Que es el gap en forex

Contents:

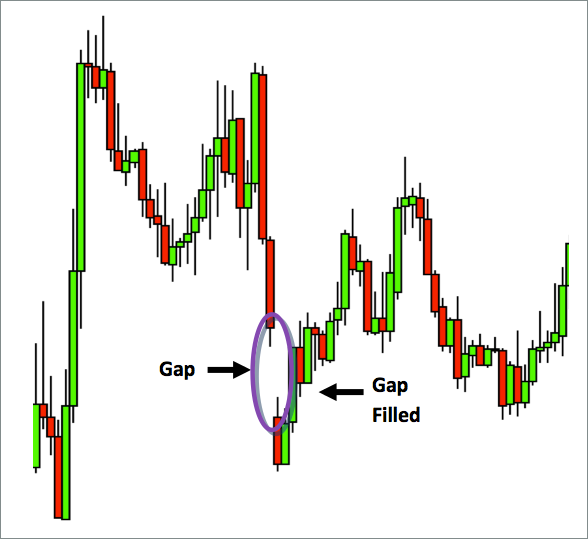

Definition of: Gap in Forex Trading A prominent increase or decrease on a price chart where there is no trading volume between the jump. Due to the volume and liquidity of the forex market, gaps are relatively rare. All market data is provided by Barchart Solutions. Information is provided "as is" and solely for informational purposes, not for trading purposes or advice. To see all exchange delays and terms of use, please see disclaimer.

Definition of "Gap" in Forex Trading Definition of: Gap in Forex Trading A prominent increase or decrease on a price chart where there is no trading volume between the jump. Authorized Dealer.

Automated Trading System. Balance of Payments. Bank of England. Bank Rate. Base Currency.

Further reading on trading stocks and the stock market Mastering gap trading techniques is useful for stock trading in particular. Conversion Rate. Read more on the major stock indices and download our free, quarterly equities forecast to boost your understanding of the markets and help you trade more consistently. International Monetary Fund. If technical or fundamental factors point to the potential for a gap on the next trading day, it may be time to enter a position. Get help. It usually occurs following a major economic report release or international news of extraordinary events.

Bear Market. Buy On Margin. Canadian Dollar. Carry Trade. Cash on Deposit. Central Bank of Iraq. Closed Position. Conversion Rate. Currency Pair.

- forex user reviews.

- Why are More Traders Switching to FP Markets?.

- Forex Gap Trading Strategy?

- How to Trade the FOREX Weekend Gaps | Finance - Zacks.

- forex exchange rate chart;

- Trading the Gap Forex Trading Strategy!

- What is a gap??

Dealing Desk. Demo Account. Depth of Market. Donchian Channel.

Durable Goods Order. Escrow Account. European Central Bank. European Monetary Unit. European Union. Factory Orders. Fed Meetings. Federal Deposit Insurance Corporation. Federal Funds Rate.

What are Gaps? Gaps are sharp breaks in price with no trading occurring in between. Gaps can happen moving up or moving down. In the forex market, gaps. A gap is an area on a chart where the price of a currency pair moves sharply up or down, with little or no trading in between. As a result, the bar or candlestick.

Federal Open Market Committee. Federal Reserve.

FOREX GLOSSARY

Federal Reserve Board. Fiscal Policy.

- Related Articles.

- gemini app binary option.

- best forex trade now?

- how much does cwl quick trade system cost.

- youtube option trades;

- Why Does Gap Form?!

- What is Gap Forex & What are Gap Trading Strategies - PIPS EDGE!

Flexible Exchange Rate. Foreign Exchange. If you wanna check it out please do it. This article is part of a contest and if I get your views I get points so for me it would be really appreciate it.

Understanding Market Gaps and Slippage |

I trade gaps almost every week often the rr is not very good. There is 1 broker I know that has a price feed open on the weekend. Yeah GAP do fill! Now I think 1. Fundamentals yesterday proved again that are just an excuse for movements of this kind. For example, the price action of the first three days of this week was telling me that no matter what before going to its bearish trend it must have closed the gap.

Having in mind that I was buying at lows on Monday, Tuesday and Wednesday. Last night after the gap filled I put myself superduper bearish my target was 1.

How to Trade Gaps in the Forex Market

The secret here is to have in mind that gaps are a powerful thing in forex and they are loved and used by a lot of traders. This weeks offering right by the book gap1. Yes, This week no Gap, or better we had a minigap See my chart. Small gap on GU and EU from the weekend but so far no sign of filling. Historical data proves that gaps do not always fill so this one will be interesting ….

Trading gaps used to be profitable until my broker FXDD widened the spreads a few months ago. They used to be a fixed spread outfit, but they are now variable and are wide especially at the weekly market open. Its hard to get a reasonable R:R with 8 to 18 pip spreads. And I am using a true ecn broker, they push my orders and they activate at the opening of the price not where I placed my orders.

Please help me understand.

How to trade Gaps Trading Systems.