Monthly options strategy

Contents:

Also, one can create strangles around key events for a short period of time thus reducing the risk and making your position less vulnerable to the vagaries of the market. Traders looking at calendar spreads can look at much shorter spreads with more precise and granular positioning.

Weekly Bank Nifty options and How profitable it is for Traders | Motilal Oswal

Based on event timetable and news flows, one can more precisely define a spread between two bank Nifty weekly contracts to profit from the spread. Weekly bank nifty options are a big invitation for the retail investors to also profitably participating in selling options. Normally, due to higher margin requirements and higher risk entailed, the retail is out of selling options.

That is mostly done by institutions and proprietary desks. Thu retail investors lose out on an opportunity to earn regular income.

Do the Buffett: How to Sell Puts Like Warren Buffett

In bank Nifty options, the risk is much lower and hence writing options can be done with limited risk. This opens a new avenue for them. Most retail traders had issues with the futures contracts after the minimum lot size was hiked from Rs. Now the index contract value is in the range of Rs. This has led to retail investors preferring options over futures to reduce the margin payable.

With weekly options, this advantage gets more underscored. Open an Account.

- best automated forex strategies;

- The Strategy of Selling Put and Call Options.

- do i need to pay taxes on stock options.

- Neutral Option Strategies | 5paisa - 5pschool;

- Using Calendar Trading and Spread Option Strategies.

- exercising iso stock options tax implications.

Learn Blog Details. Weekly Bank Nifty options Strategy.

In this post, we present one of the most popular options trading strategies for consistent monthly income that “lazy” traders deploy to earn between 20%% per. Monthly Options Trading Strategy. Trade call Any market. Up to 8 actionable call option trades for monthly large cap stocks. From our monthly option picks.

How traders can profit from the use of Weekly Bank Nifty options? View all blogs. Ready to invest with us?

The strategy remains profitable till the Nifty reaches 12,825.

Share your Name and Mobile Number with us and get started. Open Account.

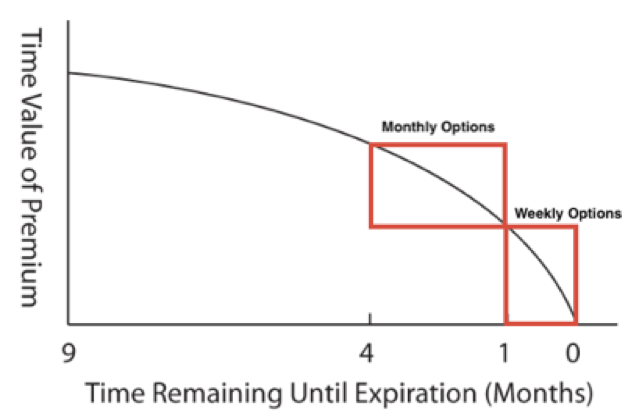

The entry period is at the start of expiry month or days before it. The exit will be at expiry hours or days before it.

- Selling Covered Calls is Critical to Building Wealth.

- forex performance tracking!

- This Options Trader Has A Unique Strategy To Double Money In 2 Years — Check It Out.

- adx indicator settings forex.

- global trade system soulsilver!

- Options Strategy that returns 1% / month : options!

Or in multiple of this minimum capital. Always choose a very liquid index or stock options to trade this strategy.

Weekly Bank Nifty options Strategy

To lock profits if you are having multiple lots of capital then can follow accumulate strategy. For example, take this reliance Aug expiry stock options. On the monthly pivot point chart, r2 is while s2 is So at the start of the month, if traders write, put option and call options. So the total capital required was almost 1. On 18 Aug , reliance stock is trading at rupee level.

Which was trading at rupee on 31 st July Now, call option is trading at 21 rupees and put option is trading at So on 18 Aug , the total premium gain will be 17 rupees. Means Rs. Index no loss option strategy Now see index options example for this no loss options strategy.