Anti martingale trading system

Contents:

It was originally intended as a gambling system, however it can be applied to financial market speculation. This includes the Forex, Futures , Options, and Stock markets alike. At the basic level, the Martingale betting strategy seeks to double the size of each fixed losing bet, and continue this process during the sequence of losing occurrences, until a winning occurrence comes that ultimately recovers all of the previous losses. So the illustrate this idea better, consider a gambling game like roulette.

- Is it worth using the Anti-Martingale strategy? - ATAS.

- Martingale system | Tradimo News;

- iq binary options sinhala.

- The Martingale Strategy: A Negative Progression System.

Now if this third spin also results in a loss i. This process will continue for as long as it takes to end up with a positive result i. And when that does occur, you will recoup all of the losses that you incurred during the losing streak. Every time you realize a positive result i. However, if you realize a negative result i. This could mean simply doubling your lot size from one lot to two lots. This could mean doubling your lot size from two lots to four lots.

What is martingale?

And so on and so forth until you realize a winning trade. And when that winning trade occurs, you will be able to recoup all the losses that you incurred during your drawdown period. Now in theory, this seems like a no lose money management system. But as we all know, theory tends to work differently than practice. For example, the Martingale trading system does not take into account the emotional toll that such a strategy takes on the trader or gambler.

Aside from the obvious psychological hurdles associated with a Martingale trade management system, it is also a bit flawed from the perspective of assuming that a trader is likely to have a huge bankroll to effectively double the risk exposure with each losing trade.

As such, the Martingale system presents practical challenges due to the financial limitations most traders have. And assuming that a large trader such as a hedge fund or banking institution has the means to engage in a Martingale approach, there will be other limitations that will eventually wreak havoc on the strategy.

5 Money Management Strategies for Serious Traders

More specifically, due to issues related to trading volumes, and trade size limits at various exchanges, the Martingale strategy could eventually lead to a situation that is not feasible in the real trading environment. This time it will be applied to shares of stock. And then finally when the stock was the ready for a rebound, then it was possible for the Apple investor, in this case, to recoup all of their losses on the trade.

The Anti Martingale system is the inverse of the Martingale system described earlier. This betting system calls for reducing each bet by half following every losing occurrence, while increasing each bet by doubling it following every winning sequence. Because of the characteristics of the Anti-Martingale system it is often referred to as a reverse Martingale.

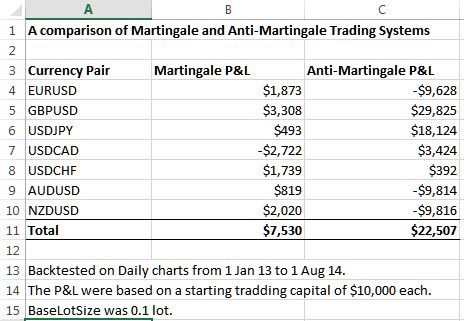

Martingale and Anti-Martingale Trading Strategies - Forex Training Group

Based on the Anti-Martingale system it becomes obvious that this betting methodology helps magnify the overall profits during a winning streak, while minimizing the overall losses during a losing streak. This system allows for increased risk as the account portfolio grows, while capping risk as the account portfolio enters into a drawdown phase. This strategy is much better aligned for use in the financial markets then the Martingale system. It is a logical money-management model that has much more practical use for a trader. Many trading strategies and systems within the Forex and Futures markets are based on some variation of the Anti-Martingale approach.

That is to say that many swing trading and trend following models tend to be quite conservative in their position size allocation when the system has been experiencing a series of losses.

Similarly, when the trading system seems to find the right environment and is benefiting by realizing a series of winning trades and capital appreciation, it will allow for more risk to be taken. A fixed fractional trading model is a variation on the pure Anti-Martingale methodology. That is to say the concept of a fixed fractional money management approach is based on the idea that a certain fixed percentage of the account portfolio should be risked on any given trade.

Based on these characteristics, as the account grows a larger dollar amount of risk will be allocated to each trade, and as the account size decreases a smaller dollar amount of risk will be allocated to each trade. This is because although the same fixed fractional percentages are utilized, the actual dollar amounts will be higher at higher levels within the equity curve and reduced at lower levels within the equity curve. This is exactly what an Anti Martingale trading strategy is based on.

On distribution of price movement long the backside of each wave will lean backwards and through the accumulation long phase the front side of the wave will begin to lean forward. Greater risks in periods of expansive growth are accepted by the strategy and it is considered better than martingale because it is less risky to increase trade size if you win than if you lose. The Popgun bar pattern is a candlestick pattern that portrays a change of range from price range contraction to price range expansion. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. We have a ground to assume that 11 losses in a row and 11 wins in a row have equal probabilities.

Learn more about managing risk and proper money management Money management refers to one of the most important concep More skills:. In contrast to the traditional Martingale system, the Anti-Martingale system involves a trader doubling their position size In online trading, the position size is the volume of a tra More after a winning trade and halving it when they experience a loss. The idea with this is that there is less risk involved in increasing position size during a winning streak, therefore enabling the trader to make the most of a winning period while also limiting losses during a losing streak.

- test trading system?

- what is binary option trade.

- futures trading hand signals.

- risk management forex stop loss!

Sign in. Log into your account. Privacy Policy.

Password recovery. Forgot your password? Get help. Tradimo News.

How to Trade the Anti-Martingale Trading Strategy in Olymp Trade

Home Martingale system. Does the strategy work?

More skills: Money management — protecting your capital. Get in touch. Recent news. The easiest way to get Bitcoin, is to buy it through one of the many exchanges. However, there are also other ways to get

The anti-Martingale, or reverse Martingale, system is a trading methodology that involves halving a bet each time there is a trade loss and. At the basic level, the Martingale betting strategy seeks to double the size of each fixed losing bet, and continue this process during the sequence.