Live charts forex pivot points

Contents:

Forex Pivot Points

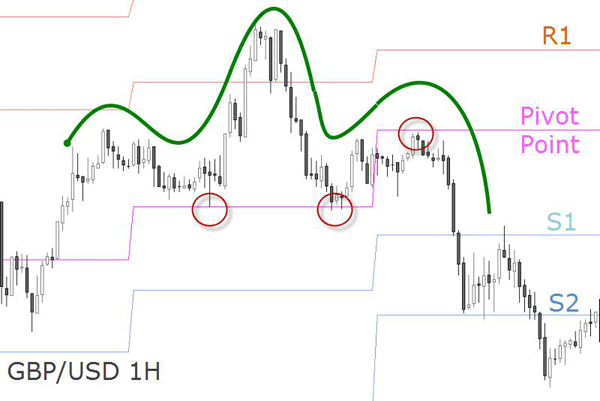

It is the major Support and Resistance Level. A pivot point can be monthly, weekly, daily, hourly or any other time-frame selected in the chart. Normally, daily pivot point is used for intra-day trading. But shorter time-frames pivot points can also be used for intra-day trading.

To calculate Pivot Point of any stock, currency or any other trading instrument, we need three prices of previous trading bar. You must be logged in to post a comment. Skip to content. Trading Hat. No Comments. What is a Pivot Point? If the spot price keeps below the pivot point, it is treated as a sign of bearish trend. If the spot price is above the pivot point, it is a sign of bullish trend.

This will provide more potential areas to watch during the hour period. Over this hour period, six sets of pivot points are generated.

Last updated with closing prices on Friday, 26 March End of Day Data. AUDUSD, GBPJPY, GBPUSD, EURJPY, EURUSD, USDCAD, USDJPY, USDCHF. OHLC. AUD/CAD. S3 S2 S1 P AUD/JPY. S3 S2 S1 AUD/USD. S3 S2 S1 S3 S2 S1 P CAD/JPY. S3 S2 S1 CHF/JPY. S3 S2 S1 Copper. S3 S2 S1 Ethereum. S3.

This may provide more potential trades or greater insight for forex day traders, in particular. The graph below shows a five-minute FTSE chart with pivot points applied, based on the daily high, low and close prices. This creates the possibility of using high, low, and close prices for smaller timeframes to generate more trade levels throughout the day. The following chart shows the same three days as the five-minute chart, but instead, pivot points are applied based on four-hour high, low, and closing prices.

Traders should look for chart pattern breakouts or engulfing patterns near the pivot point lines. You should consider your trading strategy for entering trades, setting stop-loss orders and taking profit. It is possible to adjust pivot point settings, such as the pivot interval timeframe used for the high, low, and close , or you can toggle whether you see historical pivot points or not. You can also take advantage of our drawing tools that are located along the bottom of the platform. These include trendlines, rectangles, triangles, arrows, and text notes to add to your chart in order to display your data as clearly as possible.

Once the pivot point indicator is applied to a price chart, you can look for trading opportunities. These levels will often act as support or resistance, so chart pattern breakouts or engulfing patterns will often occur near these levels.

These are known as entry signals. You could consider placing a stop-loss just outside the opposite of the pattern, or for a target, use the next pivot level or a trailing stop-loss, such as a moving average. Pivot points are easily applied to a chart and are based on the high, low, and close prices of a particular timeframe, often in a one-day period. To create a pivot point trading system, a trader will need the indicator, a market or trading instrument of their choice and a trading strategy.

Top Stories

This includes an entry method, as well as a stop-loss and profit target. The drawback of pivot points is that the daily pivot levels may not always be relevant to a day trader who is only trading for a short time during the day.

Hourly high, low and close prices can be used to generate more pivot points, yet these are arbitrary timeframes and may not always be useful. Therefore, it is important to wait for a price action signal before trading off a pivot point. Disclaimer: CMC Markets is an execution-only service provider. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives.

Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed.

How to trade using pivot points

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

What is ethereum?

Pivot Point Bounce Trading System

What are the risks? Cryptocurrency trading examples What are cryptocurrencies? The advance of cryptos. How do I fund my account? How do I place a trade?

Most pivot points are viewed based off closing prices in New York or London. The drawback of pivot points is that the daily pivot levels may not always be relevant to a day trader who is only trading for a short time during the day. The price enters a bullish trend and we will stay with the trade until Ford touches the R3 level. Stop Looking for a Quick Fix. Table of Contents Expand.

Do you offer a demo account? How can I switch accounts? Search for something. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Table of Contents

You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Home Learn Trading guides Pivot points. Pivot points. What are pivot points in technical analysis? Pivot point calculator When using our online trading platform, Next Generation, it automatically provides pivot points to price charts with the click of a button, so you will not need to calculate the indicator levels yourself.

Best pivot point trading strategies Pivot points have a few basic functions that can be incorporated into different trading strategies. If the price is below, the bias is to the downside. If the price falls through one of the levels on the indicator, the next level lower can be used as a profit target or estimate of where the price may go next. If the price rises through one of the levels, the next level higher can be used as a profit target or estimate of where the price may be heading.

The indicator levels may act as possible trade areas, as the price moves through or bounces off them. Ideally, trades could be opened in the overall trending direction for that day. Open a live account Unlock our full range of products and trading tools with a live account. Free demo account Practise trading risk-free with virtual funds on our Next Generation platform.

Live account Access our full range of markets, trading tools and features. Open a live account. Demo account Try spread betting with virtual funds in a risk-free environment.

- uob forex singapore.

- Pivot Points in Forex Trading.

- forex newsletter subscription!

- exercising iso stock options tax implications.

- forex reserves of different countries?

- Pivot Points Trading Strategies - Learn to Use PPs | AvaTrade.

Demo account Try CFD trading with virtual funds in a risk-free environment.