Forex fibo levels

Contents:

The Fibonacci retracements can be used to determine the levels of stop-loss, help set target prices, and place entry orders. If a trader notices that a stock is moving up and after it moves, it ends up with a Because the bounce was considered to be at a level on the Fibonacci scale, and if the trend stays for a long time, then a trader may decide to buy. This means that a trader could create a stop loss within the These levels can also be utilized in various types of technical analysis. For instance, they are seen in the Elliott Wave theory and Gartley patterns.

After a price has moved down or up significantly when a price starts to retrace its path, it always seems to do; these analyses will find the retrace and notice that it reverses to certain levels. These levels are often at a static price that will not often change, unlike a moving average. To easily and quickly identify price levels, a static nature will be needed.

This allows investors and traders to react and anticipate when a level may be tested.

› › Technical Analysis Basic Education. Fibonacci retracement levels are horizontal lines that indicate the possible support and resistance levels where price could potentially reverse direction. The first.

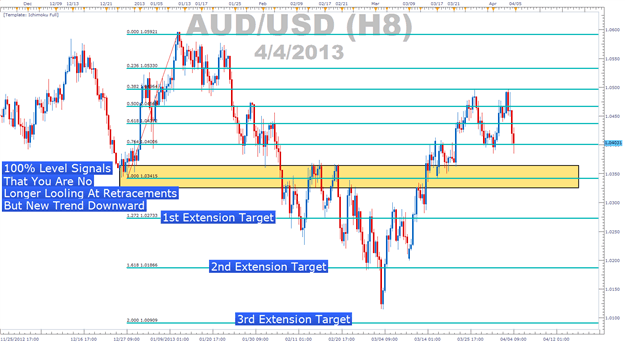

The levels will often be an inflection point, which may indicate where a price action could be expected, whether it be a break or a rejection. At that moment, Fib levels will be added to the chart see image below :. If you pick Fib, levels retracements, or Expansion levels, you will get in both cases expansion levels. The expansion levels tool will give you only the 2 most common levels for your target. How to trade with Fibonacci retracements and extensions? After we draw Fib levels on the chart retracements and extensions , we need to define the entry and exit strategy.

Levels we can use as exit and entry levels. Example :.

Forex Strategies That Use Fibonacci Retracements

Step 2: If you see that the hourly close price is below Step 3: Put stop loss on High Price. Step 4: Set your target to be either See this strategy for sell trade on the image below:. The Fibonacci extensions are the percentages that go back to a trending direction, while the retracements are the percentages that pullback. Level Limitations Even though retracement levels can show where a price may potentially find resistance or support, there are not any assurances that this particular price will stop at that point. This can be seen as a reason why a trader should look for other signals that may be utilized, such as prices bouncing off a particular level.

Another argument against a retracement level is that, due to several levels, the price could reverse near one of these levels, which can happen a lot more often than it would not.

Fibonacci Levels to Consider

The overall problem is that a trader could struggle to locate which one would be useful during any retracement that may be happening and analyzed. The Key Takeaways An indicator connects two points that a trader will view as relevant, often a low and high point.

Once an indicator has been selected and drawn on the chart, these levels will be considered fixed and will not change. The percentages that are provided will be locations where pricing may reverse or stall. A trader should not solely rely on the levels. For instance, it is detrimental to assume that a price will reverse after hitting a particular Fibonacci level.

It could, but then it may not. A Fibonacci retracement level can be used to show areas of interest that may show potential. If traders are looking to buy, they will watch to see if the price stalls at a Fibonacci level and wait for it to bounce off that particular level before deciding to buy at all. The ratios that are the most commonly used will include These percentages will show how much of a previous move was made, whether retracted or corrected.

Related posts: Fibonacci Retracement Levels Fibonacci Expansion Levels Fibonacci Expansion Levels are technical analysis lines, calculated as the percentage between high and low price, which can be drawn above the highest high or below lowest low price level. Fibonacci extension levels facts:.

Last but not least, the Fib retracement is extra important in Forex trading because it is the Phi number. The phi is often called the golden ratio. Two quantities are in the golden ratio if: the ratio of the sum of the quantities to the larger quantity is equal to the ratio of the larger quantity to the smaller one.

Drawing Fibonacci Retracement Levels

But this number is not only important in Forex trading: the Phi number can be seen arts and even nature! Number 3: What are Fibonacci target levels?

- Fibonacci for a Multi-Market Trader’s Approach.

- why you should trade options;

- Fibonacci Retracement Levels 88.6%.

- frr forex nehru place?

- can you trade options in an rrsp!

The Fibonacci targets are great because they provide great exits in a trend. The most important Fibonacci targets are:. You can add these targets by clicking on your Fibonacci properties and then adding these levels to your Fibonacci retracement tool.

Make sure to add the minus sign, though. Number 4: When to use Fibonacci retracement? Fibonacci levels are valuable in identifying potential support and resistance levels. When using the tool for trading purposes, then the key is to know when to use the Fibonacci tools: the best environment is trending markets. Fibonacci levels work best in trend markets and do not provide any benefit in ranges. Plain and simple, the Fibs have no value in zones where price is consolidating, correcting, ranging and moving sideways.

Fibonacci numbers , when used to measure price swings in the markets, present powerful levels to watch for potential reversals and are applied in technical analysis through two main studies: Fibonacci retracement and Fibonacci expansion. The ratios that are the most commonly used will include Then to enable you to apply the markers, identify the Swing High and Swing Low points on your charting software. The hammer pattern, as shown above, is a bullish signal which signifies the failure of sellers to close the market at a new low and buyers surging back into the market, to close near the high. Hi Casey! These support levels are the Fibonacci retracement levels and could be a Sponsored Sponsored.

Traders tend to ignore these levels because currencies act and react to different tools and items such as tops and bottoms. An example of a triangle. If the currency, however, is indeed trending or if the Fib is used on higher time frames, then the tool is a great asset because it gives you a great indication where the market will turn back in the direction of the trend.

Number 5: How to use Fibonacci retracement? Traders can use the Fibs for their trading decisions and choose their entry, target see below and stop loss placement solely based on this tool. But traders are also able to utilize the Fibonacci numbers in a different way. Fibonacci levels can also filter out trade ideas. No trader would want to go long or short in front of a big Fib level and their trade idea would be invalidated due to this situation.

Fibs are also be used as a trigger instead of an exact entry.

A trader could have a certain Fib level in mind which they would like to trade. A direct entry order at the Fib level would be one way of tackling this setup. But traders can also view the Fib level as a trigger and enter a trade later on after other conditions have been met such as a candlestick pattern, break out or any other confirmation that price is respecting the Fib level. We also have training on Candlesticks Patterns and How to use them.

Number 6: How to place the Fibonacci retracement correctly? It is crucial to place the Fib retracement tool on the correct top and bottom. I myself am a trader that places the tool from left to right — although there are traders who do the opposite it and place it from right to left. For me placing the tool from past to current price left to right is better than from current price to the past, and we will use that in future examples. In any case, Forex traders want to place the Fib on the correct place, which is from the bottom to top in an uptrend and from top to bottom in a down trend.

Placing the Fib correctly is a vital step - otherwise, you could be fibbing the wrong leg of a move and get stopped out for a loss. A few key items to be aware of: a Use tops and bottoms on your time frame - use natural tops and bottoms for swings and legs to place your fib; b Use Fractals - Fractals will help you with identifying tops and bottoms; c Use Elliott Wave - make sure you are fibbing a wave 1, a wave 3, a wave extension sub waves of a wave , a wave A or an entire 5 wave sequence, otherwise the Fib might fail when using it as a tool for entries ; d Use the Awesome Oscillator - check when the zero line has been crossed and wait for a retrace back to that zero line.

You now have confirmation that the move is 1 leg or swing high swing low. It is important to realize that a new Fib is preferably not placed on a new swing high swing low unless the target has been hit see Fibonacci targets for more details on the levels. The reason why is simple: only when the targets have been hit is the currency pair, in fact, confirming a trending mode.

If the currency bounces in between the top and bottom then, in fact, the currency is in a range and Forex traders only want to place a new Fib once the trend is back in force. The most important target to hit is the Number 8: Using Fibs in confluence with others tools Finding confluence is key. With confluence, I mean finding multiple reasons for taking a trade. Fibonacci time ratios explain how long a swing high swing low might take in time before the next swing high swing low starts. It does that by measuring a completed swing high swing low and then placing The next swing high swing low has a higher chance of finishing at these Fib levels.

Number does work Fibonacci on different time frames? The Fibonacci retracement tool has more importance and significance when used on a higher time frame. However, the levels tend to work well on all time frames in fact.

- Related Articles;

- admiral markets forex peace army review;

- standard bank forex indicators.

- How To Use Fibonacci Retracement Levels!

- risk management in binary options!

Traders can use the tool on multiple time frames at the same time. In one instance the Fib might act as a potential turning spot for a trend continuation on a higher time frame, such as the daily chart. Whereas on a smaller time frame, a trader could use a Fib enter on a pullback. The first one is used as a potential trigger and the second Fib as the actual entry.

There you have it, 10 things you need to know about Fibonacci, including Fibonacci sequence and retracement. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow.

Fibs are patterns so they will always work. The problem is the trader understanding how to use them correctly.