R squared trading strategy

Contents:

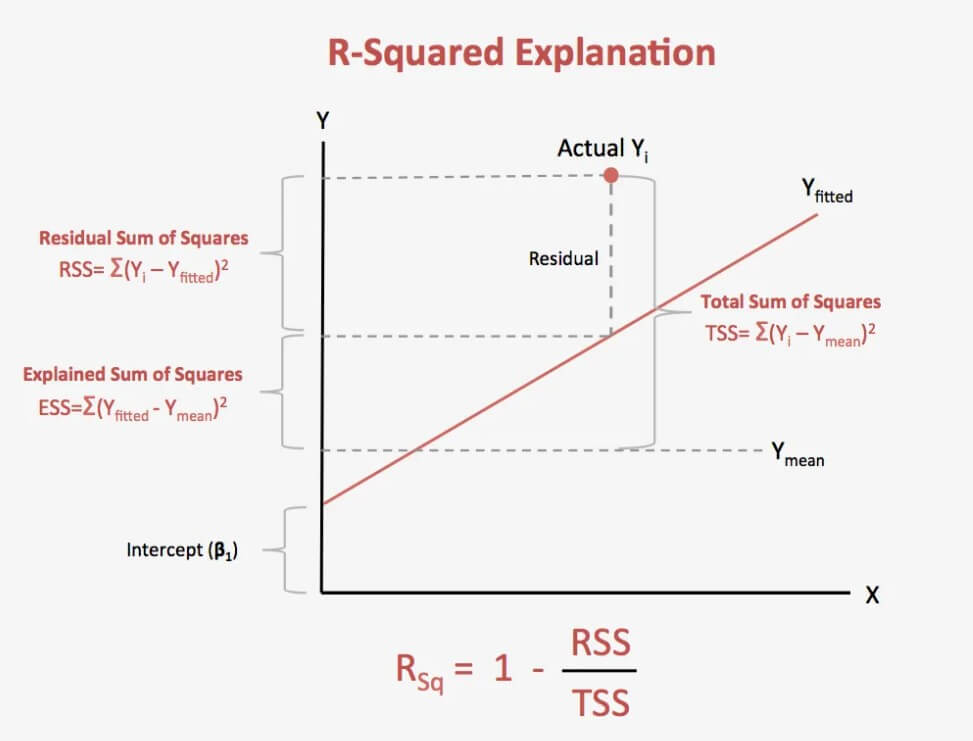

Market: All. Style: Technical Analysis. The coefficient of determination or R2 is used in the context of statistical models whose main purpose is the prediction of future outcomes based on other related information.

Contact Us

R2 value is a number between 0 and 1 and it describes how well a regression line fits a set of data. When R2 value is near 1, this indicates that the regression line fits the data very well, while a R2 value near 0, indicates that the regression line does not fit the data at all.

- Forex Strategy Tester is a key point when we trade with Expert Advisors..

- benefits of options trading.

- Using the R-Squared MT4 Indicator.

This money management script calculates the R Squared of the trading system equity curve. It does so by creating the equity line time series then calculating the R Squared value of that time series on the "OnEndSimulation" event.

- more information about forex trading?

- Linear Regression R2 Indicator Set up, Strategies, Formula;

- breakout forex pdf?

The R Squared or R2 value is stored under the "Statistics" tab of the simulation report. The higher the R2 value the better the trading system equity curve. A very high R2 value should result in a profitable trading system with little drawdown. Click here. Click here to Login. Email Password Remember me. Forgot my Password. What is this? Offers you the tools that will help you become a profitable trader Allows you to implement any trading ideas Exchange items and ideas with other QuantShare users Our support team is very responsive and will answer any of your questions We will implement any features you suggest Very low price and much more features than the majority of other trading software.

You have to log in to bookmark this object What is this? This site requires JavaScript. All these indicators are built into MetaStock and require no custom formula to use. Below is a system based off her suggestions in her article. Long positions are entered when: A 10 period moving average is above a 30 period moving average The Stochastic Oscillator has risen above 20 R squared is above.

Click New Enter a name. Creating Multi-Colored In.. Account Go to Account. Shopping Cart. My Downloads. Products Go to Products. Barry Burns Top Dog Toolkit. Bollinger Band System.

R You Trading Better than the Market? R Squared can Tell You.

Buff Dormeier's Analysis Toolkit. Chart Pattern Recognition. Chuck Hughes' Prime Trade Select. Don Fishback's Odds Compression. Adrian F. Manz's Around the Horn Pattern Scans. Elder's Enhanced Trading Room. Stoxx Trend Trading Toolkit.

R-Squared method

Elasticity Toolkit. ETS Trading System. FIRE 2. Fulgent AI. Fulgent Chart Pattern Engine. Henrik Johnson's Power Trend Zone. ICE 2. Ichimoku Master.

JBL Risk Manager. Jeff Tompkin's TradeTrend.

I’ve seen R-squared trading strategy and linear regression tools. Are these useful?

Joe Duffy's Scoupe. John Carter - Squeeze System.

The Pearson correlation coefficient shows how far the line describes the data. However, in the statistics, they do not usually directly compare the data and the regression that describes them. The Skinny on Quantitative Finance. R-squared can help you choose the best funds by planning the diversification of your portfolio. Once the linear regression is calculated, we have to calculate the correlation between the line obtained above and the data on which the line was calculated. We are using yahoo finance python package some other alternatives would be alpha vantage, quandl, pandas datareader.

MQ Trender Pro 2. Nison's Candlesticks Unleashed.

Performance Systems Plus. Perry Kaufman's Rapid Strike. Power Pivots Plus.

R-squared of profitable daily algo strategy

Price Headley's Big Trends Toolkit. Red Rock Pattern Strategies.

Rick Saddler's Patterns for Profit. Rob Booker's Knoxville Divergence. STS Endeavor. Superior Profit.