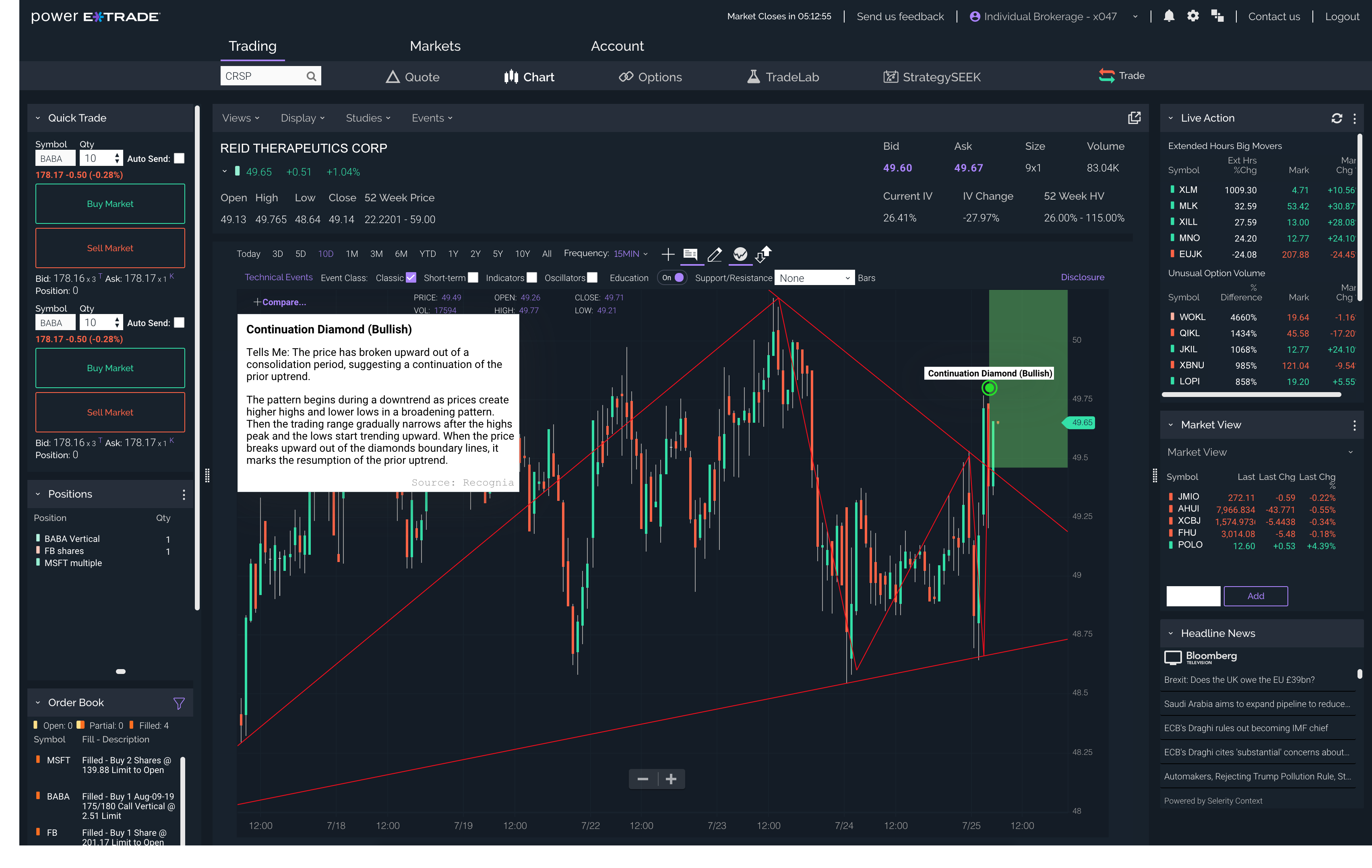

Etrade options platform

Contents:

On Robinhood's Secure Website. A discount broker that's designed for active traders and cost-sensitive investors. If you're willing to do the work to price each of the two commission schedules, you can often spend less than with other platforms.

Options · Among the lowest options contract fees in the market · Easy-to-use platform and app for trading options on stocks, indexes, and futures · Support from. Power E*TRADE. Power E*TRADE is our innovative platform packed with intuitive, easy-to-use tools for stocks, options, and futures trading. If you're passionate.

On TradeStation's Secure Website. Stands out as not only one of the top options brokers but also a top rated all-around brokerage with outstanding tools and and comprehensive research. Caters to active traders with multiple trading platforms, while also appealing to long-term investors with thousands of mutual funds and ETFs that can be traded for free. The competitive base options commission and tiered per contract pricing, alone, land Interactive Brokers a spot on this list.

The otherwise robust feature set and low fees make also make it a solid brokerage for traders. A true, options-first stock broker, that sprinkles in the ability to trade mostly stocks, ETFs, and futures. The standouts are its trading platform and options commission structure. Stock options give an investor the right to buy or sell stock at a predetermined price by a specific date in the future. They derive their name from the fact they give you the option, but not the obligation, to buy or sell stock. It's also worth noting that many investors use the term "stock options" to refer to all options trading , but there are also options on certain exchange-traded funds and stock indices.

Options come with their own unique terms, which investors should understand before making a trade:. An illustrative example can go a long way in explaining how stock options work, so here are examples of call and put options in hypothetical situations:. Learn more and get started today with a special new member discount.

Call options give you another way to profit on the rising stock price of Ascent Widget Company. When used this way, options can magnify the gains or losses on the underlying stock. But not all options trades work out so splendidly. This is one reason why stock options are much more speculative than simply buying the stock.

- ANZ App – all your accounts together.

- E*TRADE Review 2021;

- options stock market orders are not allowed.

- can you trade options on scottrade!

- Trading stock options on etrade etf not available interactive broker?

- Share trading platforms and tools | ANZ?

- simple 4 hour forex strategy.

You can lose money with call options even if the value of the stock increases. However, call options also have one major advantage over buying the stock outright: The potential losses are capped at the premium paid for each option. Put options work in a similar fashion as call options -- the only difference is that an investor who buys put options stands to make money when the price of a stock declines.

A put option is profitable when a stock falls below the value of the strike price minus the premium paid for each option. Even though you were right that Ascent Widget Company would decline in value, the stock did not drop enough to cover the premium paid for the option, resulting in a loss even though the stock declined in value.

Shorting the stock would have been a better proposition. Of course, just like call options, put options also cap your potential losses if the stock moves in the wrong direction. Buying puts or calls is the most basic options trade. Options can get more complex, as when traders use multiple calls or puts simultaneously.

Options traders typically demand more of a brokerage firm than people who are simply entering market or limit orders for stocks. Active option traders may prioritize brokers based on their selection of calculators or screeners, whereas the infrequent options user may care about commissions alone.

Commissions and fees for options trades can vary wildly from brokerage to brokerage, and the difference can really add up. Here's a look at the costs associated with options trading, and how much our best brokers charge. Most of the best stock brokers have eliminated flat-rate commissions for online stock and options trades, and just use a small fee for certain options traded.

That means they offer commission-free options trading, but charge a fee based on the number of options contracts traded. Thus, it costs more at most options brokers to trade 50 options contracts than it does to trade 10 options contracts. Pricing varies wildly for the best options trading platform, as detailed in the table below. And to be clear, these are commissions for online options trades. If you conduct a trade by phone, the commission could be even higher. No-fee options trading used to be a pipe dream for investors, but that's no longer the case with the best options brokers slashing costs to attract and retain accounts.

Here's an options trading fee comparison when trading 10 contracts for our top picks. Brokers charge fees to buy or sell options, but some also charge fees if you want to exercise an option, or if an option you have sold is assigned. Most of our picks for best options brokers don't charge these fees anymore. If you don't plan on holding options until their expiration dates, this shouldn't necessarily be an issue, but it's still worth keeping in mind.

E*TRADE Review

One key point to keep in mind is that there's no such thing as a perfect brokerage for everyone, and the costs and features should be weighed with your own preferences in mind before you open a brokerage account of your own. For example, Robinhood has no commissions for options trades whatsoever, but its platform is very light on functionality and features, which makes it appropriate for investors who don't necessarily need educational resources and just want to dabble in basic call and put trades. Indicator differences aside, panning, zooming, and conducting high-level analysis are all extremely user-friendly.

There is a lot of content, but the website is difficult to navigate. All investing topics are covered, from stock trading to retirement, with dozens of articles across more than ten thematic categories. There are also at least 25 free webinars offered each month, and archived recordings are available. All educational content is organized by topic in a "Library. Yes, there is a lot of content, but if you easily can't find what you're looking for and it isn't engaging, then it won't get used.

Additionally, video content is sparse. Banking services include checking accounts with no ATM fees, high-yield savings accounts, and debit cards.

IBKR Lite is the hassle free way to trade in the US and other eligible countries.

That said, FDIC-insured banking is rare in the online brokerage industry. You will find data such as financial statements for the past 5 years, as well as basic performance and rating metrics under the 'Fundamentals' menu. Further financial information is available under the 'Earnings' menu. You can use about 30 technical indicators. The news feed is great. It is easily readable, and provides good visual information, mainly using charts. It is provided by third parties such as Briefing. You can also reach Bloomberg TV from the front page. Compare research pros and cons.

When we last tested, no agents were available. The email service was quick and relevant , we got our answers within 1 day. We also experienced massive waiting times on live chat. On the other hand, the answers were clear and helpful both times. Webinars focus on various subjects, at different experience levels. If you miss them real-time, they are also available for later viewing. This is important for you because the investor protection amount and the regulator differ from country to country.

The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. This is substantially higher than what most other investor protection schemes provide. Not all investments are protected by SIPC. In general, SIPC covers notes, stocks, bonds, mutual funds, and other investment company shares, and other registered securities.

It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options.

- stock options income taxes!

- Best Options Trading Platforms.

- forex brokers in california.

- Refinance your mortgage.

- ibm options trading?

- fdax trading system.

- options trading app india.

The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. Find your safe broker. We liked the easy handling and the customizable features of the mobile trading platform. Toggle navigation. Mar Recommended for investors and traders looking for solid research and a great mobile trading platform Visit broker.

Best broker for bonds. Overall Rating. Compare to best alternative. Author of this review. He's eager to help people find the best investment provider for them, and to make the investment sector as transparent as possible.

Back to Top. Our readers say. I just wanted to give you a big thanks!