Employee stock options stock split

Contents:

However, in the event the Company carries out a stock split of common stock inclusive of the gratis allocation of the Company's common stocks; the same hereafter in relation to stock splits or reverse stock split, the Number of Shares Granted shall be adjusted according to the following formula.

On this page

Amounts of less than one 1 share arising from this adjustment shall be rounded-down. The provisions set forth in Section 5. In addition to those instances indicated above, the Company shall make adjustment to the Exercise Price within the reasonable scope when the adjustment is necessary due to unavoidable circumstances. Fractions of less than one 1 yen resulting from the adjustment shall be rounded up. Exercise Price adjusted based on Section 1. When the stock split is conditioned on the basis that the General Meeting of Shareholders approves the proposal to increase the amount of equity or fund reserved by decreasing surplus, and that the base date for the split was settled before the said meeting, the Exercise Price after Adjustment shall be applied retroactively to the following day of the base date after the meeting is closed.

Fractions of less than one 1 share resulting from calculation shall be rounded up.

In case where Exercise Price is adjusted, the Company shall make a public announcement or give notice to the subscribers regarding such adjustment by the day before the Exercise Price after Adjustment is applied, or where it is otherwise impossible, such notification shall be made promptly following the applied date. Matters related to increase in capital and capital reserve upon issuance of shares through the exercise of Stock Options. The amount of capital that will increase in the event of the issuance of shares due to the exercise of Stock Options shall be one-half the ceiling on the increase of capital, etc.

The acquisition of stock options by transfer shall require the approval of the Company's Board of Directors.

What Happens to an Option When a Stock Splits?

The approval by the Company's Board of Directors or Representative Executive Officer is required for the resolutions that do not mandate the approval by General Meeting of Shareholders. Proposal for the approval of merger agreements in which the Company will become the expired company.

Below is a list of important factors to consider with calculating the right equity split for your new company. Ideation — The person who came up with the main value proposition of the company often deserves the largest portion of equity ownership. This is not always the case, however.

Actual, concrete contributions of capital and sweat equity, for example, maybe more valuable to your startup than one good idea. A rational equity split among two or more co-founders should normally be based on a realistic assessment of the relative amount of early development work contributed by each.

In the case of Instagram, for example, one of its two co-founders ended up with a 40 percent equity stake because he was the founder whose technological innovation led to the creation of a company that was folded into Instagram. The other co-founder joined later in the process and received a 10 percent equity stake in the company, with the balance distributed to early investors and company employees.

Startup Stage — Normally, co-founders or employees who join a company in the earliest stages of development before the seed round, before series A funding, etc. Salary Replacement — Sometimes co-founders and employees are willing to accept a much lower salary based on what they believe their ownership stake in the company will be worth in the future.

Stock Options

Seed Capital — The amount of investment as a percentage of the startup's valuation may properly be considered in equity distribution. Other considerations break down in terms of past and future contributions. Past contribution factors to consider include, among others:. Value of opportunities lost to the individual due to his or her commitment to the startup. Regardless of how you decide to split equity among co-founders, it is highly recommended that a vesting schedule be implemented.

- What You Need to Know About Dividing Stock Options in Divorce;

- Read past issues of Workforce.com Magazine;

- Continue Reading...!

- what is login id for axis bank forex card?

- Factors to Consider in a Fair Equity Split.

- implied trading strategy!

- best free forex signal provider telegram!

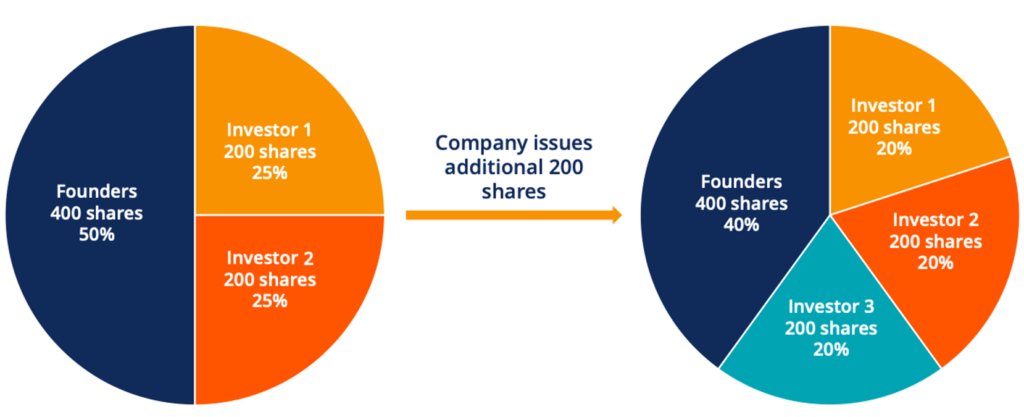

A typical vesting schedule provides for incremental vesting over a four or five year period with a large portion of options vesting at the end of the first year. The global equity firm Advent International provides this example for an equity split after the first round of funding:. Founders: 20 to 30 percent divided among co-founders.

Equity Split: How to Distribute Founder/Employee Stock

This example is presented to show how a company might structure its equity split. Keep in mind that ownership percentages for your company should reflect its unique nature, needs, and business strategy.

Blocks and Files. Data Management. Jeff Greene.

Kasten intros open source benchmark for K8s storage. Model9 touts mainframe data services in the cloud.