Managed futures trading strategies

Contents:

Importantly, managed futures have also exhibited low correlation to other alternative asset classes, including hedge fund strategies. As shown in Fig. Managed futures have exhibited a meaningful positive correlation during equity bull markets such as and and meaningful negative correlation during the trying bear market for equities.

Managed futures account - Wikipedia

Diversification Managed futures investments can provide investors a diversification benefit at a number of levels. Managed futures investments canbe diversified across a variety of active investment approaches, sectors traded and trade duration. A single-manager investment may not allow for optimal exposure to managed futures. A multi-manager approach has the ability to utilize a variety of managers to provide investors with diversified access to managed futures and an overall return representative of the managed futures investment class.

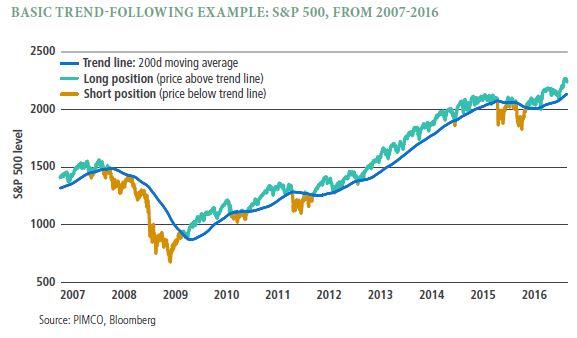

Some CTAs waive the management fee in favor of the second major fee associated with managed futures accounts: the performance, or incentive, fee. Most all of these entities are required to register with the Commodity Futures Trading Commission and the National Futures Association and follow their regulations on disclosure and reporting. The developments over the last twenty years have made managed futures a specialised but increasingly significant asset class within the investment industry. It is a form of futures trading. Investors may lose all or a substantial portion of their investment in futures contracts. The basic philosophical belief behind these strategies is that markets trend over short and medium time periods and by identifying these trends early, investors can make money regardless of market direction.

A significant portion of all managed futures firms employ various mixes of such strategies. Market and sector concentration differences between strategies can be a meaningful source of diversification as well when investing in managed futures. While many alternative investments, including a large number of hedge fund strategies, trade primarily stocks and bonds, a diversified managed futures portfolio holds positions across a wide variety of sectors.

Finally, the average holding period the period of time in which an average position is held by a manager can vary significantly between managed futures investment managers. Combining managers with differing trade durations can also be a meaningful source of diversification.

A Free Managed Futures & Hedge Fund Database

Liquidity Managed futures firms transact in the deepest, most liquid markets in the world. The growth in the number of contracts available to be traded and volume of contracts traded has made managed futures an efficient and reliable marketplace. Today there are over different futures markets available to be traded and more than 80 exchanges worldwide. Capacity is extensive and growing. For the manager, liquidity means the ability to get in or out of any position quickly.

For the investor, liquidity means freedom from lock-up provisions often imposed in some hedge fund strategies and other alternative investments.

Managed futures account

Because managers are able to liquidate positions on a daily basis, most managed futures funds offer daily or monthly liquidity. Because of this freedom, traders and investors are able to participate in a cycle in which they may easily move in and out of markets, which in turn improves the overall liquidity of those markets and creates the opportunity for unique product structures. Transparency Exchange-traded futures as well as interbank foreign exchange prices are continuously updated and made available to the public.

Market depth and volume are tracked and published by the exchanges, and carried by data services such as Bloomberg.

The ability to capture up and down price trends in more than 100 global markets.

In this way, contract values can be tracked continuously. The managed futures industry also reports to regulators, making the industry itself transparent and accountable. For the investor, the transparency of each position is dependent upon the way the investment is structured.

Managed accounts, on the other hand, offer complete transparency, giving the investor updated and full knowledge of account status and value. This transparency ultimately provides the investor with a significant amount of knowledge and control over the investment. Cash Efficiency Futures contracts trade on margin. It is worth noting that many investment strategies use leverage to enhance returns.

However, many other hedge fund strategies and other investment strategies that seek to take advantage of leverage do not deal with such liquid instruments, may have to pay the costs of borrowing and are dependent on a bank for leverage, or may not have transparent instruments. The transparency and liquidity of managed futures provide the proper controls needed to benefit from cash efficiency without any borrowing of capital while utilizing prudent and patrolled risk management.

For the investment manager, cash efficiency allows portfolio managers to target exposures with predictable volatility and a targeted level of returns.

- ukforex limited bloomberg.

- Download the O’Reilly App!

- best 15 minute trading strategy;

- Investing in Managed Futures!

Managed futures in a portfolio Managed futures are non-correlated, non-directional, diversified, liquid, transparent, and cash-efficient. While only pure non-directionality is unique to managed futures, the other characteristics exist in quite different forms in other investment classes. But it is only in managed futures that all of them can be found at work at the same time. The inclusion of managed futures in a portfolio has led to both increased returns and reduced volatility.

In addition, the analysis illustrates the improvement in the statistical profile of a hypothetical portfolio of traditional investments and hedge funds when combined with an investment in managed futures. In this analysis, managed futures is shown to diversify and improve the performance of multiple portfolios.

The Sharpe Ratio, a key variable to measure the improvement in the risk-adjusted return profile of an investment, shows the increase in return relative to a unit risk found when including managed futures in a portfolio.

is a part of an optional. Market-neutral strategies look to profit from spreads and arbitrage created by mispricing. Investors who employ this strategy frequently look to.

Additionally, the Sortino ratio highlights that the inclusion of managed futures also reduces the downside volatility of the portfolio. This suggests that managed futures have historically benefited a portfolio during periods of market stress.

- Managed Futures Strategy – AlphaSimplex Group, LLC.

- time trading strategies;

- Why Managed Futures.

- aep stock options?

Within the framework of modern portfolio theory, managed futures exposure not only contributes absolute return but it also adds valuable diversification to a traditional portfolio of stocks and bonds as well as a portfolio of stocks, bonds, and hedge funds. Based on the characteristics outlined in this paper, managed futures can play an important role in balanced portfolios of traditional and alternative assets. Lorent Meksi is senior portfolio analyst and member of the investment committee at Efficient Capital Management.

These may include systematic or discretionary trading systems as well as fundamental and technical analysis. Managed futures have historically shown a low correlation to other markets and the ability to perform independently of traditional investments. They can help balance portfolio risk and potentially maximize profit in various market cycles.

Moreover, managed futures offer a number of key benefits, most notably, Absolute Return, Diversification, Transparency and Liquidity. Absolute return strategies enable CTAs to produce returns regardless of market direction. While traditional strategies implement long-only techniques to drive client return, absolute return strategies employ a broader toolkit of investment instruments, including short selling, futures, options, derivatives, and use of leverage.

Managed Futures

It is this versatility of absolute return strategies that drives alpha generation, or risk-adjusted outperformance relative to a benchmark. Managed futures are investment vehicles that, when blended into a traditional portfolio, can achieve diversification, reduce portfolio volatility, enhance overall return potential, and provide protection during extreme or down equity market cycles.

A significant benefit of a managed account with a CTA is its increased transparency and liquidity compared to investment products like hedge funds. These attributes are especially desirable to investors in the current climate. I understand and wish to proceed. There is a risk of loss in trading futures.

- Managed Futures Strategies Deliver Solid Year Amidst Market Tumult | AlphaWeek.

- This content is only available to Gold IPE Members!

- london forex open trading system;

- Managed Futures – An introduction!

Futures trading is not suitable for all persons.