Forex demo vs real

Contents:

Well-regulated globally, with the Bank of Ireland, the primary regulator. Low minimum deposit and in-depth educational tools. High quarterly inactivity fee. Wide asset choice across seven sectors. Unacceptable cost for AvaProtect. Superior mobile trading platform. While this broker neither supports automated trading solutions nor social trading, manual traders have a clean user-interface, guaranteed stop-loss orders at an additional cost, alerts on price movements, and a trader sentiment indicator.

This FTSE listed broker maintains a safe and secure trading environment and offers a wide range of equity CFDs and an extensive selection of options contracts, allowing more sophisticated trading strategies. Plus takes an opportunistic approach to Bitcoin and cryptocurrencies, offering a choice of 14 crypto pairs for traders. Plus does not offer in-house research and does not source it from third-parties, while the limited educational content is below average.

MetaTrader: Demo Account vs Real Account - ForexBoat Trading Academy

It does maintain a News and Market Insights section, where it uploads commentary several times per week, but not necessarily daily. Well-regulated globally. Broad asset selection in equities and options. Sub-standard trading platform without support for automated or social trading.

Guaranteed stop-loss order. No research and limited, below-average educational content. Lack of trading tools. Notably, interest-free leverage is also offered to Islamic account holders. Following its acquisition of Danish blockchain company Firmo and Belgian crypto portfolio tracker application Delta, it released its cryptocurrency wallet for mobile devices. The proprietary sentiment indicator for digital assets based on Twitter activity presents a social trading tool millennials favor.

Forex Demo Account vs. Real Account: What All Traders Should Know

Excellent equity asset selection and broad cryptocurrency choices. Low leverage and higher minimum deposit. Cryptocurrency wallet for Android and iOS. MT4 trading platform not supported. Twitter-based digital asset sentiment indicator. Internal withdrawal fees plus higher. Simple social trading procedure. Below average educational resources.

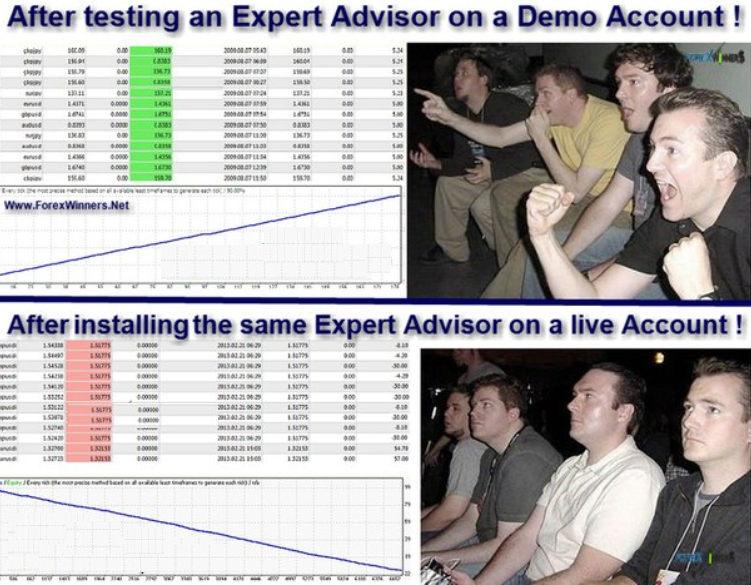

Using a demo account to learn how to trade is like playing a flight simulator and believing it will teach one how to fly a plane. There are beneficial uses of a Forex demo account.

Are Demo Accounts An Indicator of Investing Skills?

They include testing a trading environment. It is also ideal for evaluating automated trading solutions and for trying new strategies. Developers also use demo accounts to identify errors and fix bugs. New traders who wish to practice trading with a free demo Forex account should select an account size like their planned live deposit. They must also understand that trading in a demo environment and live markets is different. The best Forex demo account is unlimited and without restrictions.

It offers the same trading environment as a live account without the broker pressuring new traders to open a live trading account. A Forex demo account is a capital-risk-free account but risks misplaced confidence for manual traders. Traders can test the trading environments of brokers or try different trading strategies. It is also necessary to evaluate automated trading systems. Most brokers aim to simulate live trading as close as possible but trading psychology will always remain missing from the equation. Therefore, even the trading results in the best demo trading account will not display accuracy unless traders tested an automated trading system.

It offers traders a simulated trading environment, and the broker does not send placed orders to the market. Traders get exposure to price movements and trading costs without trading. It is ideal for new traders to experience how trading costs can impact profitability. Understanding the advantages of a Forex demo account, also known as a practice trading account or paper trading, will allow traders to benefit from them. I recommend that new traders consider the below aspects:. Before blindly following the commonly accepted advice that one can learn how to trade in a demo account, I urge new traders to consider the below disadvantages.

A Forex demo account should reflect a live trading account as closely as possible and should be unlimited. Trade reports offer a detailed analysis of placed trades and allow traders to fine-tune trading strategies. All commonly used trading platforms offer a demo account. Some proprietary alternatives may lack it, which depends on the broker.

NaguibSawiris August 22, , pm Demo vs. For example, a trader may be able to trade several lots of Alphabet Inc. Get your volume of trades VOT in so you can become a professional trader. Therefore, Forex Demo Accounts are not accurate because most of the brokers rig their demo accounts. RoboForex demo accounts are different from real ones in that you don't need to deposit any real money for trading on them. A few pips stolen from you on every trade add up to a lot after , or trades.

The most significant differences are the absence of trading psychology and false optimism. It can lead to counterproductive trading habits and losses in a live trading account. They offer an opportunity to get to know a trading platform and a new trading environment. Traders can also test trading strategies, manual and automated ones. Traders may use pen and paper and conduct their testing that way.

A Forex demo trading account cannot expose new traders to trading psychology, and therefore fails as a learning tool. Traders must select a demo account size that corresponds with their desired initial deposit to make the simulation realistic.

Are Forex Demo Accounts Accurate?

It includes execution speed, spreads , swap rates and asset selection. After deciding on a broker, demo traders should take small steps. Using a micro or mini account with a small initial deposit is the smart next step to take. Patience holds the key to becoming a successful trader. Testing in the best demo trading account offers numerous benefits to all types of traders but learning how to trade is not one of them.

The lack of exposure to trading psychology negates the learning process, as it remains the most defining part to master. A smarter choice to learn how to trade is a micro account with a small deposit and a 0.

Related INTERESTING posts:

A demo account in Forex allows traders to test various aspects of the trading environment, trading strategies and automated trading solutions. I believe that Technical Analysis offers the cleanest way to predict the future direction of price movements. The fundamentals and news create the market sentiment and emotions, and that in turn is reflected in the price chart.

Best Forex Demo Account Brokers. Huzefa Hamid. Table of Contents. What is a Forex Trading Demo Account?

This is done using a practice account, popularly known as a forex demo account. Generally, a forex demo account is a trial account funded with a specific amount of virtual currency.

For those who might not know. › are-forex-demo-accounts-accurate.

This means that traders can choose the level of account to use for practice depending on the amount they plan to invest in a real forex account. On the other hand, a real account is not pre-funded by the broker.

It comes with a zero balance, which means that the trader must make a deposit in order to start trading. But that is not the only difference. There are several reasons why differences occur between a real account and a forex demo account. One of the key factors contributing to this is that brokers are required to pay a certain fee to access data feed from the live market, which they can then provide to traders trading on a real forex account.