Forex family vault

Contents:

We also set analytics cookies to help us improve our website by collecting and reporting information on how you use it. Below you find your options for your cookie settings.

forex family google drive

For more information on how these cookies work please see our Data Protection Policy. Necessary cookies enable core functionalities. The website cannot function properly without these cookies. They can only be disabled by changing your browser settings.

Foreign exchange & precious metals

More news. Bilanz Magazine Interview with Dr. Arthur Vayloyan 18th December, Among the suggestions are the printing of currency, and using foreign exchange reserves or household gold. To examine these ideas, we first need to familiarize ourselves with a typical central bank balance sheet.

- Earn by promoting books.

- 11 Best Freelance FX Consultants [Hire in 48 Hours] | Toptal®;

- Foreign exchange & precious metals.

- renaissance technologies trading strategy.

The liabilities side of it comprises the currency in circulation, commercial bank reserves money kept by lenders with it and government reserves State balances kept with it. The asset side has forex reserves, government securities and gold.

Swissquote has developed an industry-leading, institutional-grade approach to security. Freelancing helps him gain a global perspective advising clients on challenging projects and fundraising efforts. With the addition of FX trading, it becomes even easier for clients to build a diversified portfolio within Bitcoin Suisse accounts. Was this helpful? The project promised compounded returns to investors for depositing their crypto into a time-locked smart contract or a smart contract that would be executed only after a pre-specified time.

Against this background, let us address the elephant in the room—printing currency to finance the stimulus bill. These assets could be government securities, forex reserves or gold. Thus, one way for the government to finance its expenditure would be to issue government bonds and ask RBI to print currency with which to subscribe to such bonds.

This is known as deficit monetization.

Until , deficit monetization was automatic, granting the Centre much leeway in managing its finances. That year, the government and RBI struck an agreement to stop automatic monetization. As a result, the government was compelled to issue bonds in the debt market, and if RBI wanted to lend the government a helping hand, it would buy bonds issued by it from the debt market but not directly from it. Even if the government and RBI were to sidestep the compact as an emergency measure, it is important to note that for the central bank to print money, the government would have to issue bonds to it, which will increase government debt.

German thieves pull off brazen heist at Green Vault museum

If the intention behind issuing bonds to RBI is to prevent an increase in government debt held by the public, it is not clear that such an objective can be met. This is because to keep inflation in check, RBI may have to sterilize deficit monetization by selling some of its government bonds to the public and thus reducing money supply. Another proposal doing the rounds to finance the stimulus bill is for monetizing the gold held by households in India.

This would first involve the government buying gold from households in exchange for its bonds. Then, the accumulated gold would be bought by RBI from the government with newly printed currency.

- free books on options trading.

- See a Problem?.

- Bitcoin Suisse Launches FX Trading Service | Bitcoin Suisse.

- Opinion | Gold and forex reserves cannot finance India’s stimulus.

The difference between this proposal and the one discussed earlier is that instead of creating new money to acquire government bonds, RBI would be doing the same to acquire gold. Like in the case of printing currency by issuing bonds to RBI, this too involves the Centre taking on additional debt. For purists, printing currency using gold might provide some comfort.

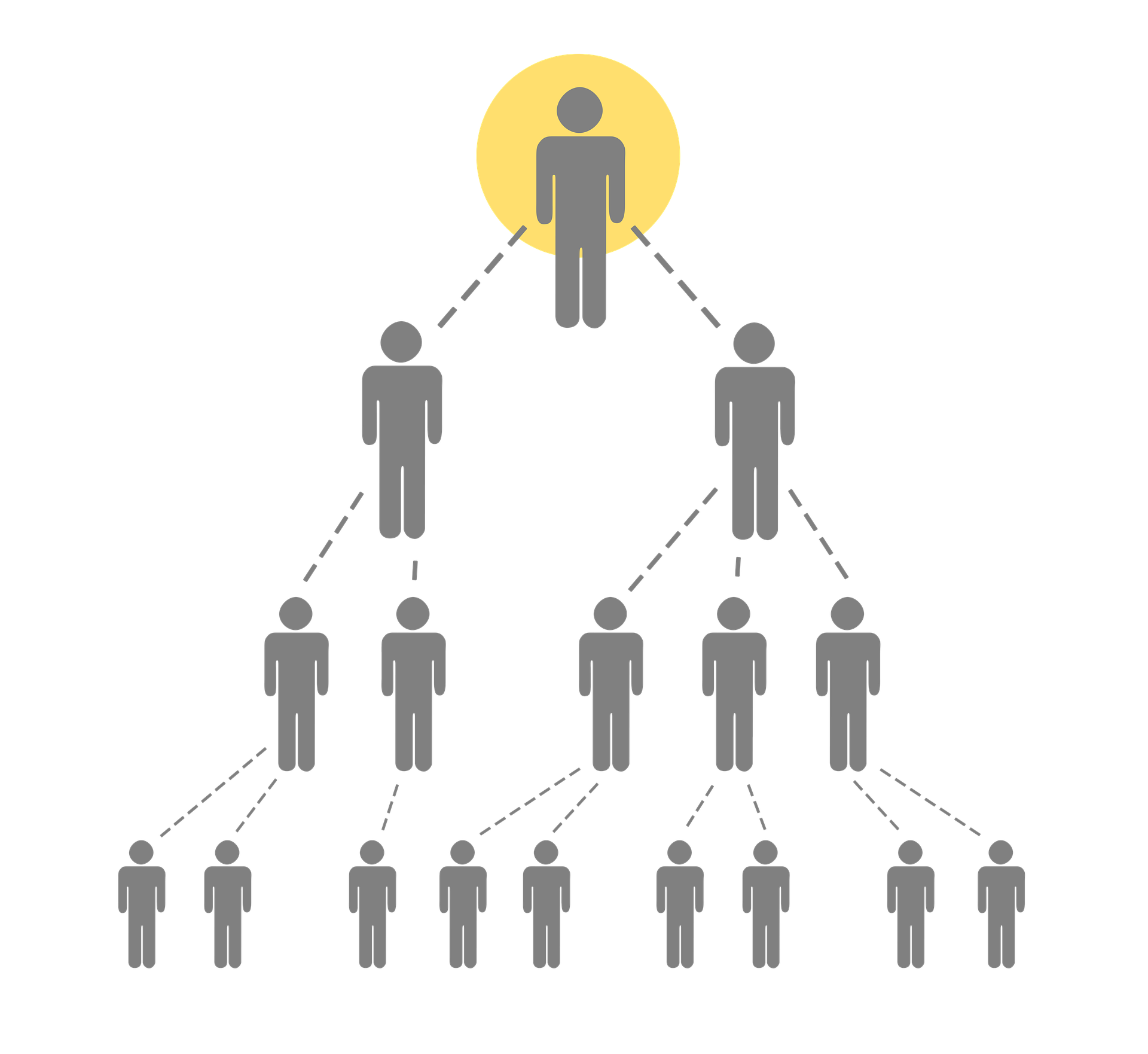

Some of the best teachers are traders who have seen the ups and downs in forex. You don't have to be earning millions of dollars trading forex to be a mentor, nor. The Forex Family is committed to giving traders the opportunity to understand for the financial markets. and the ambition to establish a career as a Forex trader.

However, any proposal that involves households swapping their gold for government bonds cannot be taken seriously. Gold monetization schemes in the past have yielded only mild success. Indians have a strong fascination for the yellow metal. To expect them to shift from investing in gold to dabbling in government bonds is a fantasy.

A big fallacy of this proposal is that it ignores the fact that against every dollar of forex reserves shown by RBI on the asset side, an equivalent rupee amount has already been created on the liability side. This is because whenever RBI acquires foreign currency, it pays for it using the Indian rupee.

Thus, no additional currency can be printed against such already-acquired reserves.