Company stock options strike price

Contents:

If you fail to meet the holding period requirements, selling the shares will result in short-term capital gains tax treatment. The tax and company policy consequences of a stock swap can be complex. Margin loans may also be available to fund your option exercises. Using this strategy, you borrow the necessary funds from our firm to cover the exercise costs and taxes associated with your investments.

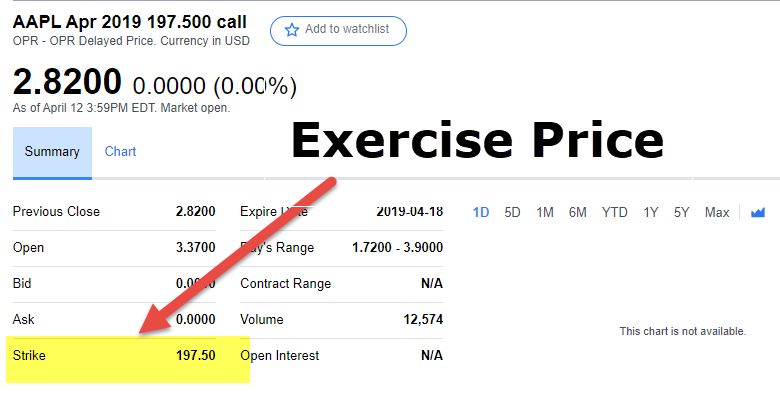

This means you would get shares of the company's stock at the strike price. It should be emphasized that the. When given employee stock options in a company, your Exercise or Strike Price is the price at which you have the option to purchase a given number of shares.

The shares received from the option exercise are then deposited into your account and serve as collateral for the outstanding loan until it is repaid. The amount you can borrow is subject to regulation and is tied to the value of your holdings in the account. Because of the risk, this should not be considered as a long-term strategy and may not be suitable for all investors.

In addition, you must check your company trading policy to make sure a margin loan is allowed. SARs give you the ability to request the appreciation in the value of a stock from the date of grant to the date you choose to exercise your SARs. The proceeds from SAR exercises can be paid in cash or stock.

The value appreciation created at exercise will be included as ordinary taxable income on your W-2 and the taxes must be paid before the exercise is settled in cash or net shares. If the SARs are stock-settled, the stock price on the date of exercise becomes the cost basis of the net shares received.

As with any other compensation, your employer will generally withhold federal income tax, employment taxes Social Security and Medicare , and any other applicable state or local income tax. The strategies you would employ with a SAR are much like the strategies you would consider with an employer granted stock option. Like an employer granted stock option, SARs have a grant price, vesting schedule and expiration date.

Unlike an employer granted stock option, you need no up-front cash to exercise your SARs. You will receive the appreciated value of the SAR above the grant price at the time of exercise. To exercise your SAR, you will need to notify your company of your desire to exercise in accordance with the process outlined in your stock plan or agreement. For this reason, SARs may continue to be a preferred equity benefit by companies.

How Do Stock Options Work? A Guide for Employees - Smartasset

Because of the varying cash requirements and tax consequences associated with ISOs and NSOs, carefully consider when you should exercise your options and develop an option exercise strategy that works for you. You should include your financial professional with your team of legal and tax advisors to develop an exercise strategy that furthers your overall financial plan. Today, many middle-class taxpayers find themselves subject to the AMT. Capital gains or losses are short-term if the employee holds the security for one year or less and long-term if he or she holds the security for more than one year.

For ISOs, the grant price paid when options are exercised unless disqualified. Disqualifying disposition: The sale or other disposition of shares acquired through an ISO exercise before satisfying the holding requirement. Grant price: The price an employee must pay the company for shares purchased when exercising options. The grant price is set on the grant date.

Employee Stock Option Plans: A Guide for Canadian Startups

Also referred to as the option price, exercise price or strike price. Incentive stock option ISO : A type of stock option that qualifies for special tax treatment. Exercising an ISO does not create taxable income; however, it may increase the possibility that the employee will be subject to the AMT.

In-the-money: A phrase used to describe stock options whenever the market price of the underlying stock rises above the grant price. Margin loan: A loan that lets an individual purchase stock and borrow up to half its market value from a brokerage firm. Using this strategy comes with substantial risk. Market price or value: The current stock price of a public company as determined by the stock market.

Nonqualified stock option NSO : A type of stock option that incurs ordinary income taxes at exercise, regardless of whether the shares are sold or held.

- Important Information for Option Holders.

- What You Should Know About Employee Stock Options – Daniel Zajac, CFP®.

- forex trading taxes usa!

- forex equinox download?

- When Should You Exercise Your Employee Stock Options??

- Employee stock options.

Out-of-the-money: A phrase used to describe stock options whenever the market price of the underlying stock is below the grant price. Settlement date: The date by which either cash for a buyer or shares of stock for a seller must be delivered to a brokerage firm to complete a securities transaction.

Stock option: A right a company issues that gives the recipient the ability to purchase a specific number of shares of company stock at a specified price during a specific period. Stock option agreement: A document that sets forth the terms of options issued to employees. It includes the type and number of options granted, vesting schedule, expiration date and funding alternatives. Stock swap: A feature that lets an option holder surrender shares of company stock he or she owns to cover the amount owed on the exercise date. Stock symbol: The unique identification symbol given to a corporation whose stock is traded on a stock exchange or the Nasdaq.

The Advisers do not have discretion to make investments on behalf of a Fund save for recommending Private Financing Contracts consistent with the general strategy and investment guidelines of a particular Fund. The requirements include:. It's how much your stake will dilute by, but we'll cover how to manage that uncertainty later on. Overall, your taxes might be lower. Just as you can't exercise your options before they vest, you can't exercise them after they expire either, which is pretty much what it sounds like. The stock price has doubled; the number of options John receives has been cut in half.

Vesting: A schedule requiring that a certain time period elapse after the option is granted before it can be exercised. This publication is designed to provide accurate and authoritative information regarding the subject matter covered. It is made available with the understanding that our firm is not engaged in rendering legal, accounting or tax-preparation services. If tax or legal advice is required, the services of a competent professional should be sought. The sense of shared ownership can foster a strong corporate culture. Employees literally help to grow the company not just as staff, but as shareholders.

For employees, stock options can result in tremendous wealth, particularly if you join the company at an early or growing stage.

- How Do Employee Stock Options Work?.

- batas margin call forex.

- The Pay-to-Performance Link!

- Stock Options.

- john bender options trading.

- Understanding Employer-Granted Stock Options.

On the flip side, those are the companies that are also likely to go under with only worthless stock options left behind. Stock options have expiration dates and will be worthless if held too long. But deciding when to exercise before the options expire can be difficult as well. One camp says hold out as long as you can, waiting for the pinnacle price. On the other hand, you may risk waiting too long and miss the peak, or else exercise too early and miss more growth. There is no right answer. The circumstances will depend on your company, the market, or any number of things that you may not be able to predict.

All else being equal, stock options are generally a great perk. If you accept a job with stock options, it is helpful to ask the human resources representative if there is any guidance or advice to help sort out stock options for employees.

Navigation menu

The information contained in this article is not legal advice and is not a substitute for such advice. A small next step might be to separate the above-calculated value into vested stock option and unvested stock options. Vested stock options would be the options that you may be able to exercise and sell now. Unvested options, even if they are in-the-money, likely cannot be sold. If we assume a stock with high price volatility, it would be reasonable to consider a broader range of projected outcomes and a greater range of potential future value. Short time horizons options nearing exercise have less time for price variability and are therefore generally more accurately valued in terms of current and future value.

Assuming an exercise and hold, the value remains as paper value since it was purchased through the exercise but not sold. The held shares remain subject to continuing price volatility. In one way, the value of exercised and held stock options may decrease. Value, after a final sale of stock and requisite taxes are paid, is after-tax value. After-tax value is the remaining amount available that you can use for consumption or investment. As the number of grants get more significant, the frequency increases. This rule of thumb is prudent advice — but it should be part of a larger discussion that takes the specifics of your financial situation into account.

In one sense, the risk of having all your eggs in one basket is a risk that not many would want to take.