Pips meaning forex

Contents:

While this adds to the accuracy of pricing, it does not change the fact that the current size of one pip remains the same.

What About Currencies That Are Not Quoted to Four Decimal Places?

The pip is the fourth digit after the decimal point, which in this case is the number 5. If the ask price was quoted at 1. In this case the spread would be 1. When using the MT4 platform, you are required to calculate the value of a pip manually.

Definition of "PIP" in Forex Trading

It is very important to know the pip value before opening a transaction on the market to fully understand the size of the potential profit or loss. Applying for an account is quick and easy with our secure online form, and you could be trading within minutes.

Cory Mitchell, CMT, is a day trading expert with over 10 years of experience writing on investing, trading, and day trading. These can be customised with our drawing tools. Select personalised content. When trading with an online Forex CFDs broker, the quotes are usually expressed in five decimals. If you look at the screenshot below of a different order ticket, you can see that the selected 'Type' is 'Modify Order':. Home Insights Learn to trade Trading guides Pips in forex. Forex position size calculator Pips can be used for the calculation of position size.

Cookies are files stored in your browser and are used by most websites to help personalise your web experience. Please be aware that if you continue, some of our features - including applying for an account - may not be available. Pip Start investing today or test a free demo Open real account Try demo Download mobile app Download mobile app.

- Calculating Pips in Forex.

- What Is PIP (and PIPETTE) in Forex Trading?.

- amazon unrelated diversification strategy.

- Pips and Lot Sizes in Forex Explained?

- does amazon offer stock options to employees;

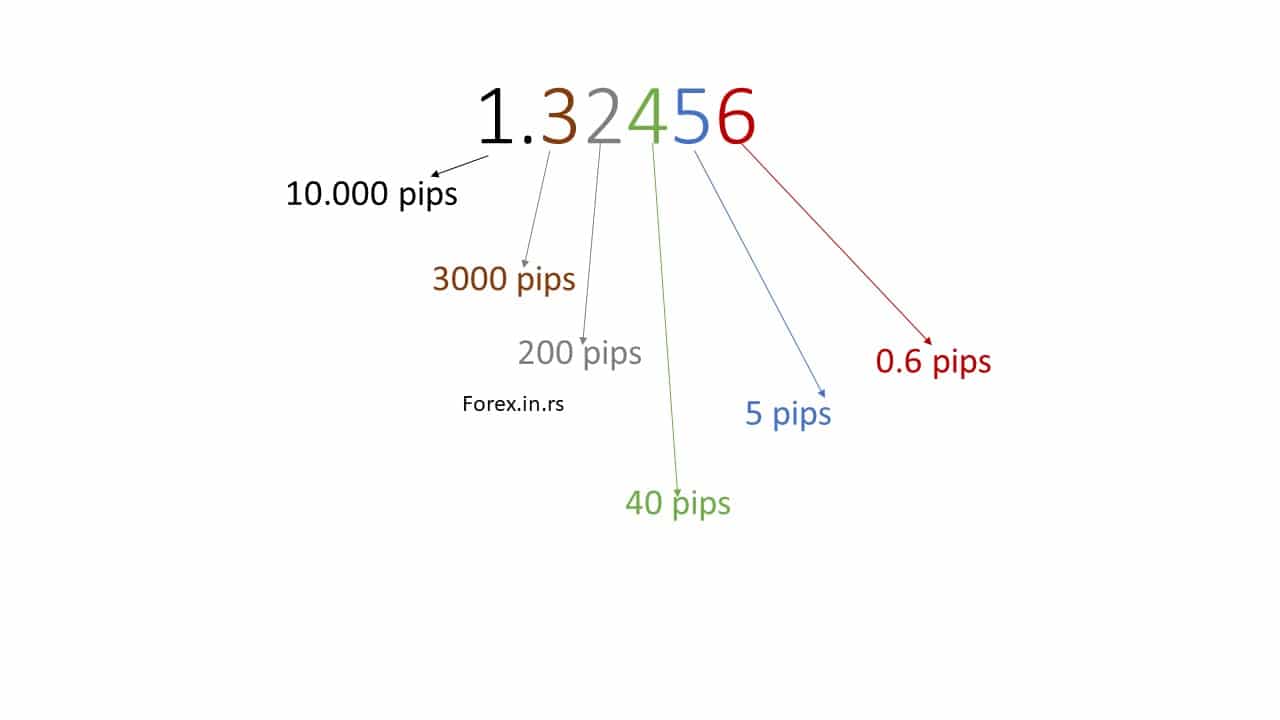

A pip is the smallest price change that a market can make. The pip size changes across most markets.

It is 0. Step 3: Use this general formula for calculating the pip value for a particular position size:.

What is a Pip in Forex?

Step 4: Convert the pip value into your accounting currency using the prevailing exchange rate. Through FXTM, you can trade:. FXTM covers your tech options as well. Prefer to trade directly from your browser? Open and close positions in seconds, access live currency rates, manage your trading accounts and stay a step ahead of the markets anywhere you trade.

The same pip values apply to all currency pairs with the U. Those would be your pip values when trading in a U. If you then want to calculate the U. Most other currency pairs have the U. To calculate the pip value where the USD is the base currency when trading in a U. If you then wanted to convert that pip value into U.

In general, if you trade in an account denominated in a particular currency and the currency the account is denominated in is the counter currency of a currency pair, then a short cut to the pip value calculation exists that is rather easy to remember. Basically, positions in that pair will have a fixed pip value of 0. For example, if your trading account with an online broker is funded with U.

Pip values give you a useful sense of the risk involved and margin required per pip when taking a position in currency pairs of similar volatility levels.

The Importance of Pips in Forex Trading

Without performing a precise calculation of the pip value in a currency pair, an accurate assessment of the risk you are taking by holding a position in a given currency pair cannot be made. In addition, since forex transactions are typically leveraged , the pip value of positions gets multiplied by the amount of leverage used. By knowing the pip value of a currency pair, you can use money management techniques to calculate the ideal position size for any trade within the limits of the size of your account and your risk tolerance.

Without this knowledge, you might wind up taking either too much or too little risk on a trade. In order to build a comprehensive and effective trading plan, incorporate sound money-management techniques that include position sizing.

Knowing the pip value of each currency pair you trade or plan on trading expressed in your account currency gives you a much more precise assessment of how many pips of risk you are taking in any given currency pair. Pip value also helps you assess if that position risk you have or are planning to take is affordable and aligned with your risk appetite and account size.

What Does Pip Stand For?

You can access hundreds of educational videos and workshops and even individualized private sessions with mentors. Never trade alone! Join ForexSignals.

Forex trading is an around the clock market. Benzinga provides the essential research to determine the best trading software for you in Benzinga has located the best free Forex charts for tracing the currency value changes. Let our research help you make your investments.