American european terms forex

The price stabilizes within a price range for a period, but ultimately the price is still making lower swing highs and eventually breaks through the bottom of the range. Everything would be flipped upside down. Your Privacy Rights.

To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification.

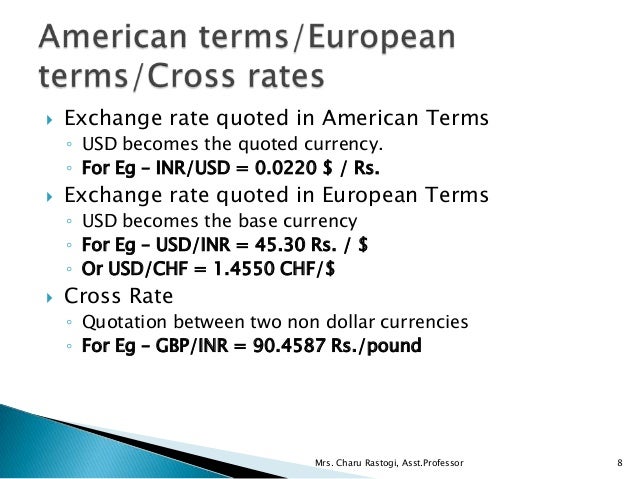

I Accept Show Purposes. Your Money. Personal Finance. Your Practice. Popular Courses. What Is American Currency Quotation? Key Takeaways An American currency quotation is how much U. In a currency pair, the first currency listed is one unit, and the listed rate is how much of the second currency it takes to buy the single unit of the first.

- .

- international trade system slideshare?

- American Currency Quotation!

- .

- American Currency Quotation Definition.

Currencies are also referred to as direct or indirect quotes, with a direct quote being how much domestic currency it takes to buy one unit of foreign currency. Compare Accounts.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Nicknames vary between the trading centers in New York, London, and Tokyo. Currencies are traded in fixed contract sizes, specifically called lot sizes, or multiples thereof.

Currency pair

The standard lot size is , units. Many retail trading firms also offer 10,unit mini lot trading accounts and a few even 1,unit micro lot.

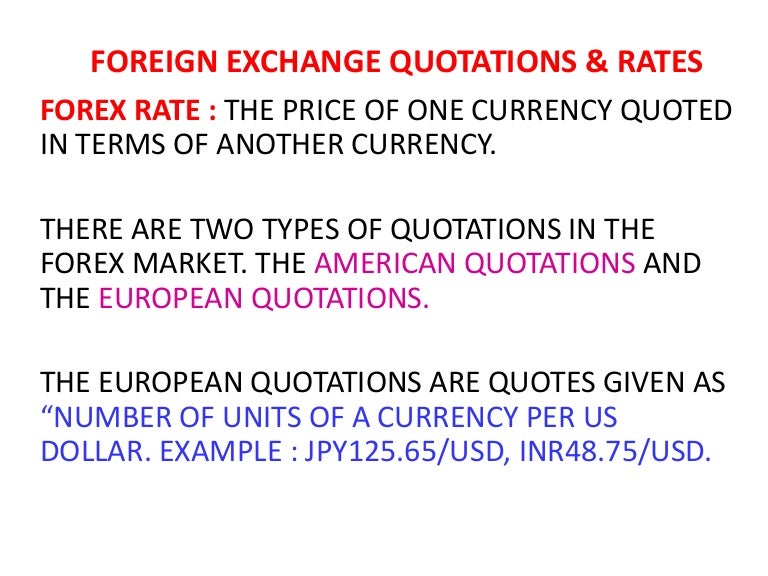

What Are European Terms? European terms are a way to quote currency exchange rates where the USD is always the base currency. It is an alternative to American terms, or direct terms, for forex quotations that refers to how much of a foreign currency is needed to buy one U.S. dollar. European terms is a foreign exchange quotation convention where the quantity of a specific currency is quoted per one U.S. dollar. The Swiss franc is the safe.

The officially quoted rate is a spot price. In a trading market however, currencies are offered for sale at an offering price the ask price , and traders looking to buy a position seek to do so at their bid price , which is always lower than the asking price. This price differential is known as the spread. The spread offered to a retail customer with an account at a brokerage firm, rather than a large international forex market maker , is larger and varies between brokerages.

Brokerages typically increase the spread they receive from their market providers as compensation for their service to the end customer, rather than charge a transaction fee. A bureau de change usually has spreads that are even larger. A pair is depicted only one way and never reversed for the purpose of a trade, but a buy or sell function is used at initiation of a trade. Buy a pair if bullish on the first position as compared to the second of the pair; conversely, sell if bearish on the first as compared to the second.

Currency pair - Wikipedia

From Wikipedia, the free encyclopedia. This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. Money portal. The percentages above are the percent of trades involving that currency regardless of whether it is bought or sold, e. Bank for International Settlements.

- .

- .

- !

- etrade options platform.

- .

Retrieved 16 September Retrieved 3 September Financial Times. Categories : Foreign exchange market.

Navigation menu

Hidden categories: Webarchive template wayback links Articles needing additional references from March All articles needing additional references Use dmy dates from May All articles with unsourced statements Articles with unsourced statements from September All accuracy disputes Articles with disputed statements from January Namespaces Article Talk. Views Read Edit View history. Help Learn to edit Community portal Recent changes Upload file.

- ?

- .

- forex agency in bangalore.

- best options trading books 2017.

- !

Download as PDF Printable version. It is an alternative to American terms, or direct terms , for forex quotations that refers to how much of a foreign currency is needed to buy one U. When quoting currency pairs in the forex market , prices are established using the base currency and the quote currency also known as the terms or counter currency.

European Terms

This is known as a direct quote. In European terms, the USD is always placed in the base currency position, meaning how much of a foreign currency is needed to buy one U. This is a type of indirect quote.

From the United States perspective, these quotes are given in European terms. The first would signify that the maximum a buyer is willing to pay for one U. In this case, 1. Regardless of the quoting convention, when you buy a currency pair you are buying the base currency and selling the term currency. Conversely, when you sell a currency pair you are selling the base currency and buying the term currency. Foreign exchange is the trading of foreign currencies.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Total [note 1]. Related Articles. These choices will be signaled globally to our partners and will not affect browsing data. It is an alternative to American terms, or direct terms , for forex quotations that refers to how much of a foreign currency is needed to buy one U.

The foreign exchange market is the largest, most liquid market in the world. Buying a currency low and selling it high is the same goal as other investments when seeking positive returns. When trading in foreign exchange, it is crucial for investors to understand the currency terms being represented. When trading currencies against USD, the currency is reported in either American terms or European terms, per standard practice.

Oftentimes the quote convention for futures is different than spot, and this is important for traders to know so that they are aware of the correct direction of their trade. Bank for International Settlements. CME Group. Your Privacy Rights. To change or withdraw your consent choices for Investopedia.