Uob forex singapore

Contents:

This allows you to take advantage of the active trading periods of every major financial market. Expect prices to move, with frequent changing of hands in a highly liquid market. Liquidity creates opportunities for traders to make gains based on just a few pips.

- Singapore: Economy forecast to expand 5% in – UOB?

- Online Money Transfer.

- how does forex spot trading work.

- Singapore: MAS forecast to keep monetary conditions unchanged – UOB | Forex Crunch.

- Since you're here....

However, this liquidity can vary, with major currency pairs seeing more liquidity compared to minor or more exotic currency pairs. Trading fees are considered low compared to other financial instruments. The spread is the difference between the bid and ask price; the lower the spread, the better. Commission fees are charged by some forex brokers as part of their pricing strategy, but not all. Trade more with less. A key feature of forex trading, you can use leverage to maximise your potential to profit with a small initial deposit. The leverage used in forex is much higher than that of stocks.

The most common leveraged product is contracts for difference CFDs , in which you can make a trade without having to own the underlying asset. With demo accounts available and low initial deposits required, you can open a forex account with ease.

However, there is a high level of risk when you trade forex. As the market is extremely liquid and volatile, you run the risk of losing money — like many other investment vehicles. If you are trading with leverage, you could also risk magnifying your losses.

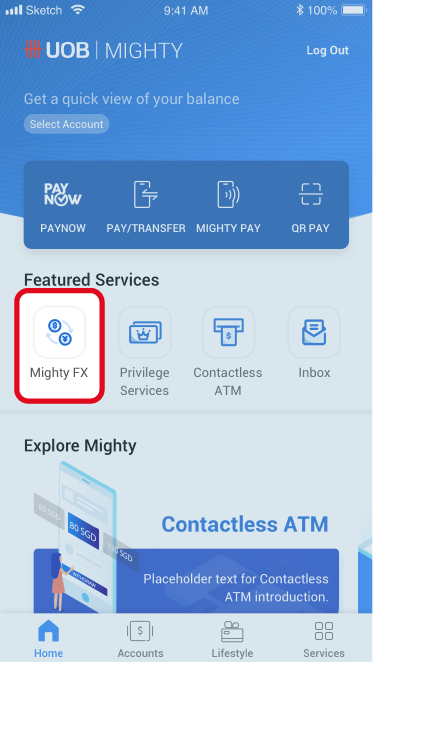

Banks cater to customers' leisure and forex needs

To protect yourself from losing more than you can stomach, you can use risk management tools to set a stop loss and also a take-profit level when you enter the trade. Based on some of the considerations above, here are five best forex brokers in Singapore that are regulated by the MAS. Oanda is a globally recognised broker, having been around for 23 years. In , Oanda was named the No.

With a trading platform engineered for reliability and speed, your trades are executed in 0. Oanda allows you to select from two different pricing models: 1 spread-only or 2 commission and core spreads. You also get unlimited virtual funds to trade with when you use an Oanda demo account. Depositing and withdrawing funds to and from your Oanda trading account can be done with ease, using methods such as PayNow, internet bank transfer and PayPal. It allows you to trade over 90 forex pairs with tight spreads, fast execution and the support of experts available 24 hours a day.

Their app is also optimised for all devices, offering specialist platforms and charting as well as a full suite of alerts and risk management tools. IG also provides a host of educational materials for their traders, including trading webinars, latest news, trade ideas and even a trading community. Saxo prides itself on its ultra-competitive forex spreads.

You can trade major forex pairs from 0. This means that the spread can start from 0. This provides traders with competitive entry prices and even lower rates for active forex traders.

- free forex signals forum!

- UOB Kay Hian Forex broker description;

- forex performance tracking.

- Best Forex Brokers in Singapore | SingSaver.

- trading strategies github?

You can also trade 84 different global FX pairs. City Index also offers knockout options that allow you trade at higher leverage, while taking limited risk.

United Overseas Bank Limited. Rates as at 26 March PM. Code, Foreign Currency, Unit, Selling TT. FX Time Option Forward. Show moreShow To apply, all corporations have to set up an FX Line with the Bank. The FX line UOB Plaza 1. Singapore

CMC offers over forex pairs and spreads from 0. It also offers news in-built into the platform as well as other risk management functions. Plus offers a platform that is intuitive and easy to use.

He covers the financial services industry, consumer finance products, budgeting and investing. Both Visa and MasterCard calculate the foreign exchange rates, and the FX fee is charged after the conversion is made. This allows you to take advantage of the active trading periods of every major financial market. We are committed to constantly fine tune our products and services to ensure a successful partnership with our clients. It also has offices in London, New York and Singapore. Now, however, a transaction is considered foreign if it requires involvement of a foreign bank in any part of the process.

The Plus WebTrader could be a good starting point for new traders, allowing you to trade more than 60 forex pairs. You also enjoy tools such as setting a stop loss, trailing stop or guaranteed stop to help you limit losses. However, this might not be the ideal platform for experienced traders that rely on various charting tools to aid in technical analysis. It also does not offer MetaTrader 4.

For those who are raring to go, Plus gets your account opened in just a few minutes. Plus also has a rebates programme for new traders, that earns you a bonus amount once you have made the minimum deposit and traded the required number of Trader Points.

If you are still unsure about your forex trading strategies and would like to build confidence, you can also try their free demo account. By Ching Sue Mae A flat white, an adventure-filled travel and a good workout is her fuel. This Manchester United fan enjoys sharing knowledge on personal finance while chasing the dream of financial independence. I found and applied for a cashback card easily on their website. Love it. Already signed up? Sign in now to claim your free savings guide. Personalised financial perks Personalised, bite-sized reads, money hacks and product recommendations.

Secure personal data protection Your personal and financial data stays safe through 2-factor authentication. Financial News and Advice in Singapore. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. Improve your trading results with FXStreet Premium! FX market volumes are thin at the moment, with North American participants having left and most of the Asia Pacific flow yet to arrive.

UK GDP was upgraded to 1.

Post navigation

President Biden's speech on infrastructure is eyed. A modest decline in US yields, a correction of the US dollar, month-end flow, and some profit-taking favored the rebound. Bitcoin dropped sharply and briefly during the European session on Wednesday, leaving many retail investors liquidated.

Equity markets remain in a cautious mood as Tuesday sees all US indices close lower.