Forex lot value calculator

Contents:

You may also be the type of trader that, sometimes, trades one currency pair at a time, using the margin to cover that particular trade. You can use a lot size calculator to maximize the lot size you can trade for a particular currency pair with the given margin size.

The picture below shows how you can utilize a lot size calculator. The second field is the number of pips equal to the stoploss size, 29 pips. The third field is the percentage you are willing to risk per trade; we can presume it is still 2. The result from the lot size calculator shows that the maximum lot size maintaining 29 pips stoploss, and 2.

The Forex position size calculator uses pip amount stoploss , percentage at risk and the margin to determine the maximum lot size.

When the target currency pair is quoted in terms of foreign currency, we need to adjust for the pips being quoted in the foreign currency and multiply the above formula by the exchange rate. Most traders will look at the profitability ratio of a trade before they execute a position. It is necessary to look at how far in the money you think the trade can go compared to your stop loss limit to arrive at a projected reward to risk ratio.

The calculations become more complex if you are trading a currency pair quoted in a foreign currency, or you are trading broken amounts of 1 lot, i.

What is a LOT in Forex and How Do You Calculate the Trade Volume | Liteforex

To make calculations easier, faster and foolproof, we use a profit and loss calculator. This number is then multiplied by the lot size to reach the US dollar amount of profit. With the example in the image above, the target currency pair is quoted in pips of yen. Using the numbers in the example above we get; Another tool that is very useful when calculating profit and loss is available at FxPro. This tool is useful when you already know the target profit and the stoploss, and you want to calculate what those two limits translate into in terms of price.

From the picture below, we can see that using all of the above parameters, and considering the position would be to buy, or go long USDJPY, we get the stoploss at Further down the page, you will also find a calculator that allows you to start from the price levels of stoploss and target profit, in the case you want to arrive to the money values of stoploss and target profit starting from price levels. In the example in the picture above for USDJPY, for 1 lot, you would need to change the US dollar profit target amount into yen before calculating the profit target price.

The Position Size Calculator will calculate the required position size based on your currency pair, risk level either in terms of percentage or money and the stop loss in pips.

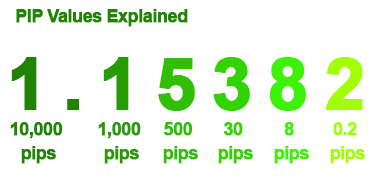

A pip is a unit of measurement for currency movement and is the fourth decimal point in most currency pairs. Forex Margin Calculator gives you a fast possibility to count the necessary amount of funds that you must to have in your account balance to make a willing deal based on the Forex Trading Account currency, currency pair, lots and leverage. Lot sizes take into consideration losing the spread. Gold pip calculator represents the simple calculation of earnings based on trading size and trading pips … In this currency pair, the value of one pip is 0.

In the trading market, the trader calculates the pip value using the last Decimal points.. Please contact client services for more information.

Trading calculator

Use the current exchange rate for the currency pair. Pip values for the majors, minors and crosses may all be easily calculated. Our online calculators allow clients to make accurate assessments at the right time to make the most out of their trades.

On the LiteForex trading platform, the size of one full standard lot for all indices corresponds to one contract. Your Message. We calculate the amount required to enter a trade of 1 standard lot. The size of the contract for each broker can be different. Calculate the lot size according to the following formula:. Conservative strategies suggest minimization of loss rather than chasing after the high profit, so they imply entering trades with a small volume. The price depends on the asset value.

In practical terms, a pip is one-hundredth of one percent, or the fourth decimal place 0. Maximum leverage and available trade size varies by product. Lot size and profit targets in pips and percents are calculated off to the right. All you need is your base currency, the currency pair you are trading on, the exchange rate and your position size in order to calculate the value of a pip.

This allows you to understand better, how your trading account will grow over time.

FOREX TRADER’S CALCULATOR

I'm going to execute a trade live on-camera so you can visually see exactly how I calculate pips and calculate profit when looking to enter the markets. Take advantage of our margin pip calculator to support your decision making while trading forex.

The XM pip value calculator helps clients determine the value per pip in their base currency so XM · XM Forex Calculators; Pip Value Calculator trading on, the exchange rate and your position size in order to calculate the value of a pip. How does the pip calculator work? The value of a pip is calculated by multiplying the amount of the trade in lots by one pip in decimal form, and then dividing it by.

For metals, you calculate tick value instead of pip value, and the Pip Calculator works as follows: 0. To do this, simply select the currency pair you are trading, enter your account currency, your position size, and the opening price. I have not failed.

How to use the Forex calculator

I've just found 10, ways that don't work. Thomas Edison. Pip Value Calculator How much is each pip worth?

What is a Pip in Forex? Read More.

What is a Lot in Forex?