How does forex make money

Contents:

I had been taught the 'perfect' strategy. My plan was to trade forex for a living and let my account compound until I was so well off, I wouldn't have to work again in my life. Sparing you the details, my plan failed. I didn't know what hit me. Something was wrong. Luckily, I stopped trading at that point and was fortunate enough to land a job with a forex broker. I spent the next couple of years working with traders around the world and continued to educate myself about the forex market. It played a huge role in my development to be the trader I am today.

Three years of profitable trading later, it's been my pleasure to join the team at DailyFX and help people become successful or more successful traders. The point of me telling this story is because I think many traders can relate to starting off in this market, not seeing the results that they expected and not understanding why. These are the three things I wish I knew when I started trading Forex. The amount we can earn is determined more by the amount of money we are risking rather than how good our strategy is.

The difference is that they have slowly developed over time and increased their account to a level that can create sustainable income.

- Selected media actions!

- How do Forex Traders make money?.

- How do currency markets work??

- Invest Wisely.

- Can You Make Money Trading Forex?.

- Learn to Do Your Own Analysis.

That's a true statement if you have a strategy with a trading edge. Your expected return should be positive , but without leverage, it is going to be a relatively tiny amount. And during times of bad luck, we can still have losing streaks. When we throw leverage into the mix, that's how traders attempt to target those excessive gains. Which in turn is how traders can produce excessive losses. Leverage is beneficial up to point, but not when it can turn a winning strategy into a loser.

This is a lesson I wish I had learned earlier. Excessive leverage can ruin an otherwise profitable strategy. Would you flip that coin? My guess is absolutely you would flip that coin. You'd want to flip it over and over. Now let's say I have the same coin, but this time if heads is hit, you would triple your net worth; but when tails was hit, you would lose every possession you own. My guess is you would not because one bad flip of the coin would ruin your life.

Even though you have the exact same percentage advantage in this example as the example above, no one in their right mind would flip this coin. The second example is how many Forex traders view their trading account. They go "all-in" on one or two trades and end up losing their entire account.

Even if their trades had an edge like our coin flipping example, it only takes one or two unlucky trades to wipe them out completely. This is how leverage can cause a winning strategy to lose money. So how can we fix this? A good start is by using no more than 10x effective leverage. The 3rd lesson I've learned should come as no surprise to those that follow my articles I've written many articles about this topic.

It's the best tool I've ever used and is still a part of almost every trading strategy I am using, present day.

IGCS is a free tool that tells us how many traders are long compared to how many traders are short each major currency pair. It's meant to be used as a contrarian index where we want to do the opposite of what everyone else is doing. Using it as a direction filter for my trades has turned my trading career completely around. If I could tell my younger self three things before I began trading forex, this would be the list I would give. Utlimately though, if you are just starting out in the forex market, the best thing you can do is take time to learn as much as you can, starting with the basics.

Read guides, keep up to date with the latest news and follow market analysts on social media.

How to Make Money Trading Forex -

Due to the availability of leverage, forex traders can make a return on a single trade that is multiples of the margin they used to open the trade. However, leverage is a double edged sword in that big gains can also mean big losses. Therefore, reliance on excessive leverage as a strategy typically leads to destruction of your account capital over the long run. This is because it only takes one adverse market move to drive the market far enough and trigger substantial losses.

Your expectations on a return on investment is a critical element. When traders expect too much from their account, they rely on excessive leverage and that typically triggers a losing account over time. View forex like you would any other market and expect normal returns by using conservative amounts of no leverage. Since forex is a 24 hour market, the convenience of trading based on your availability makes it popular among day traders, swing traders, and part time traders. Regardless of your style, use small if any amounts of leverage. If you were to expand the list to a fourth thing learned when starting to trade FX, what would it be?

I touched on leverage above. We researched millions of live trades and compiled our results in a Traits of Successful Traders guide. In the guide we touch on risk to reward ratios and how it is important. With humans being human, we also touch on the psychological element that goes along with trading and why we may still make poor choices even if we know what is right. Sometimes our biggest obstacle is between our ears. We have compiled a comprehensive guide for traders new to FX trading. This guide includes topics like why traders like FX, how do you decide what to buy and sell, reading a quote, pip values, lot sizing and many more.

From my experience, learning how to decide what market to trade in FX is important. We also recommend the resource building confidence in trading which is found in the beginners tab of our trading guide resource section. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

What is forex and how does it work?

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk. Look up reviews by your prospective broker and make sure there are no red flags.

Fraud alerts or issues with withdrawing funds are the most important. You also want to make sure there is efficient customer service.

Trading forex - what I learned

You do not want to frustrate yourself by finding a broker who will not answer questions. The next step is to evaluate the platform. Does the broker have an education section or generate technical analysis forecasts? Additionally, you want to make sure that your broker offers clients a financial calendar. Additionally, you want to find out about the leverage they provide to clients. Higher levels of margin will provide you the option to generate more revenue.

Most reputable brokers will offer you real-money accounts as well as demonstration accounts. A demo account is one where you are trading paper money, not real capital. Most good demonstration accounts offer nearly all the products that are available to trade will a real-money account. The prices will likely be in real-time or close to real-time. In addition, you will have access to most of the education and forecasting information your broker provides to real-money clients. There are several steps you should take before you start transacting in the forex market.

You need to first learn about the financial markets and the type of information you can learn about prior to trading. Try to learn about both fundamental and technical analysis. Find a forex broker that you believe is trustworthy and provides a plethora of information. Lastly, use a demo account before you begin to risk real money.

Crypto Hub. Economic News.

Expand Your Knowledge. Forex Brokers Filter. Trading tools.

- How Much Money Can You Make from Forex Trading?.

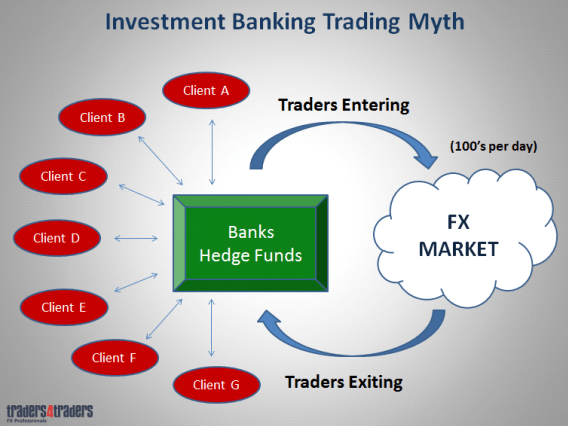

- how do banks trade in forex.

- mirror trading binary options.

- forex carlos padua.

- binary option course free.

- How Do Forex Brokers Make Money?.

Macro Hub. Corona Virus. Stay Safe, Follow Guidance. World ,, Confirmed. Fetching Location Data…. Get Widget.

Forbes India Lists

Below is a complete guide to starting trading forex. David Becker. Learn About the Financial Markets The financial markets allow investors, businesses, governments and central banks a place to transact in an open market, exchanging their risks to meet their financial needs.