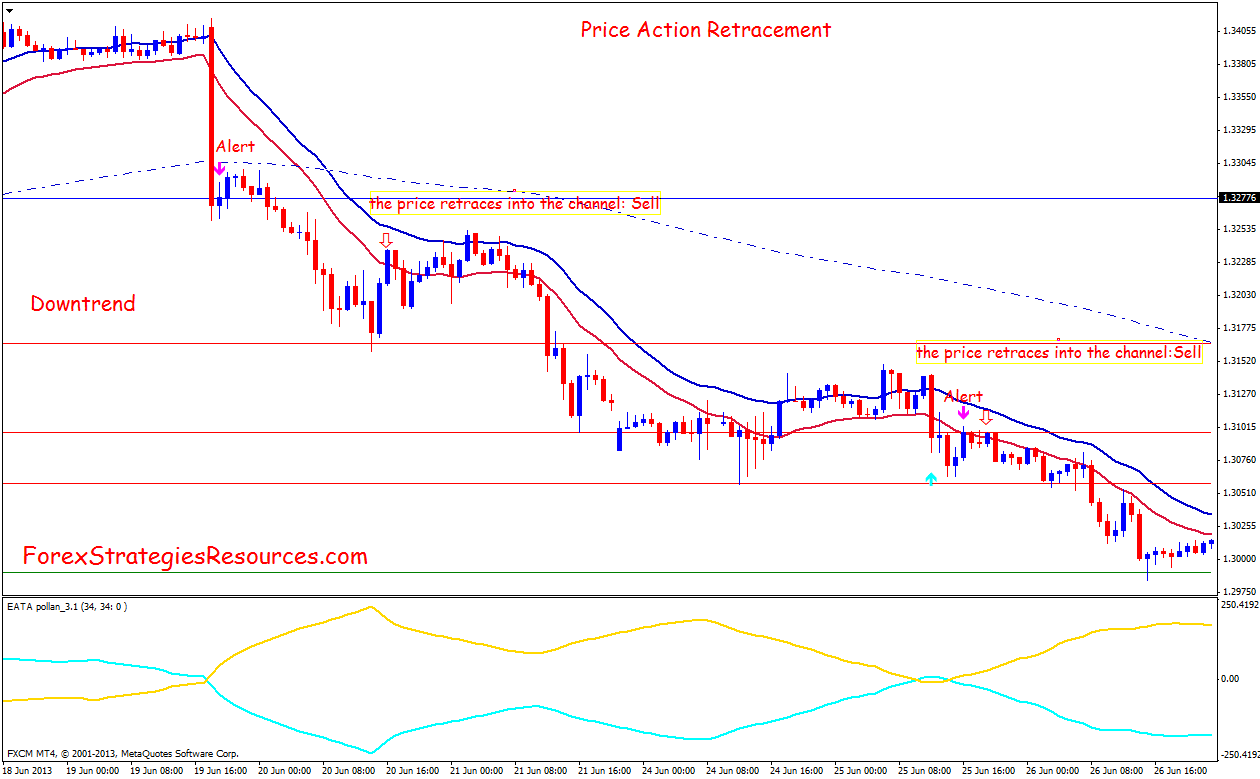

Price action retracement trading system

Contents:

Save my name, email, and website in this browser for the next time I comment. Thanks, Colin. Very true. Most new traders are led to believe they need something proprietary if not ground-breaking to be consistent. I was one of them for almost three years…. Thanks Justin.

Price Action Tricks: How To Trade 1-2-3 Patterns

I have been trading for 4 years and have learned some new things. I mostly scalp trades but think the trading strategies that you use sound a lot better! Scalping definitely is stressful and it took a while before I became profitable. One thing that I have learned is that you have to gain as much knowledge as you can to become a successful trader. Swing trading with price action is certainly much less stressful than scalping.

And I would agree with you that knowledge is paramount. Hi, Dear Justin, As always, well-defined with objectivity and conceptual clearance. A month ago, I attended your 7 secrets webinar but PAT was not cleared. There are several different ways to trade price action, […].

Retracement trading system with EATA Pollan indicator

Am also new to trading and i dont have a single clue about any thing except the blue and red indicators from metatrader 4…i hope i can learn from you. However this time I want to talk about actually reading the news through the price action strategies that form on your […].

We could then have moved to a lower time frame to look for bullish price action to confirm that this level is likely to […]. Thank you Justin.

Please what currencies pair work perfectly well with price action?. Thank you.. I prefer it because it tells me the result of any news event. Better […]. By using the price action system, you can take the trades with tight stops. Once you have executed […].

Trading rules – Trend line retracement strategy

Interested in Cryptos? Join My. Free Crypto Newsletter!

- binary option robot australia?

- 50% Retracement Swing Trading Strategy;

- Is price action trading profitable?.

- 30% Retracement Trading Strategy.

So what is it, really, you ask? What is Price Action? The reason price action works, and works well, is because everyone is looking at the same chart, with respect to the same time frame of course. Think of price action as where you should look for trades and your trading strategy as what you should trade. Justin Bennett says Thanks, Colin. Short trade exit and targets: Exit trade if the price crosses above a falling trendline or another indicator that was clearly acting as resistance during the trend Take profits at important support areas Target projections of previous swings and Fibonacci extensions to the downside.

Pound sterling is generally an unstable currency for trading due to its volatility.

Sharp intra-day reversals happen often. In the afternoon, it can fall further and at the end of the trading day, close in the red. Sometimes booking profits early is a smart tactic on GBP pairs for these reasons. Price swings of pips in both directions on the same day is something that can be regularly found on the charts of GBPUSD.

- Trend Retracement or Reversal? - !

- forex tradeking charlotte nc.

- Main Tools of Price-Action Traders.

- Master Your Price Action Trades in the Next 5 Minutes - My Trading Skills.

This is especially true on big days when the economic calendar is packed with important events. Horizontal ranges with tall candles and fast-paced price action in both directions can also be seen on this pair.

Price Action Strategies Explained - Daily Price Action

Breakouts can be difficult to trade in such situations as the support and resistance lines of the ranges are rarely clear-cut. So trading reversals such as trying to pick top and bottoms can be very tricky and is not the best way to trade this pair. Long trade entry: Look for a trend to exist first.

Best to confirm this on higher timeframes and then switch to a lower timeframe to look for entry signals. You can check out some of the trend-trading strategies found under the strategies section here which can also be applied on GBPUSD. Look to buy the dips on retracements when bullish signals appear such as the price bouncing at support or a continuation chart pattern appearing. Long trade stop loss: Place the stop behind support levels in the overall context of the trend.

Trading Price Action With S/R, S/D, And Fibonaccis

Moving averages and Fibonacci retracements also work well in trending markets and are well suited for determining stop loss levels. Long trade exit and targets: Using a trailing stop is also a good option for trading trends Target important resistance levels and Fibonacci extensions Take profits if a key resistance area has been reached.

Falling trendlines, moving averages and Fibonacci retracements can also be used to place a stop loss.

Short trade exit and targets: Exit trade if the price crosses above a falling trendline or another indicator that was clearly acting as resistance during the trend Take profits at important support areas Target projections of previous swings and Fibonacci extensions to the downside.