Macd forex indicator

Contents:

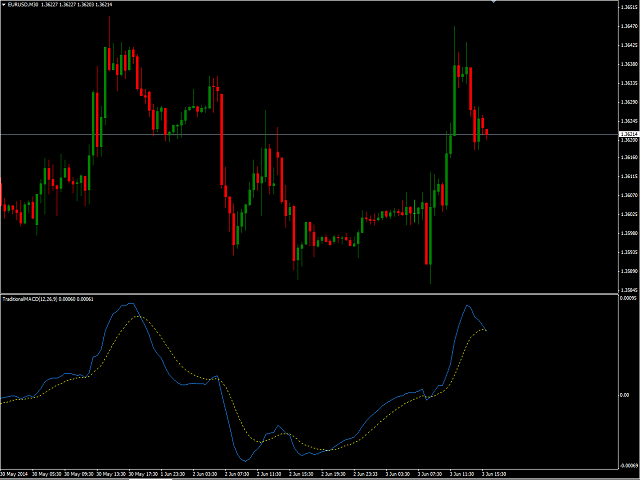

This is basically a volatility based trading strategy developed to get us out of choppy market conditions which makes trading less fun. Hello everyone, this is indicator has always been my go-to MACD indicator for many years.

It is such a beautiful easy to understand indicator. You can also view different timeframe resolutions which is helpful. When the MACD crosses up the signal line it is green, and when it crosses below the signal line it is red. The signal line is the constant yellow line This strategy will look for opportunities when price touches the lower Bollinger band, then enters Long when it anticipates a MACD crossover signal. Setup: on 1-day chart interval Exits when either a hitting trailing stop loss, or b meeting risk-to-reward, if defined by user.

The red columns are stochastic of macd histogram. The green histogram is the stochastic rsi of price. It is not meant to take Hey everybody, This is my first strategy and script I wrote mostly myself. There's tons of content out there to learn how to code in Pinescript and it's exactly what I wanted and needed in this time of my life.

If the short term Default 7 moving average cuts the medium term default 25 moving average, BUY. Conversely, it generates the SELL signal.

MACD – 5 Profitable Trading Strategies

You can change the moving average and the number of days as you wish, and you can This script was created to see the Macd and Rsi indicators in one place. Common Stock Bitcoin Russian Stock Index. VTB 0. Silver Ruble Exchange Rates.

Can Pivot Points Be Used for Trend Trading?

Euro Bitcoin is again feeling the pull of gravity. Market focus Holidays in the U. What is crypto-currency in simple words?.

In the blue circle, we see the fast red curve crossing the slow purple one upwards. The following performance was achieved by me while trading live in front of hundreds of my clients : Connect With Me:. If you see price increasing and the MACD recording lower highs, then you have a bearish divergence. When price and momentum diverge, it typically indicates that the market is primed for a reversal. For example, the MACD line moving below the signal line may be an exit short.

Crypto-currency is electronic virtual or digital money. How to make money OUT of crypto-currency? How to earn bitcoin? What is bitcoin in simple words? How to buy a bitcoin? Upcoming events. In the calculation of their values, both moving averages use the closing prices of whatever period is measured.

If prices are rising, the histogram grows larger as the speed of the price movement accelerates, and contracts as price movement decelerates. The same principle works in reverse as prices are falling. The chart below is a good example of a MACD histogram in action:.

Best MACD trading strategies

The MACD histogram is the main reason why so many traders rely on this indicator to measure momentum, because it responds to the speed of price movement. Indeed, most traders use the MACD indicator more frequently to gauge the strength of the price move than to determine the direction of a trend. As we mentioned earlier, trading divergence is a classic way in which the MACD histogram is used. One of the most common setups is to find chart points at which price makes a new swing high or a new swing low , but the MACD histogram does not, indicating a divergence between price and momentum.

The chart below illustrates a typical divergence trade:. Unfortunately, the divergence trade is not very accurate, as it fails more times than it succeeds. Prices frequently have several final bursts up or down that trigger stops and force traders out of position just before the move actually makes a sustained turn and the trade becomes profitable.

What is MACD?

The chart below demonstrates a typical divergence fakeout , which has frustrated scores of traders over the years:. One of the reasons traders often lose with this setup is that they enter a trade on a signal from the MACD indicator but exit it based on the move in price.

Since the MACD histogram is a derivative of price and is not price itself, this approach is, in effect, the trading version of mixing apples and oranges. To resolve the inconsistency between entry and exit , a trader can use the MACD histogram for both trade entry and trade exit signals. To do so, the trader trading the negative divergence takes a partial short position at the initial point of divergence, but instead of setting the stop at the nearest swing high based on price, he or she instead stops out the trade only if the high of the MACD histogram exceeds its previous swing high, indicating that momentum is actually accelerating and the trader is truly wrong on the trade.

If, on the other hand, the MACD histogram does not generate a new swing high, the trader then adds to his or her initial position, continually achieving a higher average price for the short. Currency traders are uniquely positioned to take advantage of this strategy, because the larger the position, the larger the potential gains once the price reverses. In forex FX , you can implement this strategy with any size of position and not have to worry about influencing price.

Traders can execute transactions as large as , units or as little as 1, units for the same typical spread of points in the major pairs.

In effect, this strategy requires the trader to average up as prices temporarily move against him or her. This is typically not considered a good strategy. Many trading books have derisively dubbed such a technique as " adding to your losers. In effect, the trader is trying to call the bluff between the seeming strength of immediate price action and the MACD readings that hint at weakness ahead.

Still, a well-prepared trader using the advantages of fixed costs in FX, by properly averaging up the trade, can withstand the temporary drawdowns until price turns in his or her favor.