Stock options diluted eps

Contents:

Earnings Per Share (EPS) vs. Diluted EPS: What's the Difference?

The remainder progress through the treasury stock method. For awards with contingencies like options and PSUs, payout is still contingent upon performance metrics or stock price movement in the future. Thus, the shares remain in the treasury stock method calculation and are included in diluted EPS until final settlement. For year-to-date diluted EPS, ASC requires the computation of incremental dilutive shares to be an average of the amounts included in each interim quarterly computation, rather than an independent year-to-date calculation:. ASC The number of incremental shares included in quarterly diluted EPS shall be computed using the average market prices during the three months included in the reporting period.

For year-to-date diluted EPS, the number of incremental shares to be included in the denominator shall be determined by computing a year-to-date weighted average of the number of incremental shares included in each quarterly diluted EPS computation. Example 1 see paragraph provides an illustration of that provision. Many companies choose to take a simplified approach by performing an independent year-to-date computation based on the information and assumptions as of the current period.

Earnings Per Share

In most cases, the underlying math arrives at the same result as performing the computation based on the average of interim quarters. But the two approaches can lead to different, sometimes even material, results in certain scenarios. Situations that result in different year-to-date dilution calculations include:. Naturally, the safest approach is to follow the guidance and compute the year-to-date diluted EPS by weighting the incremental shares from each interim quarter.

Put simply, antidilutive shares are those that are excluded from the diluted EPS computations because including them would be antidilutive. However, the guidance is unclear about the antidilutive share computation for different reporting period, resulting in variations in practice. We lean toward the second interpretation.

By disclosing the unweighted outstanding shares as of the reporting period end date that are antidilutive, all shares that may cause future dilution are captured. Again, practices vary. The second approach may be more straightforward to calculate, and the difference from the first approach may not be material for most cases. However, the second approach could result in certain shares being included for the year-to-date diluted EPS as well as being disclosed as year-to-date antidilutive shares. That will conflict with the concept of antidilutive shares being excluded from the diluted EPS computations.

Basic and diluted EPS impact is one of the most complex areas of equity compensation.

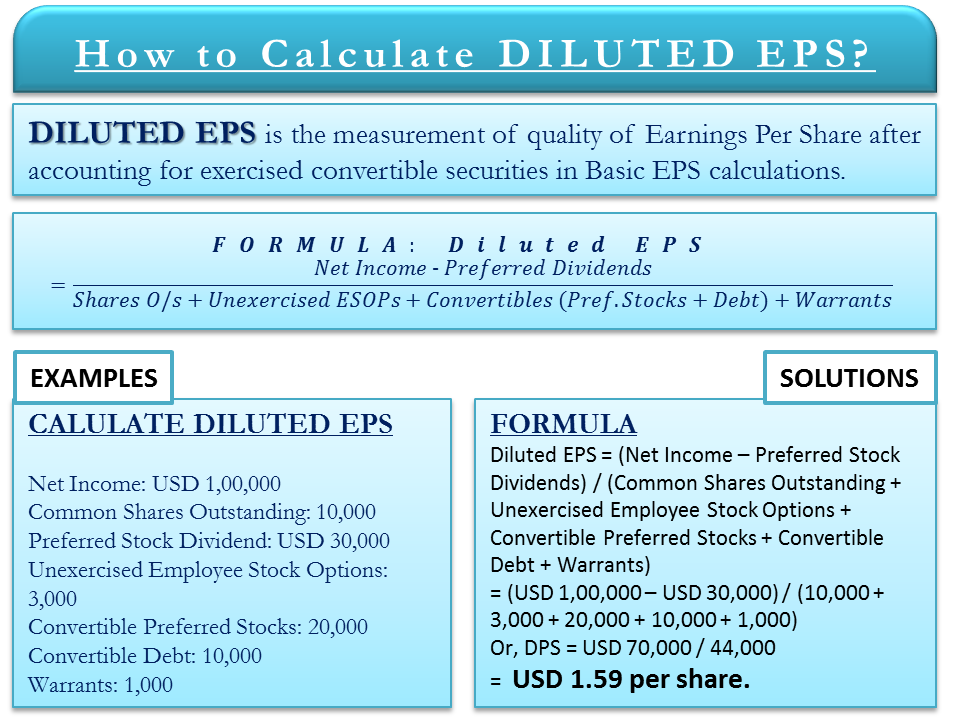

The earnings per incremental share equals the preferred stock dividends if deducted from income available to common shareholders in the basic EPS calculation divided by the number of shares of common stock issued from the assumed conversion. It is unlikely that everyone holding options, warrants, convertible preferred shares, etc. For accuracy, it is best to use a weighted average of the company's outstanding shares for the period. Convertible preferred stock, stock options, and convertible bonds are common types of dilutive securities. The two major components of EPS are the earnings available to common shareholders—the numerator—and some measure of the number of common shares—the denominator. The formula is dividends for preferred stock subtracted from net income, divided by the sum of the weighted average of shares outstanding and the impact of all dilutive securities, including convertible shares, warrants, and stock options. In either case, the foregone interest expense—aftertax—must be added to the EPS numerator.

We just touched on some of the issues here. Key assumptions for forecasting the EPS impact of stock compensation include the composition of future grants and the size and frequency of settlement events. Of course, there are also stock prices, which themselves can affect other assumptions.

More on the EPS impacts of equity compensation coming from us soon, so stay tuned. In the meantime, please reach out to us if you run into any tricky situations.

CALCULATING THE EFFECT OF EMPLOYEE STOCK OPTIONS ON DILUTED EPS - Munich Personal RePEc Archive

Expense multiplier is a multiplier applied to the target number of shares when expensing an award with a performance condition so that period accruals articulate to the then-probable outcome. Dilution multiplier is used to develop the number of issuable shares by scaling the target shares up or down per the contingency logic we described earlier.

This follows the logic of ASC ASC Shares issuable for little or no cash consideration upon the satisfaction of certain conditions contingently issuable shares shall be considered outstanding common shares and included in the computation of basic EPS as of the date that all necessary conditions have been satisfied in essence, when issuance of the shares is no longer contingent. Computation of Year-to-Date EPS For year-to-date diluted EPS, ASC requires the computation of incremental dilutive shares to be an average of the amounts included in each interim quarterly computation, rather than an independent year-to-date calculation: ASC The number of incremental shares included in quarterly diluted EPS shall be computed using the average market prices during the three months included in the reporting period.

A large difference between a company's basic EPS and diluted EPS can indicate high potential dilution for the company's shares, an unappealing attribute according to most analysts and investors. Convertible preferred stock, stock options, and convertible bonds are common types of dilutive securities. Convertible preferred stock is a preferred share that can be converted to a common share at any time.

Stock options, a common employee benefit, grant the buyer the right to purchase common stock at a set price at a set time. Convertible bonds are similar to convertible preferred stock as they are converted to common shares at the prices and times specified in their contracts. All of these securities, if exercised, would increase the number of shares outstanding and decrease EPS. Financial Ratios.

What is the Diluted Earnings per Share Formula?

Tools for Fundamental Analysis. Financial Analysis. Your Privacy Rights. To change or withdraw your consent choices for Investopedia.

What is diluted earnings per share (EPS)?

At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes. Your Money. Personal Finance. Your Practice. Popular Courses.

Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Earnings per share serve as an indicator of a company's profitability. Diluted Normalized Earnings Per Share Definition Diluted normalized earnings per share measures a company's regular earnings distributed across its shares outstanding and those exercised in the future. Dilution Definition Dilution occurs when a company issues new stock which results in a decrease of an existing stockholder's ownership percentage of that company.

Convertible Security A convertible security is an investment that can be changed into another form, such as convertible preferred stock that converts to common stock. What Is Conversion in Finance?

The formula for diluted earnings per share is a company's net income (excluding preferred dividends) divided by its total share count -- including. Diluted earnings per share (diluted EPS) calculates a company's earnings per share if all convertible securities were converted. · Dilutive securities aren't common.

A conversion is the exchange of a convertible type of asset into another type of asset, usually at a predetermined price, before a predetermined date. Partner Links.