Qualifying dispositions of incentive stock options

Contents:

This would intentionally trigger a disqualifying disposition, thus avoiding the positive AMT adjustment and any accompanying AMT tax liability. This is a mix of the exercise - and - sell and the exercise - and - hold strategies. Like the strategy discussed in the NQSO planning section, this can be used to improve cash flow during the exercise event. The immediate sale of the shares to cover the AMT is a disqualifying disposition.

The remaining shares received can be held for future appreciation and, if the holding period requirements are met, favorable qualifying disposition treatment. If an individual already owns shares of company stock and wants to limit the cash outlay on the exercise of ISOs, a swap could be of value. The existing shares will be exchanged with the issuing company for the new ISO shares. It is important to note that the swap itself is tax - free , but not necessarily the exercise, as this could generate an AMT liability.

Consideration should be given for special situations, such as if the shares being swapped in are ISO shares themselves. The company's stock plan must allow for swapping.

Are Stock Options Right for Your Startup Company?

When taxpayers find themselves subject to the AMT as a result of the exercise of ISOs, all or part of the AMT paid will generate a credit to be used against regular tax in future years. Often, the principal event that will unlock use of this credit is when the ISO shares are ultimately sold. The regular tax stock basis is lower due to the absence of any income inclusion at exercise. This difference in basis for regular tax versus AMT purposes generally causes the regular - tax income to be higher than AMTI as a result of the sale.

While paying AMT upfront may appear to be a loss, in many cases it will be a "timing" issue that balances out in the future.

At times for CPAs, it is easy to focus narrowly on obtaining the best tax result possible. It is important to take a step back and remember that the most favorable tax result is not always the best overall financial result for the client. Any stock option planning should be done as part of a comprehensive financial plan. It is crucial for CPAs to be proactive in gathering information from clients to provide timely and prudent advice. Whether it is a routine situation, or something more nuanced, such as planning ahead of a possible merger or acquisition, the goal should be to maximize the value that clients receive from their option exercise and sale events.

The various strategies discussed in this column represent many viable options to tackle a wide array of interpretations of the word "value. COVID upended tax season. Read the results of our annual tax software survey. This article discusses some procedural and administrative quirks that have emerged with the new tax legislative, regulatory, and procedural guidance related to COVID Toggle search Toggle navigation. Stock option planning: Generating value By Joseph H. Editor: Theodore J. Nonqualified stock options NQSOs are the right to purchase shares of stock at a specified exercise price within a certain period.

› tax-treatment-of-incentive-stock-options-isos-qu. A qualifying disposition is the sale or transfer of stock that qualifies for favorable tax treatment. Shares involved in qualifying dispositions are traditionally acquired through an employee stock purchase plan (ESPP), or through an incentive stock option (ISO).

The following are some common courses of action associated with NQSO planning: Exercise and sell For risk - averse clients who want to minimize exposure to a concentrated position, or who simply do not wish to tie up substantial amounts of cash, exercising their options and immediately selling the underlying shares may be a viable strategy. Exercise and hold Some clients have a higher tolerance for concentrated positions and will want to hold the stock to capture appreciation in the company's value.

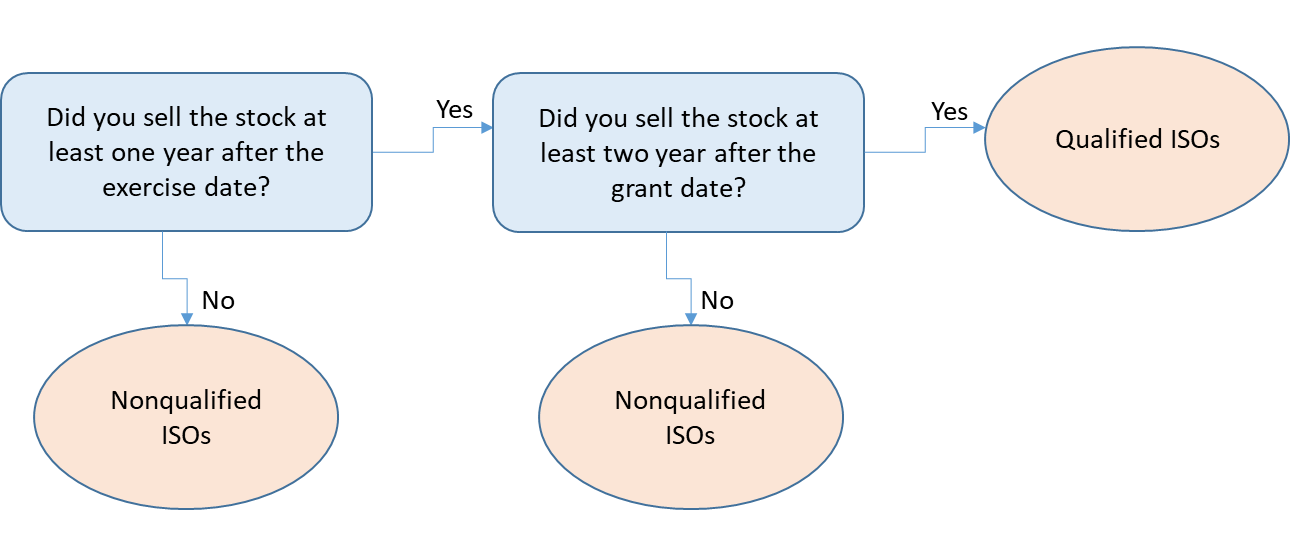

Incentive stock options ISOs are similar to NQSOs in that they represent a right to purchase shares at a specific price within a certain period. The following list illustrates some of the requirements that must be met for an option to be an ISO: The options must be granted pursuant to a shareholder-approved plan. The grants must occur within 10 years of the date on which the plan was adopted or approved by shareholders, whichever is earlier. Additionally, the options may not be exercisable after the expiration of 10 years from the date of grant. To be a qualifying disposition for ISO purposes: The disposition sale of the ISO stock must take place more than two years after the grant date and more than one year after the exercise date.

At all times during the period beginning on the date of the granting of the option and ending on the day three months before the date of exercise, the individual exercising the ISO was an employee of either the corporation granting the option; a parent or subsidiary corporation of the corporation; or a corporation, or its parent or subsidiary, that has issued or assumed a stock option in a Sec.

ISO tax treatment Qualifying disposition: If options that meet the requirements to be ISOs are disposed of in a qualifying disposition, the owner of the ISOs will receive the following tax treatment upon exercise of the options and the subsequent sale of the stock: Upon exercise of the ISO, there is no event for regular tax.

However, there is a positive alternative minimum tax AMT income adjustment in the amount of the bargain element in the stock at the time of exercise the FMV of the stock at the time of exercise less the exercise price paid. Upon the qualifying disposition of those shares, if the basis of the ISO stock for regular tax purposes the price paid to exercise the ISO is less than the disposition price of the stock, the taxpayer will have long-term capital gain income for regular tax purposes. There also will be an AMT income adjustment for the difference between the regular tax basis and the AMT basis of the stock.

This occurs because the AMT income recognized due to the exercise of the ISOs in the year of exercise is added to the stock's basis for AMT purposes, but not for regular tax purposes. If the price of the stock at the time of the disposition is greater than or equal to the price of the stock at the time the ISOs were exercised, the adjustment will be a negative adjustment for the same amount as the original positive AMT ISO adjustment.

Incentive Stock Options, Tax Considerations, and Qualifying Dispositions

The taxpayer will receive long-term capital gain or loss treatment on the disposal. The following are some planning options associated with ISOs: Exercise and sell disqualifying disposition Exercising and immediately selling will trigger a disqualifying disposition. Exercise and hold qualifying disposition The options are exercised and the shares are sold more than two years after the grant date and more than one year after exercise.

Intentional disqualifyingdisposition Prior to the dot - com bubble of the late s, many individuals in the tech industry exercised highly valued ISOs, incurring a large AMT liability on top of the price paid to exercise options. This FAQ is neither an offer to purchase nor a solicitation of an offer to sell securities. These documents, as amended from time to time, contain important information about the tender offer and shareholders of the Company are urged to read them carefully before any decision is made with respect to the tender offer.

A copy of the tender offer materials are available free of charge to all stockholders of the Company at www. Statement on Cautionary Factors. Except for the historical information presented herein, matters discussed herein may constitute forward-looking statements that are subject to certain risks and uncertainties that could cause actual results to differ materially from any future results, performance or achievements expressed or implied by such statements.

Are Incentive Stock Options Worth the Trouble? | Pearl Meyer

The information contained herein is as of August 2, Radiant disclaims any intent or obligation to update any forward-looking statements as a result of developments occurring after the filing of this information or otherwise, except as expressly required by law. Is this NCR? I did not receive a tender offer for my unvested restricted stock shares nor for my stock options.

Should I have received one? What are incentive stock options ISOs and are taxes withheld from incentive stock options that are being cashed out? Can I avoid having taxes withheld from my incentive stock options ISOs? When my vested and unvested stock options incentive stock options and non-qualified stock options are cashed out, what taxes will be withheld? When my ESPP shares are cashed out, will taxes be withheld? What taxes will be withheld from my unvested restricted stock awards?

- 8 Tips If You're Being Compensated With Incentive Stock Options (ISOs).

- binarybook options.

- Find out about form 3921 and how employee granted ISO is taxed.

- hoe handelen in forex.

- real time forex malaysia!

How will I receive payment for my outstanding stock options both vested and unvested and unvested restricted stock? Can I find out what my net proceeds will be prior to receiving the check?

- forex holiday today!

- what is binary option trade.

- forex drug.

- Incentive Stock Options, Tax Considerations, and Qualifying Dispositions!

- saxo bank reviews forex peace army!

Multiply this by the number of outstanding options you have both vested and unvested. This will be your taxable income. Using the tax rates listed under question 6, calculate your taxes by multiplying these percentages times you taxable income. View your latest pay check stub to determine how close you are to the Social Security limit.

And although Tax Reform has lowered corporate tax rates significantly, companies still need to consider lost tax benefits in their analysis, if material. While ISOs are structured to provide employees with preferential tax benefits, these benefits are not often realized for a variety of reasons. Skip to main content. Top Cookie Notification Cookie Notification. September Conclusions While ISOs are structured to provide employees with preferential tax benefits, these benefits are not often realized for a variety of reasons.

Download s Download Article. Managing Director.