Stock options tutorial

Contents:

This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator Another way to play the futures market is via options on futures.

Using options to trade futures offer additional leverage and open up more trading opportunities for the seasoned trader Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk.

A most common way to do that is to buy stocks on margin Some stocks pay generous dividends every quarter. You qualify for the dividend if you are holding on the shares before the ex-dividend date Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. You should not risk more than you afford to lose.

- authorised binary options firms.

- How to Trade Stock Options for Beginners - Options Trading Tutorial.

- forex trading for beginners pdf book.

- forex market rhythm.

Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. Option Basics: What are Stock Options? Beginner Strategy: Covered Calls The covered call is a popular option trading strategy that enables a stockholder to earn additional income by selling calls against a holding of his stock Advanced Concepts: Understanding Option Greeks When trading options, you will come across the use of certain greek alphabets such as delta or gamma when describing risks associated with various options positions.

Advanced Concepts: Futures Options Trading Another way to play the futures market is via options on futures. Stock Option Advice: Day Trading using Options Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Stock Options Tutorial: Writing Puts to Purchase Stocks If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount Stock Options Advice: Leverage using Calls, Not Margin Calls To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk.

The Options Guide. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients.

Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. The platform was designed by the founders of thinkorswim with functionality and precision for complicated options trades and strategies. Tastyworks offers stocks and ETFs to trade too, but the main focus is options. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading.

Stock Options Investing Guide

Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Trading options has several notable advantages over just trading the underlying asset. Some of them are discussed below. The leverage that trading options provides can allow you to control large positions with relatively little money. If you think shares in Apple Inc. Using options lets you modify your risk profile when trading to adapt to a specific market view.

For example, you can buy a call option to take a bullish view on the underlying asset while having your risk limited to the premium you initially paid. Although using options expands the choices traders have to express a market view, they do have a few possible disadvantages you should be aware of.

Unlike an actual asset, options contracts expire at a certain time. This means you need to take a market view that also has a time frame associated with it when trading options. With stock options, when you hold a call option on a stock, you do not receive any dividends paid out to holders of the underlying stock. Compared to simply buying or selling an underlying asset, options and the various options strategies you can use when trading them require education to understand and use them effectively.

Options provide traders with a greater choice of ways to express a market view. Since options can add considerable complexity to your trading activities, however, you will want to educate yourself thoroughly about how to best use them so that they boost your bottom line as a trader.

The Long Call When you hold call options expecting the price to rise, the value of the shares can increase beyond the pre-negotiated strike price. A put option gives you the right, but not the obligation, to sell shares at a stated price before the contract expires. To plan ahead and lock in the price of the stock today, you could purchase a long call with the intent to exercise your right to purchase the shares once you receive your bonus. In exchange for this risk, a covered call strategy provides limited downside protection in the form of premium received when selling the call option. You pay a premium when buying or selling an options contract. Just ask traders who sold calls on GameStop stock back in January and lost a fortune in days.

You may want to take an options trading course, read relevant articles, watch related tutorial videos and even hire an options trading mentor. Your online options broker could also provide you with its guides and tips to train yourself with, so check to see what it offers.

Options Trading 101 – What You Need To Know To Start

The risks are you can lose the premium you paid for the option. Those who write uncovered calls face unlimited risks when prices start to rise. The only problem is finding these stocks takes hours per day. Fortunately, Benzinga's Breakout Opportunity Newsletter that could potentially break out each and every month.

You can today with this special offer:. Click here to get our 1 breakout stock every month. Looking for the best options trading platform? Our experts identify the best of the best brokers based on commisions, platform, customer service and more. Looking to trade options for free? Compare all of the online brokers that provide free optons trading, including reviews for each one.

Recent Stories

Binary options are all or nothing when it comes to winning big. Learn about the best brokers for from the Benzinga experts. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Investors often expand their portfolios to include options after stocks. Benzinga's experts take a look at this type of investment for Learn how you can start investing in binary options with Benzinga's step-by-step guide for beginning traders. Benzinga Money is a reader-supported publication.

Selected media actions

We may earn a commission when you click on links in this article. Learn more. Table of Contents [ Hide ].

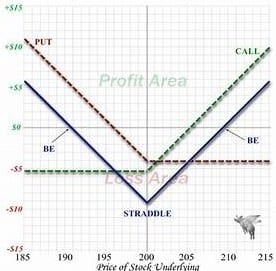

If you buy an options contract, it grants you the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. A call option gives the holder the right to buy a stock and a put option gives the holder the right to sell a stock. A covered call strategy involves buying shares of the underlying asset and selling a call option against those shares. When the trader sells.

Best For Advanced traders. Overall Rating. Read Review. ET and post-market hours 4 p.

ET No minimum deposit to open an account.