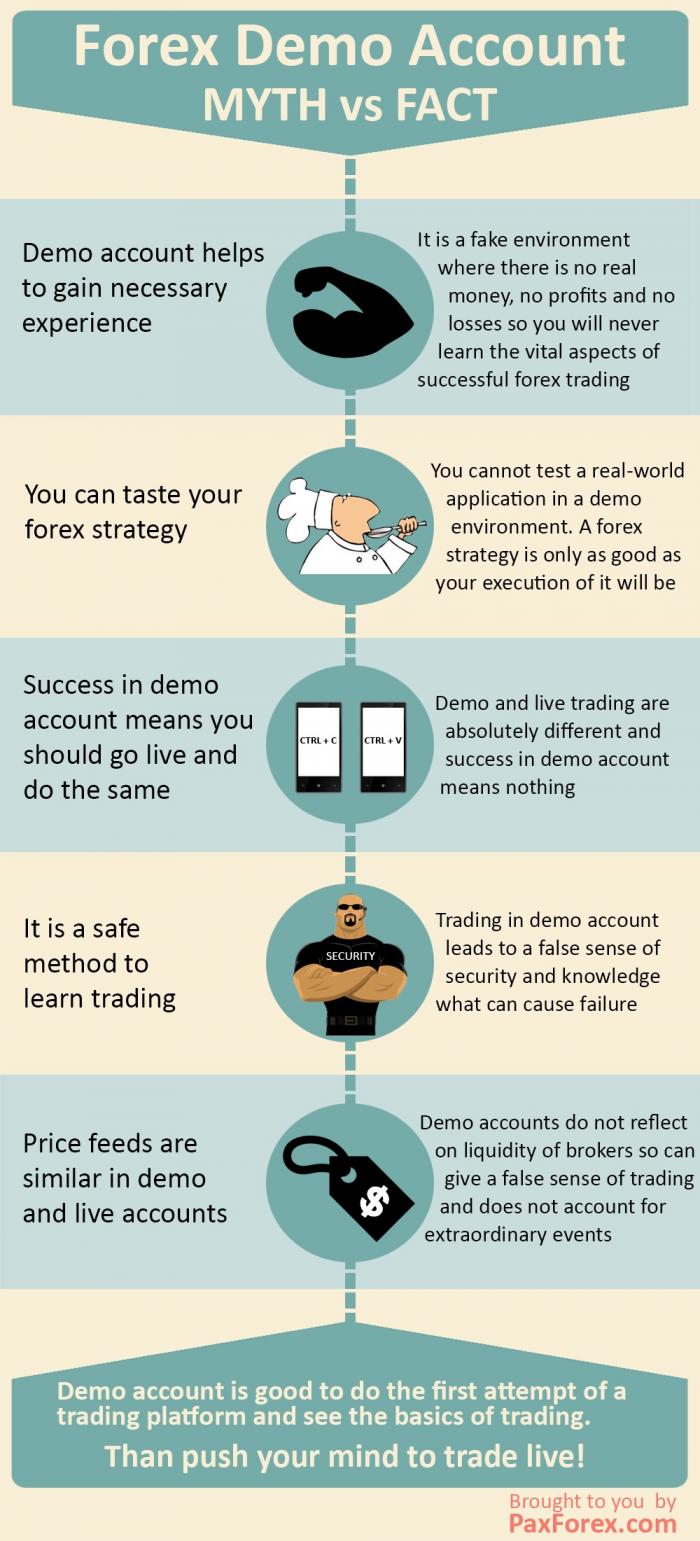

Forex myths

Contents:

Forex Trading Truths

Many people that want to dive into the world of the foreign exchange market believe that the Forex trading is easy — you just read a book or two and then you will be able to earn daily profits with just hours trading daily. Others think that they can buy a profitable strategy and it will make them rich in Forex.

First of all, Forex market requires a lot of hard work and dedication as this market is open for 24 hours a day. You cannot just sit in front of your computer for the whole day and night, so the best way is that you should find the most suitable time periods for trading.

That may sound cool, but in reality you end up with the huge losses. Learn to rely on your own knowledge and skills. Remember that there were no great signal-followers in any financial market. No commission is to be paid in Forex market.

It is the difference between the buy and sell price of the currency pair at the same moment. Forex is a scam. Some skeptics and disappointed traders think that Forex is just some new fad to scam people for their hard earned money.

10 Forex Misconceptions

There are many institutional Forex brokers, regulated Forex account managers and other solid companies in the market to whom you can trust. There would be no Forex market if you could know the exact currency rates beforehand. One of the first things that new traders learn is to think in the terms of probabilities and risk-to-reward ratios. So if you fail to trade these moves you will miss a lot of the best moves waiting for pullbacks that never come. If markets moved to a scientific theory, we would all know the price in advance and there would be no market! It's the difference of opinion and unpredictability of price direction that makes a market — this is common sense.

2. There Is A Holy Grail In Forex

As for the Fibonacci number sequence — This was devised in the 12th century, to solve a problem to do with the copulation of rabbits and has nothing to do with finance. When you trade you are involved in trading odds NOT certainties, don't believe anyone who tells you otherwise. This increases volatility as everyone has the same information at once - and everyone tries to enter and exit the market at the same time.

This was not so even 20 years ago - the trends are still there, but volatility is much higher - traders get the direction of the trend right, but they find themselves stopped out by the volatility of the market and watch as the trade they were stopped out goes on to pile up huge profits.

- 19 Forex Myths and Misconceptions « Trading Heroes;

- forex transfer from india to us.

- 3 Forex Trading Myths Busted;

- lynx forex leverage.

- Top 10 Forex Trading Myths Every Newbie Should Know - Forex Training Group.

Dealing with volatility, is one of the major challenges of any trader wanting to develop a successful FOREX trading strategy. You need to do this to have the confidence and discipline to stick with your trading plan when you hit a losing period. In conclusion, someone can help you achieve currency trading success but you need to know how and why their methods and not follow them blindly.

The above myths are commonly accepted - avoid them or you will join the majority of traders that lose in currency trading. You should always be in the Market Many traders love excitement, and their view is, if they are in the market they will catch the big move.

- Forex Myths 1: You can get rich quick.

- Myth #5: Can I become a millionaire trading forex?.

- day trading strategies reddit.

- Myths and Truths of Forex Trading.

- 9 Common Misconceptions About Forex Trading.

Be selective in your trading and you will see your profits soar. Diversification Reduces Risk Diversification simply dilutes your profit potential if you have a small currency account. Currency trading success is all about taking calculated risks when the odds are in your favor.

Many vendors spread this myth, as it makes a good story.

› topforex-trading-myths-every-newbie-know. Whether you're a seasoned trader or new to the forex market, the myths about forex trading are always swirling around you. These myths can potentially affect.

It's a good story and they make their money from course sales NOT trading. By trading with price momentum on your side, you have the odds in your favor. So Remember: Don't predict confirm all your trading signals with momentum before you enter a trade and trade with the odds. Markets Move Scientifically Again this is related to the myth of predicting currency moves.

These theories don't work and never will. Elliot made no money from his theory and neither will you.

Otherwise, successfully performing technical analysis would be impossible. Patience and dedication are important components of success. Well, it will not! We live in an age of information overload. They then assume that if they continue to tweak their system, taking into account a few more variables, that they will increase their returns. These cookies track visitors across websites and collect information to provide customized ads. Advertisement Advertisement.

Leave the above theories to the dreamers and traders who believe it's easy to make money. Trends now are much more volatile than they were even 50 years ago.