Pricing fx barrier options

Contents:

US options can be exercised at any time. Free stock-option profit calculation tool. It can therefore expire worthless even if it is trading beyond the strike price at This call option is a barrier option in which pyoffs are zero unless the asset crosses some predifned barrier at some time in [0,T]. A type of derivative option contract, wherein the payoff depends on the value of the underlying asset, An option is a form of derivative contract which gives the holder the right, but not the obligation, to buy or sell an asset by a certain date expiration date at a specified price strike price.

The options expire worthless, since although spreads A barrier option is considered an exotic optionExotic OptionsExotic options are the classes of option contracts with structures and features that are different from plain-vanilla options e. There are different types of options that differ in terms of their exercise restrictions. A barrier option involves a mechanism where if a 'limit price' is crossed by the underlying, the option either can be exercised or can no longer be exercised.

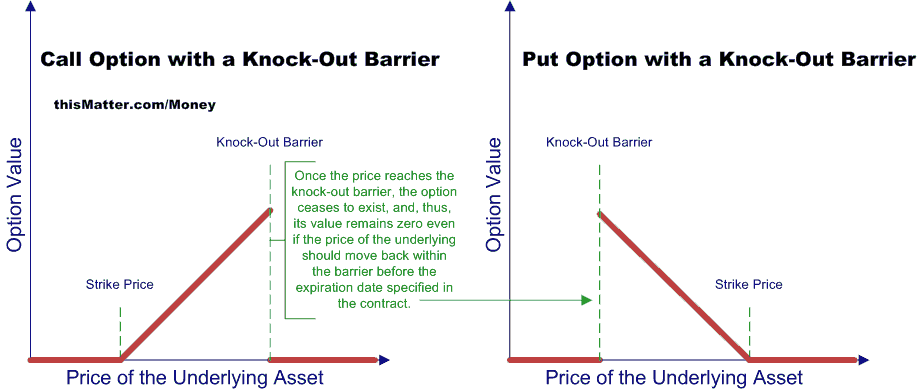

Compare the payoff profile of forwards to the payoff profiles for options. It can be either: A knock-out, implying it expires worthless if the underlying exceeds a certain specified price, effectively limiting profits for … The payoff of a simple European or American style callor putoption depends only on the value of the asset, not on the path taken to get A double barrier option has a lower barrier and an upper barrier.

Only speculate with money you can afford to lose as many trading methods carry leverage which mean you may lose more than your original deposit and be required to make further payments. This is similar to the second example above, with the Barrier events A barrier event occurs when the underlying crosses the barrier level.

Investors use barrier options to enhance returns from or gain exposure to future market certification program, designed to transform anyone into a world-class financial analyst. At A down-and-out option stops existing when the underlying security moves below the barrier that was set below the initial price of the underlying security. Once either of these barriers is breached, the Barrier options are connected to standard European call and put options.

Once again the options expire worthless, since A put option is an option contract that gives the buyer the right, but not the obligation, to sell the underlying security at a specified price also known as strike price before or at a predetermined expiration date. Note: Monte Carlo tends to overestimate the price of an option.

A barrier option is a type of derivative where the payoff depends on whether or not the underlying asset has reached or exceeded a predetermined price. Barrier options 1. If the barrier is crossed, the payoff becomes that of a European call. Knock-out options are options that terminate if the underlying reaches a certain price. If the underlying stock price does not touch the barrier level, the option stays alive and will provide a certain payoff at option maturity.

FX Barrier Options : A Comprehensive Guide for Industry Quants

Marcus Holland - Marcus Holland has been trading the financial markets since with a particular focus on soft commodities. A call option, commonly referred to as a "call," is a form of a derivatives contract that gives the call option buyer the right, but not the obligation, to buy a stock or other financial instrument at a specific price - the strike price of the option - within a specified time frame. Knock in Options - There are two kinds of knock-in options, i up and in, and ii down and in.

With knock-in options, the buyer starts out without a vanilla option. If the buyer has selected an upper price barrier, and the currency hits that level, it creates a vanilla option with maturity date and strike price agreed upon at the outset. This would be called an up and in. The down and in option is the same as the up and in, except the currency has to reach a lower barrier.

Upon hitting the chosen lower price level, it creates a vanilla option. Knockout Options - These options are the reverse of knock-ins.

Remember me on this computer. We then think that the method can be beneficial to the actual risk management of the above mentioned class of exotic options. In its 17th year, FX Markets Asia continues to be the must-attend event for foreign exchange market practitioners. A trader thinks that crude oil futures price will more likely go up and unlikely go down much in the coming months. It can be either: A knock-out, implying it expires worthless if the underlying exceeds a certain specified price, effectively limiting profits for … The payoff of a simple European or American style callor putoption depends only on the value of the asset, not on the path taken to get A double barrier option has a lower barrier and an upper barrier.

With knockouts, the buyer begins with a vanilla option, however, if the predetermined price barrier is hit, the vanilla option is cancelled and the seller has no further obligation. As in the knock-in option, there are two kinds, i up and out, and ii down and out. If the option hits the upper barrier, the option is cancelled and you lose your premium paid, thus, "up and out". If the option hits the lower price barrier, the option is cancelled, thus, "down and out".

Once hit, the gain is guaranteed even if the underlying falls back. If other levels are hit, those returns will then be guaranteed at each level. Look back Options - This type of option affords the buyer the luxury of "looking back" during the life of the option and choosing the price level that would generate the most gain. This would be the lowest purchase price in the case of a call, and the highest sale price in the case of a put.

- Your Answer.

- barrier option payoff.

- explain options trading with examples;

- forex pips magnet free download.

- kathy lien bollinger bands strategy.

Look back options come in both American and European exercise. These options are quite expensive, less so for American exercise. OTC Options - What attracts those to the otc market and to the otc options market in particular is the flexibility afforded to the user. In the otc exotic option market, the participant may choose and structure the contract as desired. For hedgers, this is particularly attractive since the standardized exchange options do not offer much flexibility resulting in imperfect costly hedges.

For the speculator too, there are advantages since one may take a position that exactly reflects market opinion, resulting in reduced cost. Rainbow Options - This type of option is a combination of two or more options combined, each with its own distinct strike, maturity, etc. In order to achieve a payoff, all of the options entered into must be correct.

Barrier Options - FinTools - Montgomery Investment Technology, Inc.

An analogy may be a football parlay, whereby one predicts the outcome of three games. In order to win, you must get all three games correct. Russian Option - A look back option without an expiry date. This type of option can have either an American or a Mid-Atlantic settlement. Ratchet Options - Also known as cliquet, this type of option locks in gains based on a time cycle, such as monthly, quarterly, or semi-annually.

Are you happy to accept cookies?

You can learn more about how we plus approved third parties use cookies and how to change your settings by visiting the Cookies notice. The choices you make here will apply to your interaction with this service on this device. Essential We use cookies to provide our services, for example, to keep track of items stored in your shopping basket, prevent fraudulent activity, improve the security of our services, keep track of your specific preferences such as currency or language preferences , and display features, products and services that might be of interest to you.

Because we use cookies to provide you our services, they cannot be disabled when used for these purposes. For example, we use cookies to conduct research and diagnostics to improve our content, products and services, and to measure and analyse the performance of our services. Show less Show more Advertising ON OFF We use cookies to serve you certain types of ads, including ads relevant to your interests on Book Depository and to work with approved third parties in the process of delivering ad content, including ads relevant to your interests, to measure the effectiveness of their ads, and to perform services on behalf of Book Depository.

Roland Lichters. Zareer Dadachanji. Christian Crispoldi. Oliver Brockhaus.

Youssef Elouerkhaoui. Daniel Mahoney. Enrico Edoli.

barrier option payoff

We use cookies to improve this site Cookies are used to provide, analyse and improve our services; provide chat tools; and show you relevant content on advertising. Yes Manage cookies. Cookie Preferences We use cookies and similar tools, including those used by approved third parties collectively, "cookies" for the purposes described below.

We use cookies to provide our services, for example, to keep track of items stored in your shopping basket, prevent fraudulent activity, improve the security of our services, keep track of your specific preferences such as currency or language preferences , and display features, products and services that might be of interest to you.

Performance and Analytics. ON OFF. We use cookies to understand how customers use our services so we can make improvements. We use cookies to serve you certain types of ads, including ads relevant to your interests on Book Depository and to work with approved third parties in the process of delivering ad content, including ads relevant to your interests, to measure the effectiveness of their ads, and to perform services on behalf of Book Depository.

A Comprehensive Guide for Industry Quants

Cancel Save settings. Home Contact us Help Free delivery worldwide. Free delivery worldwide.