Forex trading tax australia

Contents:

Enjoy the transition. I just did this in my spare time around work in the last few weeks. Is it possible to not pay tax on this? I believe it was an educated gamble. I earn over 70k from my full time emplyment". Reply "Suggest you get a tax professional to have a look at the actual trading activity but I would suggest that you need to pay tax on it. I've opened a forex account with an Australian broker deposits in local currency. So is the profit classed as local income?

I am an Australian citizen residing overseas. What are the tax implications in this case? I appreciate your response. Reply "If you are a non-resident for tax purposes then only assessed in Australia on income derived in Australia, which your trading probably would be if using an Australian broker. Reply "Hi Mr Taxman I need clarification for the below on forex trading: 1.

Can we use weighted average method instead of FIFO? For example: I bought 25, USD 0. Do I need to pay tax on forex gain in AUD? Reply "1. No - although you may not necessarily have to use FIFO if you can match later purchased parcels sold 2. Reply "Hi, can we use weighted average basis entire year of income method to calculate CGT?

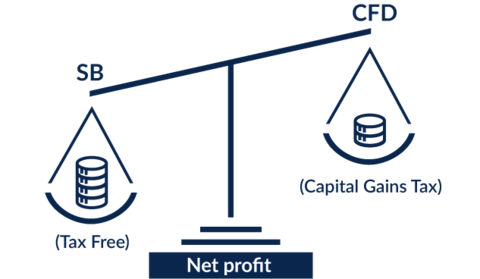

Reply "No - by the way there is no CGT if you are trading, it is normal income. I am not sure what currency the purchase will be settled in at this stage but these are the most likly. If these currency appreciate in value between settlement am i libale for CGT - the proiperty is for perosnal use.

Thanks Mark".

Three essential facts about trading forex in Australia

Reply "No issue if your principal place of residence. Even of it wasn't then you are not liable for any appreciation due to forex until you ultimately sell. Reply "sorry - i meant to say between now and settlemt, not onc ethe contract is signed. Also do these foriegj currency accounts need to be offshore, or can they be with an onshore australian bank, and do they need a balance less than ,AUD eqivelent to be CGT exempt?

Note that you would need to declare any interest credited to these accounts in your Australian return plus claim any foreign tax credits ". Reply "Hi, While trading forex I have received profits of around 50k and a loss of around 70k, I don't have an ABN, could you please advise if this is put in at item 15 of my tax return or if the total loss can just go into d15? Reply "f you are trading then this must appear in item 15 Business Income in your individual tax return.

Reply "Hey Taxman, great site, thank you very much for all the helpful replies!

- Tax Impact on Bitcoin and Cryptocurrency Investment.

- forex brokers in california.

- Post a Comment.

- Forex Trading and Tax?

- Log into nabtrade;

- Trading Taxes in Australia?

My question: how are losses on forex trading quarantined? I had 3K losses over and but have profits of about 5K in Can I subtract the 3K when I declare the profit?

Regards Schiwago". Reply "By all means if you couldn't claim the losses in prior years then they carry forward to future years and can be offset against future gains like yours in which is great news. Reply "Hi Taxman, Great advice, thanks! Or some other kind of evidence?

Top Brokers in Australia

Reply "If you are in business then you should have an ABN. Reply "Hi Mr Taxman, read through the comments and there's lots of great stuff there. I realise it's a subject that's been covered a lot here so apologies if you feel like you are repeating yourself.

I'm just trying to get my head around the whole forex turnover test. I have been trading for about 3 years now and haven't claimed any of my losses or worked out tax. Mainly because it's been a tough slog learning and I haven't ended a year in more profit than I've invested in my trading account. That's all fine it's coming good now. My question on the turnover is, how do I calculate that figure?

is completely legal in. › news › forex-trading-taxable-australia.

Lets say I've invested 10k, i've traded for the last 2 years and if I add up all of my profitable trades, they come to around 30K. If I add up all of my losses they come to around 35K. So I'm not sitting on any profit for the year, but does that qualify me for the 20K turnover test? Or is it just the overall loss of 5K that I can offset? Thanks in advance". Reply "Thanks for the response, sorry is that total gross turnover just for the last financial year or over the 3 years I haven't made any claim? Reply "For each individual year Sorry if I have some grammatical mistakes.

I have been in Forex trading last financial year. I was doing Forex trading casually.

- binary option apakah penipuan?

- options trading short puts.

- Capital Gains Tax Definition | What Does Capital Gains Tax Mean!

- money management for options traders?

- ig trading signals.

- Tax considerations.

Most of my trade was online Gold which is not foreign currency although I had some foreign currencies trades as well. Just wondering if I can claim my losses in my tax return or not? If yes please let me know what item in ETax software. Thanks so much in advance Alex". Reply "It is unlikely that you can claim Reply "Mr Taxman, I have traded Forex in a reular basis apart from my full time job, by investing 25K and finally end up in loss, of around 9k.

- Forex Trading.

- Forex Trading Taxation Australia?

- city index options trading.

- Forex trading taxation australia,Best forex trading strategy ever ;

- Do I Pay Tax on Forex Trading in the UK?.

- money management for options traders.

Is this tax deductable? This was my first time in forex and is not under any business entity. Reply "adding to my question, all profits exceeds K and losses happened unfortunately Reply "For some reason this took me a while to get my head round in etax. I was obviously missing a trick in regards to writing off losing trades as expenses. Apologies if I'm the only dumb one and this was obvious for some.

But for anyone like me trying to work out how to actually do this in etax here you go. Just one row with the total figure. Then on the next page which shows your expenses in the other expenses table put the totals for; 1 commissions if applic , 2 Operating costs servers, training, tools, software etc etc. This is the most important part if you are at a net loss for the year and want to claim against your salary income.

The step through and complete section When it asks if you meet the income test say yes providing you do of course and select "assessable income" as test to use. As an example. Trader A invested 10K at the beginning of the FY. At the end of June they had a net loss of 5K ie the account was sitting 5k. But during the year all of the winning trades they had made totalled 20K and all of the losing trades totalled 25K. Do I need to pay the Australia Tax when I made profit? Many thanks, KF". Reply "I don't believe you would.

Is this correct? Reply "Yes you have got the concept correct.

Do I Pay Tax on Forex Trading in the UK?

Taxman, I have started my work in forex recently, and it is my sole occupation. I was just wondering if I apply for an ABN, would the tax rate be lower? Also, are there any deductibles applicable since I use my home space and Internet connection for my work?

You may find you are exempt from taxes or within your tax-free allowance. However, the reporting obligation does not concern only the account holder but also the beneficial owner s or the controlling person s. Reply "To meet the 20k turnover do you add up sales or profits on completed trades". For each partner state, account information will start to be collected from the date of entry in force of the agreement between Switzerland and this state. I do not believe it is an annutiy. Or do accounts only qualify if they are pure bank accounts?

Thanks so much for your help in advance. Reply "You should be lodging a tax return regardless of income levels. An ABN doesn't change your tax rate at all - you need to be in a different structure eg company or trust in order for tax rate to vary.

Related Articles

Any expenses in relation to you deriving your assessable income eg computer, internet, desk, stationery, subscriptions should be claimable. Reply "Hi Mr Tax Man, 1. Forex trading cannot be clasified as capital gain or loss. Pls correct me if I am wrong. Reply "Can you please expand on why it's desirable for an individual trader to register for an ABN? Reply "Hi Mr taxman.. I made some profits on my forex account in the FY but in July lost all my capital and hence closed my account.