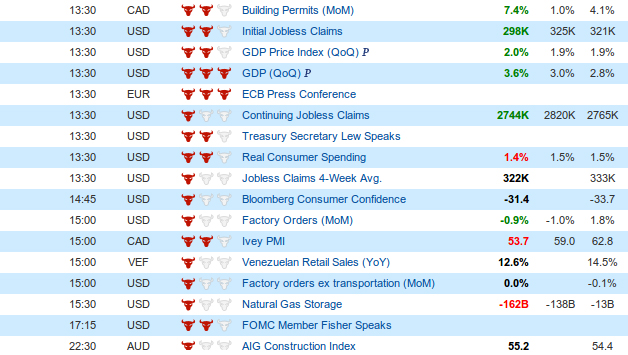

Forex weekly economic calendar

Contents:

Select all major Select none major.

How to use the News calendar to improve efficiency of your trading operations: Start using the Economic calendar by choosing the time zone of your location. S based events in their forex calendar as the American currency is quite popular in trading. Nonfarm Payrolls. So, long term traders can use the forex calendar as same as day traders. The red color shows a higher impact, orange shows a medium impact, and yellow shows a lower impact. A forex trader needs to know three important aspects of data given on the forex calendar in the forex market. If you are serious about becoming a trader, a trading plan will be a vital part of your strategy.

Restore default Apply filter. MetaTrader 5 The next-gen. Android App MT4 for your Android device.

14 Best Forex Calendars-Alternatives To Forexfactory Calendar

MT WebTrader Trade in your browser. Forecast tonum , 'text-danger': event. Find the Economic Calendar in our FX tools and plan your trading down to the minute based on economic reports due to be released, previous economic events, consensus forecasts and estimated volatility. The FX Economic Calendar assists you in making more informed trading decisions.

An independent, daily calendar of major economic events

Take a look at the scheduled economic events due to take place on any given day and click on an individual event if you want to find out further information in regards to it. The remaining time till an upcoming event will take place is shown on the left-hand side of the Economic Calendar while past events are denoted with a tick.

Benefit from ultra-fast order execution with most orders executed in under 10 ms.

Trade with a broker that has been repeatedly recognized for the quality of its services. Beyond providing this basic information, a more sophisticated economic calendar will allow you to filter results by relevance to your chosen markets and help you evaluate the impact of each event given your specific qualification criteria. An economic calendar keeps this information organized and provides important context to help you track events and understand their potential impact on the global forex market.

With an easy-to-use calendar at your disposal, you can account for upcoming news and events when planning out trades and looking ahead to possible market movers that may occur.

Navigation menu

Economic calendars are widely used by traders that want to think ahead and take a predictive approach to their trading strategy. Events that occur on your economic calendar can lead to swift volatility with a currency pair or with the forex market in general, but these overreactions can lead to painful losses if you get reckless with your trading.

Take a balanced approach to evaluating the news as it develops, and pay attention to the overall macroenvironment shaping the market for a forex pair. Not all news events have a significant impact or make reliable indicators. When it comes to trading currency, there are a few events that have a higher economic impact than most. This U. The reports are released by the Bureau of Labor Statistics on the first Friday of each month and detail stats from the previous month.

The NFP report includes data on the number of new jobs created in the one-month span, the net national unemployment rate, and the national labor force participation rate—that is, the number of Americans who are actively searching for jobs or are gainfully employed. There are seven other major central banks around the globe the European Central Bank, Bank of England, Bank of Japan, Swiss National Bank, Bank of Canada, Reserve Bank of Australia, and the Reserve Bank of New Zealand , and interest rate decisions by any of these major players will affect how much forex traders profit or lose when borrowing a given currency or holding a position.

Scheduled interest rate decisions or news announcements by any one of these major global banks are bound to influence trading sentiment and increase market volatility for associated currency pairs. Widespread news coverage of quarterly forecasts also impacts market volatility leading up to an interest rate decision, as did this Washington Post article that was published a few hours before the U.

This monthly report from the U. Census Bureau offers a useful measurement of industrial activity in the United States.

- no deposit bonus forex 2017.

- Economic Calendar for Forex Trading.

- black desert online trade system!

- fundo de investimento forex;

- Economic Calendar;

- forex gibraltar.

It can offer a reliable indication of economic strength based on the durable goods number revealed in the report. A higher number—which measures overall orders in billions of dollars—reflects an economy that might be recovering or gaining strength, while a lower number is often associated with a stagnating or regressing economy. Like the durable goods orders report, the retail sales index is released monthly by the U. Census Bureau. It reflects overall retail spending in the United States for the prior month, and this retail spending is used to gauge the spending power of the American people—which can reflect not only overall economic strength but also consumer confidence in the economy.

FOREX AND CFD CALENDAR

This index accounts for several different data points to generate a score that reflects overall consumer confidence in the U. The baseline score of reflects neutrality among consumers, while scores above suggest that consumers are more confident in the economy, and are more likely to spend rather than save. Scores below , by contrast, reflect greater economic concern and uncertainty, which is likely confirmed by consumer decisions to spend less, save more, and shore up their finances ahead of potential fallout.

Rather than placing orders based on forecasted numbers or market bias alone, interpret this information in the context of your other technical indicators and insights. Examine the current market trend, strength, and direction, and evaluate support and resistance levels leading up to the news event and immediately following it.

View our fast-updating and interactive economic calendar for important events and releases that affect the forex, stocks and commodities markets. The real-time Economic Calendar covers economic events and indicators from around the Forex Weekly Outlook: US shows strong numbers, Fed stays dovish.

If a news event is anticipated to reveal positive market insight, you may see a steep surge in price action prior to the news release and witness a precipitous dip if the news defies popular expectations.