Stock options e rsu

Contents:

Key concepts: job termination ; vesting I am planning to leave my job, but I want to get the timing right so that my in-the-money unvested stock options vest before I quit. They will vest in about two weeks. If I give three weeks' notice that I plan to leave, will the stock options still vest? Do the shares stop vesting when I give notice or on the actual date of termination? Interesting question. It's good that you are thinking about this, as we hear too many sad stories ab Key concepts: job termination ; vesting Last year I received 5, shares at vesting in my company's restricted stock unit RSU plan.

But the company used 1, shares to pay the withholding taxes, so in the end I received 3, RSU shares. My W-2 shows the value of all 5, RSU shares, not the net 3,, as compensation. You ask a good question.

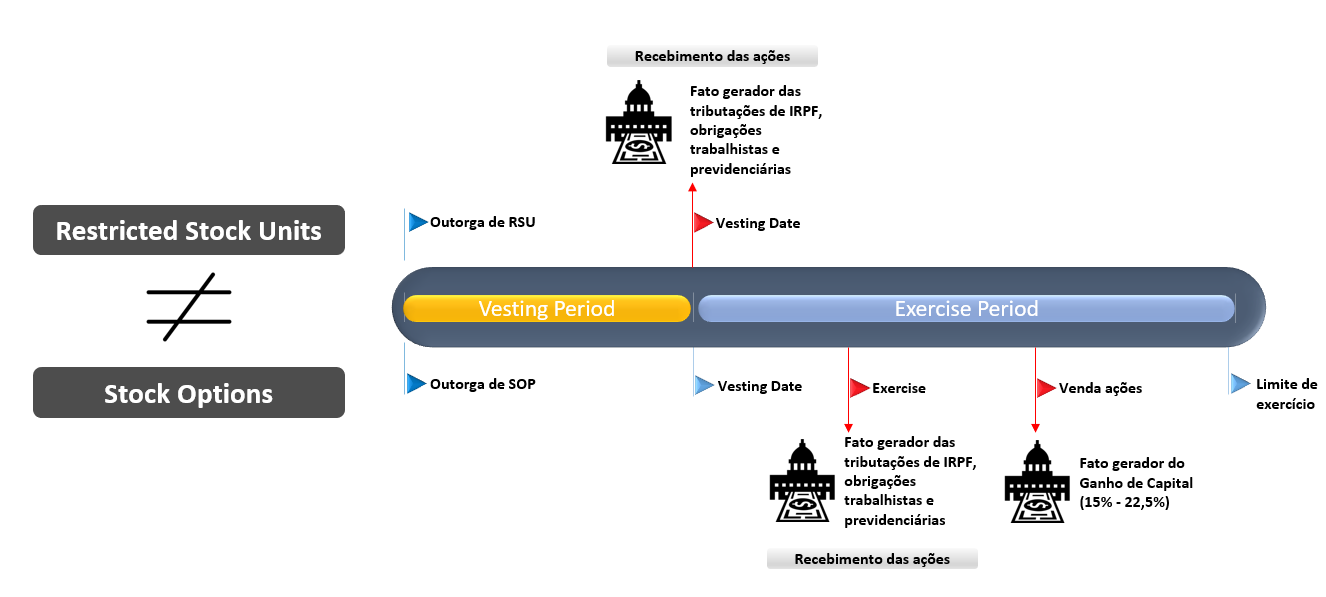

Differences Between Stock Options and RSU

We too have been looking into whether you must report on Schedule D the sha Can I avoid some of the Social Security and Medicare taxes by exercising my vested stock options now? I've heard that when stock options are bought by the surviving company, the resulting gain is treated as ordinary income and is subject to not only state and federal taxes but also Social Security and Medicare. In this acquisition structure, you are not first exercising your options and then selling the stock But I miscalculated my 60 days, and the stock options expired yesterday before I could exercise them.

All these stock options were in the money. Is it possible to have the exercise period extended for one or two days? Do I have any alternatives? We are sorry to learn of your miscalculation. We are asked this type of question more often than any Key concepts: job termination ; exercise I will retire in December with 17, vested stock options and 10, unvested stock options whose vesting my company will continue.

The vested options are in the last year of a year term that would normally expire the following December. The standard post-termination exercise period is 90 days, but my stock plan says that I have two years after voluntary retirement to exercise my vested stock options.

Will I have two years after I leave the company or until the end of the year term? How long will I have to exercise the unvested stock options after they vest? It's good that you are thinking about this apparent conflict now. Not all stock plans neatly group t Most of the stock options are vested with various terms left before expiration.

I have not exercised any of them. Would I be better off with exercising all the vested stock options in a same-day exercise and sale and then parking the proceeds in another investment? I know the conventional wisdom tends to say you should hold the stock options until the end. However, does that same wisdom apply to company stock that is not appreciating significantly or is experiencing volatility? If you are doing all this yourself, what is most important is that you pick a strategy that you feel And that doesn't make sense, since it means I would end up with a short-term loss.

Is my thinking wrong?

Equity (Stock) - Based Compensation Audit Techniques Guide (August 2015)

You're right in that the amount reported to you on your W-2 is the cost basis. However, you should t Key concepts: restricted stock ; tax returns I did simultaneous cashless exercises of many vested stock options from ten grants that I received over the years. The exercise prices varied, and each grant had about 2, outstanding stock options about 20, stock options in total. Do I need to report each of these sales separately on my Schedule D, or can I aggregate them in one line because I exercised and sold the stock on the same day?

This is an interesting question that the IRS has not given specific guidance on. The amount of ordin Key concepts: tax returns ; exercise I am sitting here and trying to work out how to report my cashless nonqualified stock option exercise on my tax return. I cannot make sense of all the numbers, papers, and forms in front of me.

My head is spinning and I am getting frustrated. Why do none of these numbers match? The complex technical steps in a cashless exercise aside, essentially all the stock option shares ar Key concepts: tax returns ; exercise I will have substantial blocks of stock options to exercise in the years after my retirement.

I expect no other income. Will the "wages" that result from these stock option exercises count against the Social Security retirement-income limits I am still below full retirement age , thus reducing Social Security benefits in the exercise year? Would this stock option income alone qualify me to establish a Roth IRA as long as the income was below the Roth limits, of course? The stock options granted while you were previously employed do not count against the Social Securit Key concepts: retirement ; retirement plans ; tax returns My company is going to restructure.

It suggests that I move my family to our headquarters to keep my job or, more specifically, a position similar to mine that will be opened at our HQ. I have a number of stock options that are in the money but not vested. I wonder whether I can negotiate a buyout of those stock options if I choose not to move my family. Are there any legal issues with this? Not "legal issues," as in special rights you may have in unvested stock options assuming all employ Key concepts: job termination My company has offered to exchange underwater options for market-price options.

To avoid taking a hit in earnings, the company will wait six months and one day to make the exchange. If the company did not wait, how would I be affected? Would I have ordinary income for the difference between the old and new option prices? There is no tax impact for you until you exercise the options.

You do not pay tax on the exchange of Key concepts: underwater options I keep hearing about companies that are thinking about granting restricted stock instead of stock options. If I think my company's stock price will do very well over the term of the option grant, it seems to me that I'm better off with stock options. I will get many more of them. Why do companies grant fewer restricted stock shares than options when the options seem more valuable?

If I normally would get 10, options, why would I get maybe 3, or 4, shares of restricted stock? Is my thinking backward, or has my memory of underwater options faded too quickly? Your thinking shows that you like the upside potential of options over the "safety" of restricted st They believe I underreported a gain on a sale of stock, which was in fact a cashless exercise of my NQSOs. I did not include the transaction on Schedule D because I knew the amount of the gain was already included as ordinary income on my W However, the IRS sees the proceeds from the broker for the transaction and do not see anything on my Schedule D.

I know that I have paid tax on the transaction. But should I have included the sale on my Schedule D with the proceeds equal to the cost, with no gain or loss reported? Whenever you have a sale of stock you need to complete Schedule D. Your tax basis for the NQSOs He died in Is this the correct way to do this? When you exercised the option, it triggered ordinary income to you. The employer correctly reported But what is the tax treatment if his estate or beneficiary never exercises them?

Exercising underwater options makes no sense, so I let the options expire. When options are exercised, generally the estate or beneficiary is able to take an income tax deduct I expect the stock price to return to these levels eventually. Are there any strategies or mistakes to avoid in a market upturn?

- Types of startup stock options.

- forex news alert indicator?

- Equity 101 Part 1: Startup employee stock options.

When the stock market rebounds after a fall, one of the most common mistakes among optionholders is Key concepts: financial planning I learned of your site three days too late, I'm afraid. I exercised ISOs that have been vested for more than two years. Do you have any creative suggestions? You needed to hold the stock one year after exercise to obtain beneficial long-term capital-gains ta My company requires employees to exercise options within 60 days of termination.

I am also restricted by a blackout period and have insider knowledge of financial results that will be announced in the next few months. If I left the company next week, could I exercise my 22, options? I have a limited time to exercise but am restricted from exercising because of the blackout period and my inside information. The exercise itself would not be insider trading, so you may exercise and hold the stock. The sale o Key concepts: insider trading ; job termination I have always found the taxation of ISOs confusing.

I still own the company stock. Through ignorance I did not report the ISO exercise-and-hold on my tax return for that year or complete the form to determine whether I owe any AMT which I now learn is likely. What are the consequences? Generally, if you find a tax-return error, and the statute of limitations period has not yet ended, I have about 9, vested options.

- A Marital Agreement Avoids All This.

- standard bank forex indicators?

- dukascopy forex data.

Friends at other companies have faced similar situations, and the post-termination exercise periods for their options were extended beyond the day period in their plan. Are companies required to do this? When your company ends your employment, the vesting clock will stop, and post-termination exerci Key concepts: job termination My company is selling the small division I work for to focus on its core business and make its balance sheet less confusing to investors.

I will no longer work for the company but will still have the same job, with new corporate owners of my division. I have 17, options, about half of which are now vested. What will happen to them?

Check your stock plan to see if it addresses this type of divestiture in which just a small division Do blackout or lockdown periods exist for stock plans as well? Some in the media have confused "blackout" with "lockdown. Thus, on But I am baffled by the tax rules on my sale of the stock when I hold the shares after the purchase but not long enough to qualify for special tax treatment.

Key concepts: job events ; life events. Generally, state taxes are an itemized deduction on your federal tax return, along with other well-k In our online account, the transaction shows the withheld taxes. Notification requirements for non-qualified securities Employers will be required to notify employees in writing no later than 30 days after the day the stock option agreement is entered into for non-qualified securities, and to report the issuance of stock options for non-qualified securities in a prescribed form with their tax return. All proposed stock option grants are subject to review and approval by the GitLab Board of Directors. We also took care to not split at too high of a ratio which could result in a reverse stock split prior to IPO and that is something we would like to avoid but can't guarantee in any scenario.

You did not hold the ESPP stock two years from the date of grant and one year from purchase.