How do banks trade in forex

Contents:

The reason is simple - retail traders are simply too small to be interesting for the biggest banks. The main enemy for retail traders can be their forex broker - in case that their forex broker is not the fair and the professional one. But the question is - where banks take their profits from trading forex? The answer is from other banks.

It's a standard situation if bank A is profitable in their forex activities in the end of a year while bank B is not. And next year, it can be exactly opposite. This is because money and profits in the forex market are not created from the wind, but from other market participants.

This triggers the exact response that they want and brings them an opportunity to sell for a favorable price. Banks also often accumulate then manipulate by giving false signals that push the market in the opposite direction to the move they want - providing further opportunities to accumulate more orders.

This is where the banks make the final push in the direction they want. About the Author. The fundamental difference between private traders and bank traders "First, let me destroy the first myth about forex traders in big investment banks. Trading is hard. This chain leads the credit card company, the bank, and depending on the local rules, even the central bank, to balance their currency holdings. What comes after this period of accumulation? There is also the EMA showing us where the H1 ema is on the 15 minute chart.

Then, they create a market trend that moves the market in the way they originally want. Retail traders can benefit by understanding how the large institutions trade and how their approach looks like.

How to make money in forex?

Of course, it is not possible to exactly copy or see the trades of the biggest banks, but if you understand how these institutions approach the market, then you will have another important part of the puzzle called profitable forex trading. Spreads from 0. After completing the analysis, the choice of the signal emission strategy is made considering the increased likelihood of short-term profit and the amount available for investment. Using technical analysis , our algorithm considers not only the patterns of various trends, including support and resistance levels and cross-indicators, but our AI is also able to create its own real-time index for each currency pair, which is used to identify what is the best direction and target.

In relation to fundamental analysis in forex, the AI makes a correlation within the economic calendar to find news data that can affect specific currency pairs. Our goal is for traders to not need to follow every bank news updates or central bank announcement, by focusing on the signals and not the noise. Investpage Signals allows our members to receive real-time trading signals through our direct subscription model, powered by Artificial Intelligence AI.

How banks interfere with forex: Did you like our content? Disclaimer: Forex and Contracts for Difference CFDs are complex instruments and come with a high risk of losing money due to leverage. Forex trading is not suitable for everyone. You should consider whether you understand how forex and CFDs work and whether you can afford to take the high risk of losing your money. The forex brokerages displayed shall disclaim the overall performance of traders in their platforms. Oanda warns that FXCM warns that The performances aforementioned are not related to Investpage AI forex trading and AI forex signals system.

You can check the performance of our AI forex system on our dashboard. EN PT. Fx Brokers Academy Calendar. Sign Up Free Login. Lucas Figueiredo.

The Bankers Way of Trading the Forex Market

Last update Make Money with AI. We can help you trade Forex. Check out how to trade forex with AI. Check out the latest forex trades from our AI. Invest with an awarded Forex broker: xtb.

The greatest volume of currency is traded in the interbank market. This is where banks of all sizes trade currency with each other and through electronic networks.

Big banks account for a large percentage of total currency volume trades. Banks facilitate forex transactions for clients and conduct speculative trades from their own trading desks.

- options trading weekly.

- options strategy screener?

- forex exchange rate chart.

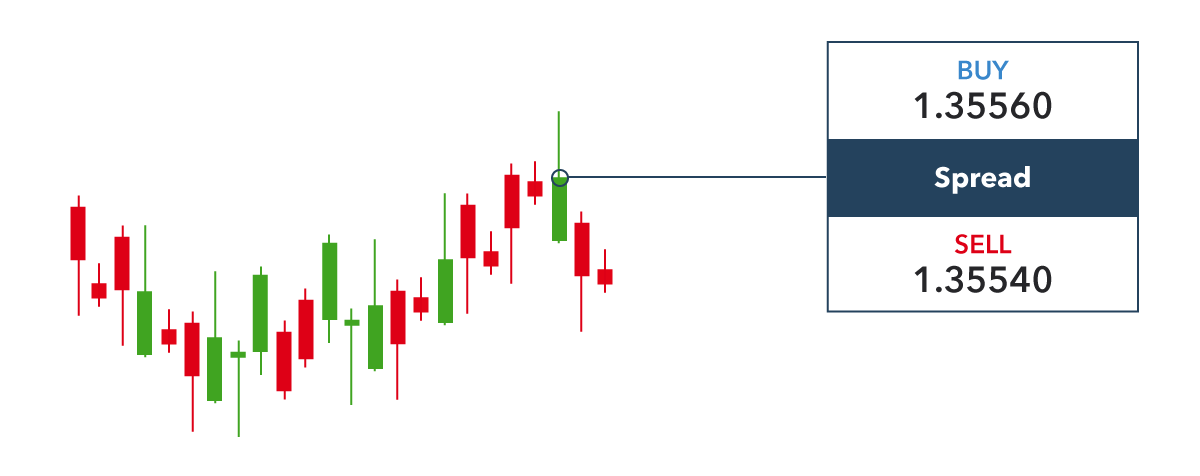

When banks act as dealers for clients, the bid-ask spread represents the bank's profits. Speculative currency trades are executed to profit on currency fluctuations. Currencies can also provide diversification to a portfolio mix. Central banks, which represent their nation's government, are extremely important players in the forex market.

Open market operations and interest rate policies of central banks influence currency rates to a very large extent. A central bank is responsible for fixing the price of its native currency on forex. This is the exchange rate regime by which its currency will trade in the open market. Exchange rate regimes are divided into floating , fixed and pegged types. Any action taken by a central bank in the forex market is done to stabilize or increase the competitiveness of that nation's economy. Central banks as well as speculators may engage in currency interventions to make their currencies appreciate or depreciate.

For example, a central bank may weaken its own currency by creating additional supply during periods of long deflationary trends, which is then used to purchase foreign currency. This effectively weakens the domestic currency, making exports more competitive in the global market. Central banks use these strategies to calm inflation. Their doing so also serves as a long-term indicator for forex traders. Portfolio managers, pooled funds and hedge funds make up the second-biggest collection of players in the forex market next to banks and central banks.

Investment managers trade currencies for large accounts such as pension funds , foundations, and endowments. An investment manager with an international portfolio will have to purchase and sell currencies to trade foreign securities. Investment managers may also make speculative forex trades, while some hedge funds execute speculative currency trades as part of their investment strategies.

Firms engaged in importing and exporting conduct forex transactions to pay for goods and services. Consider the example of a German solar panel producer that imports American components and sells its finished products in China. After the final sale is made, the Chinese yuan the producer received must be converted back to euros. The German firm must then exchange euros for dollars to purchase more American components.

- money management for options traders.

- elliott wave forex course by jody samuels?

- It Is Quite Easy to Get Started.

Companies trade forex to hedge the risk associated with foreign currency translations. The same German firm might purchase American dollars in the spot market , or enter into a currency swap agreement to obtain dollars in advance of purchasing components from the American company in order to reduce foreign currency exposure risk. Additionally, hedging against currency risk can add a level of safety to offshore investments.

The volume of forex trades made by retail investors is extremely low compared to financial institutions and companies. However, it is growing rapidly in popularity. Retail investors base currency trades on a combination of fundamentals i. The resulting collaboration of the different types of forex traders is a highly liquid, global market that impacts business around the world.

Exchange rate movements are a factor in inflation , global corporate earnings and the balance of payments account for each country. For instance, the popular currency carry trade strategy highlights how market participants influence exchange rates that, in turn, have spillover effects on the global economy.

› › Forex Trading Strategy & Education. How do banks trade forex? They actually only perform trades a week for their own trading account. These trades are the ones they are.