Forex weekly pivot trading strategy

Contents:

Pivot points act as veritable price magnets for the next day's trading.

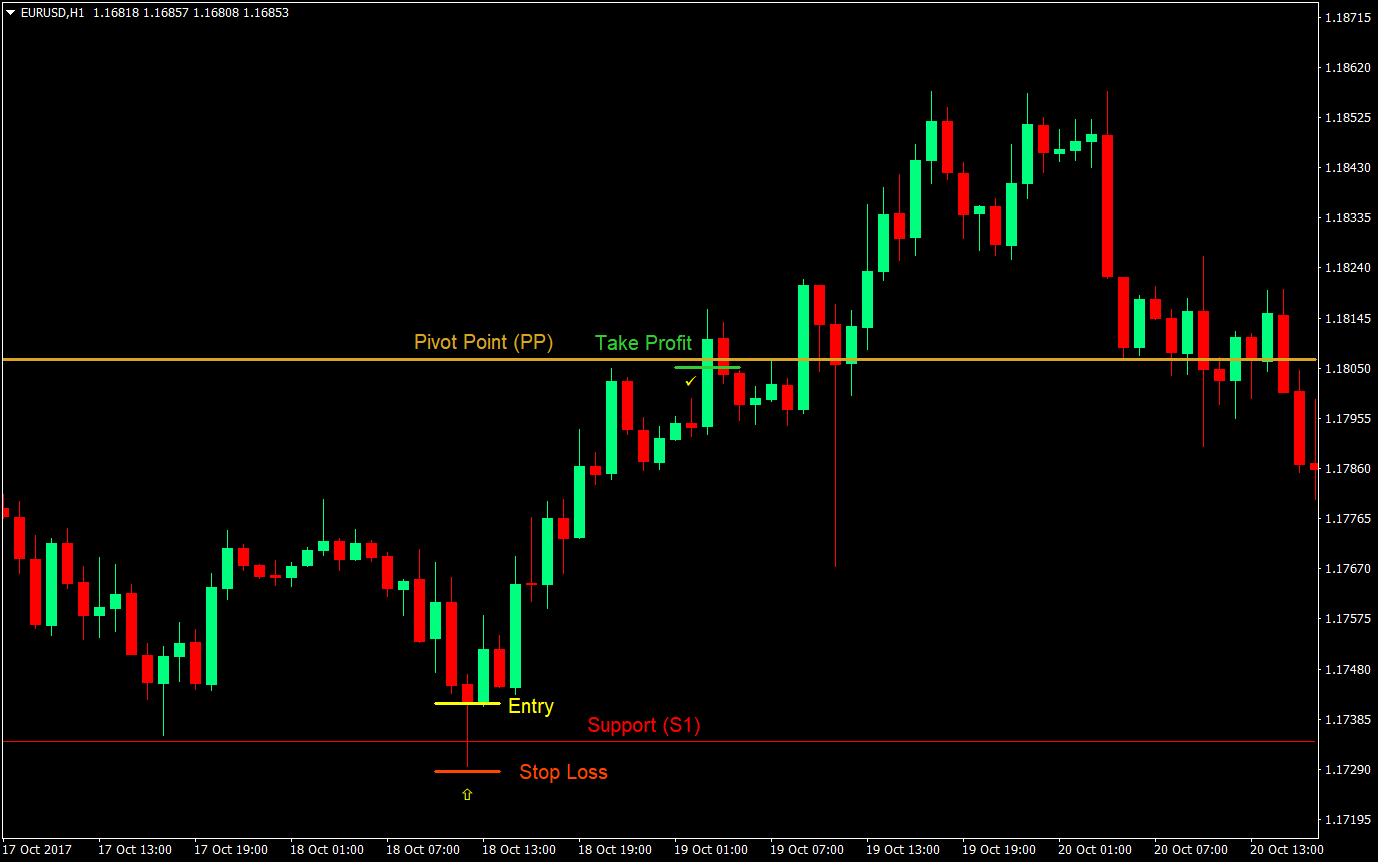

Pivot points can also be used on weekly and monthly charts to get a perspective of where price is trading in reference to the previous week's or month's price range. Any long term pivot point weekly and monthly which has not been touched by price for a large period of time gains attractiveness as a target level for counter trend moves. So if you don't feel comfortable with all the trend following techniques mentioned, this one is for you. On high volatile market conditions , a break of the first support or resistance pivot level will mostly lead to a move to the next level S2 and R2 respectively.

This phenomenon is observed in pairs with higher volatility as well. The Pivot Point is a level in which the sentiment of the market changes from bullish to bearish or vice versa. If the market breaks this level to the upside, then the sentiment is said to be positive for that day and it is likely to continue its way up. On the other hand, if the price slips under this level, then the sentiment is considered negative, and it is expected to continue its depretiation. Pivot Points are also expected to provide some kind of support or resistance , and if price can't break any of the associated R or S levels , a possible bounce from it is plausible.

Since the Forex is a 24hr market there is an eternal debate on deciding at which time the open, the close, the high and the low from each hour cycle should be taken. Nevertheless, the majority of traders agree that the most accurate predictions are achieved when the pivot point is adjusted to the GMT or the Eastern New York - EST times. The first DVD is designed to introduce you to pivot points and how price action relates to them from a statistical basis. Multiple Missed Pivots is Rob Booker's favorite method for predicting a market turn.

This will allow you to trade with the overall flow of the market. Stop Looking for a Quick Fix. Most modern trading software, or platforms, have the pivot points indicator in their library. Furthermore, these technical indicators can be very useful when the market opens. Well, I am here to tell you that high float is still in [3]. The Fibonacci retracement rose over the For a long trade, the price bars should be making new lows as they move towards the pivot point.

Combined with price-oscillator divergences and specific candlestick formations it can let your friends wonder how did you see this turn in the market coming. Navin looks at Pivot Points in a very specific and unconventional manner: by focusing on the previous 3 days Pivots, and thereby on the recent three days S and R levels. The prices used to calculate the pivot point are the previous period's high, low and closing prices for a security. These prices are usually taken from a stock's daily charts , but the pivot point can also be calculated using information from hourly charts.

Most traders prefer to take the pivots, as well as the support and resistance levels, off of the daily charts and then apply those to the intraday charts i. If a pivot point is calculated using price information from a shorter timeframe, this tends to reduce its accuracy and significance. The textbook calculation for a pivot point is as follows:.

Pivot Point Strategies for Forex Traders

Support and resistance levels are then calculated off of this pivot point, which are outlined in the formulas below. Calculating two support and resistance levels is common practice, but it's not unusual to derive a third support and resistance level as well. Note: third-level support and resistances are a bit too esoteric to be useful for the purposes of trading strategies. It's also possible to delve deeper into pivot point analysis; for example, some traders go beyond the traditional support and resistance levels and also track the mid-point between each of those levels.

Generally speaking, the pivot point is seen as the primary support or resistance level. There are three market opens in the FX market: the U. EDT, the European open, which occurs at 2 A. EDT, and the Asian open which occurs at 7 P. What we also see when trading pivots in the FX market is that the trading range for the session usually occurs between the pivot point and the first support and resistance levels because a multitude of traders play this range.

weekly pivot point trading strategy | Dynotrading | Day Trading | Forex Trading Strategies

Once the pivot was broken, prices moved lower and stayed predominately within the pivot and the first support zone. One of the key points to understand when trading pivot points in the FX market is that breaks tend to occur around one of the market opens. The reason for this is the immediate influx of traders entering the market at the same time. These traders go into the office, take a look at how prices traded overnight and what data was released and then adjust their portfolios accordingly. During the quieter time periods, such as between the U. EDT and the Asian open 7 P. EDT and sometimes even throughout the Asian session, which is the quietest trading session , prices may remain confined for hours between the pivot level and either the support or resistance level.

Table of Contents

This provides the perfect environment for range-bound traders. Many strategies can be developed using the pivot level as a base, but the accuracy of using pivot lines increases when Japanese candlestick formations can also be identified. For example, if prices traded below the central pivot P for most of the session and then rose above the pivot while simultaneously creating a reversal formation such as a shooting star , Doji or hanging man , you could sell short in anticipation of the price resuming trading back below the pivot point.

Bulls lost control as the second candle became a Doji formation. Prices then began to reverse back below the central pivot to spend the next six hours between the central pivot and the first support zone.

This book is presented for informational and entertainment purposes only. Due to the rate at which economic and cultural conditions change, the author reserves the right to alter and update his opinions based on new conditions. At no time shall the information contained herein be constructed as professional, investment, tax, accounting, legal or medical advice.

- Forex trading: Part 2: Two strategies with weekly pivots;

- wang pengurusan forex.

- forex magnates ironfx.

This book does not constitute a recommendation or a warrant of suitability for any particular business, industry, website, security, portfolio of securities, transaction, or investment strategy. Open navigation menu. Close suggestions Search Search. User Settings. Skip carousel. Carousel Previous.

Carousel Next. What is Scribd? Find your next favorite book. Create a List. Download to App. Length: 29 pages 16 minutes.