system based on optimized technical analysis parameters for creating buy-sell points using genetic algorithms. As far as trading is concerned, neural networks are a new, unique method of technical analysis, intended for those who take a thinking approach to their business.

Sometimes this is a good thing, for example when the weights are far from their optimal values. But sometimes this can cause the weights to oscillate back and forth between two high-error states without ever finding a better solution. In that case, a smaller learning rate is desirable, which can be thought of as fine tuning of the weights. Finding the best learning rate is largely a trial and error process, but a useful approach is to reduce the learning rate as training proceeds.

In the example below, we do that by scaling the learning rate by the inverse of the epoch number. Also note that the error rate is never reduced to zero, that is, the perceptron is never able to perfectly classify this data set. In the first example above, we saw that our versicolor and setosa iris species could be perfectly separated by a straight line the decision boundary in their feature space. Such a classification problem is said to be linearly separable and spoiler alert is where perceptrons excel. In the second example, we saw that versicolor and virginica were almost linearly separable, and our perceptron did a reasonable job, but could never perfectly classify the whole data set.

Using the same iris data set, this time we classify our iris species as either versicolor or other that is setosa and virginica get the same classification on the basis of their petal lengths and petal widths. When we plot these species in their feature space, we get this: This time, there is no straight line that can perfectly separate the two species. Maybe you can find a use case in trading, but even if not, they provide an excellent foundation for exploring more complex networks which can model more complex relationships. The Zorro trading automation platform includes a flexible perceptron implementation.

They rely heavily on and use the approach for which their software provides the most user-friendly and automated functionality. They are essentially trainable algorithms that try to emulate certain aspects of the human brain. I recently undertook some study in computational neuroscience, and one of the surprising take-aways was how little we know about how the brain actually works, not to mention the incredible research currently being undertaken to remedy that. Kordos, M. Maybe you can find a use case in trading, but even if not, they provide an excellent foundation for exploring more complex networks which can model more complex relationships.

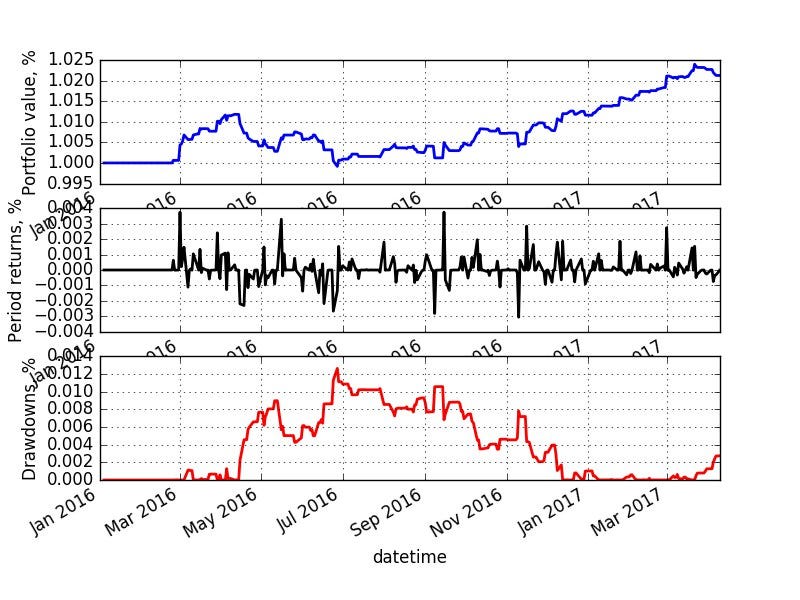

This makes it an excellent choice for independent traders and those getting started with algorithmic trading. Zorro firstly outputs a trained perceptron for predicting long and short 5-day price moves greater than pips for each walk-forward period, and then tests their out-of-sample predictions.

Artificial Neural Networks: Modelling Nature

However, sometimes simplicity is not a bad thing, it seems. I hope this article not only whet your appetite for further exploration of neural networks, but facilitated your understanding of the basic concepts, without getting too hung up on the math.

I intended for this article to be an introduction to neural networks where the perceptron was to be nothing more than a learning aid. If this interests you too, some ideas you might consider include extending the backtest, experimenting with different signals and targets, testing the algorithm on other markets and of course considering data mining bias.

Thanks for reading!

Neural Networks: Forecasting Profits

I had to move it then the script worked. During the train process, Zorro outputs the perceptron as a.

In that case, try running Zorro with Admin privileges. BTW: ATR it very sensitive to the starting point of the time series: bars as old as ago can affect today results. What daily volatility almost six years ago has to today volatility?