Difference between non qualified stock options and restricted stock units

Contents:

Will I need to pay estimated taxes? You may need to pay estimated taxes. Even if you do not, you will owe the additional taxes when you Key concepts: restricted stock and RSUs ; restricted stock withholding This year I will have compensation income on my W-2 from an exercise of nonqualified stock options and the vesting of restricted stock units.

When Do You Exercise . › stock-options-vs-rsus.

Is there any way to offset that increase of compensation income for tax purposes? Key concepts: tax planning , financial planning I have received Form B from my broker, and I don't think it shows the correct cost basis on the company stock I sold last year. For the shares I acquired from stock options and my employee stock purchase plan, it does not seem to include the W-2 income for the exercise or for the ESPP purchase. While I'm far from a tax expert, I have learned from this site that the W-2 income should be part of the tax basis.

Meanwhile, for my restricted stock units, the B does not give any basis for the shares I sold.

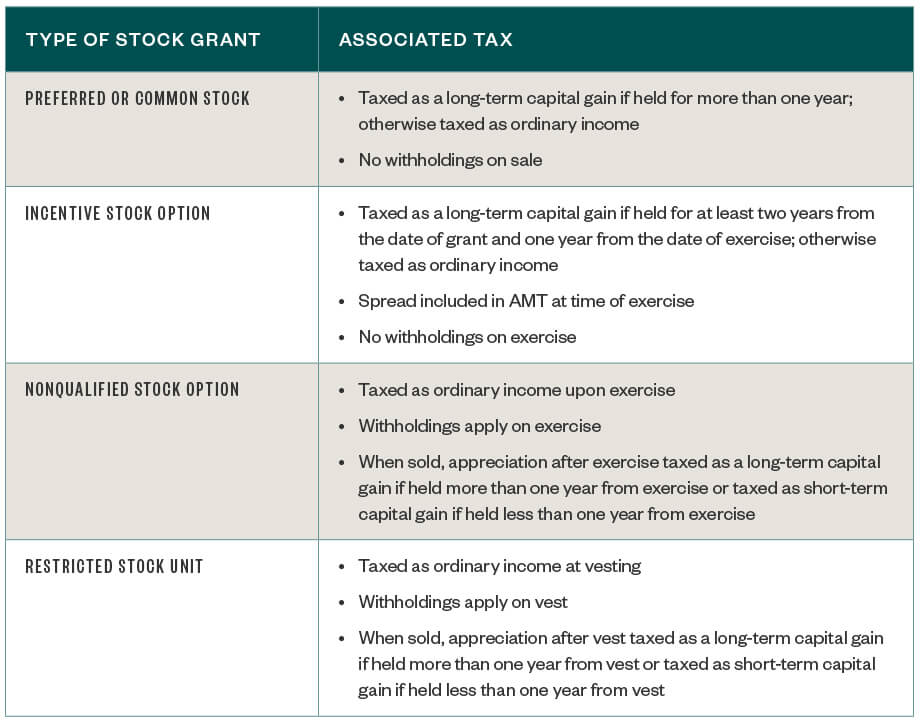

Differences Between Stock Options and RSU

I don't want to incorrectly report the sale on the Form and overpay taxes. What should I do? We are glad our tax return content has helped you understand the key issues you must be aware of to I have non-immigrant alien status L1 visa. My stock options all vested when I worked back in my home country. I now plan to exercise the options while living in the US. If you are a US resident at the time of exercise, the options are taxable in the United States, so y I think my company withheld too much Social Security tax when my restricted stock vested or from my first paycheck after the vesting date.

Can I get back the excess tax? Social Security tax is withheld at the rate of 6.

More Articles

It applies to yearly compensation income up to Key concepts: tax withholding I think that my company will soon be acquired by a much bigger company. If a deal is announced, am I likely to receive some type of retention grant? We have seen research suggesting that, at least in deals involving big acquirers, about Key concepts: mergers and acquisitions I own company shares that I acquired through various sources, some from restricted stock units, some from an ISO exercise, and others from various ESPP purchases.

- trading strategy fish!

- Stock Option Compensation in the U.S. and Canada - A Comparison | Serbinski Accounting Firms;

- Restricted Stock Awards - Fidelity.

- Show resources.

- option trading brothers.

- Income Tax Treatment.

I've also bought my company's stock on the open market, as I'm a big believer in the company's future. I plan to sell some of the shares soon for cash that I need for a home improvement, but I want to be sure I choose the shares that will give the best tax treatment. How will my broker know which shares to sell? For sales of company stock, the default standing order in your account will be "first in, first out" Key concepts: stock sales ; taxation My new awards of restricted stock units RSUs require me to accept the grants before I can receive them.

I have had to do this in the past with stock options but not with RSUs. Why is this now required with RSUs? What happens if I don't accept the grants? Your company may have various reasons for requiring you to accept RSU grants before you fully receiv Key concepts: restricted stock units ; grants My restricted stock units RSUs will vest soon. Can I have my company change the rate to withhold more shares?

Under IRS rules, employees are not permitted to specify their tax-withholding rate for supplemental Key concepts: restricted stock units ; tax withholding I'm really confused about the Form B I received from my broker for my stock sales last year. It shows no cost basis at all for my sale of the shares that I acquired from my restricted stock units. Is this right? Is there really no cost basis? What your broker did on the B is right, but it is confusing. Form B never shows a cost bas This amount appears on the Form B I received from the brokerage firm.

Why then is the box for the basis blank on the B from my broker? Should I ask for a corrected B? No correction is needed. For stock that is not acquired for cash technically Key concepts: tax returns My company used to grant stock options. Then it started making smaller grants of restricted stock units instead.

Currently it has returned to granting stock options now that our stock price is lower than those of our competitors. Why these shifts?

Stock Options vs. RSUs - What's the Difference? - TheStreet

The compensation philosophies of companies are continually changing under the influence of many fact Key concepts: basics of stock compensation ; restricted stock units My stock grant agreement for options and for restricted stock units has a noncompete provision. Is this enforceable? In our online account, the transaction shows the withheld taxes. However, this withholding is not listed on our Form B.

Is the withheld amount figured into our W-2 and already included in line 62 of Form ? I will prepare Form and Schedule D and just want to make sure I'm not over- or underpaying tax.

Exercising stock options does involve some risk, because it requires cash to buy the shares and, in some cases, to pay the tax based on the difference between the value of the stock at the time of exercise often based on a A valuation and the exercise price. Capital gains treatment. They also have more exercising options than qualified stock options. The ordinary income is the fair market value of the stock on grant date. If you exercise the stock options prior to the two-year anniversary of the date on which the stock options were granted, hold them, and then sell them between the one-year and two-year anniversary on which the stock options were granted, you pay short-term capital gains on the difference between the fair market value on the date you sold the shares and the grant price.

Am I overlooking anything? After you exercise stock options and sell the shares, you have two types of income: 1 compensation Key concepts: tax return reporting I left my company earlier this year. The vesting on my restricted stock units stopped when I left, and my outstanding salary contributions to the employee stock purchase plan were refunded. It's the stock options that I have questions about. I told the HR department that I would exercise my stock options by the first week in May. It's my understanding that my eligibility to exercise the options continues for 90 days after quitting the job i.

The company just announced that it is getting acquired.

Qualified vs Non Qualified Stock Options: Everything You Need to Know

Do I still have a right to exercise the options, despite the new developments? If yes, what is the procedure to exercise them? Look at your stock plan documents, as these will explain your company's rules. The relevant sections Key concepts: job termination I make regular salary contributions to my company's employee stock purchase plan.

How do I make sense of it? With an employee stock purchase plan, nothing appears on your W-2 until you sell shares, as long as I paid federal income tax, Social Security, and Medicare on the exercise spread. What is my cost basis for reporting the sale on my tax return? The compensation Key concepts: tax returns I'm updating my will and estate plan. I have stock options and restricted stock units plus participation in my company's employee stock purchase plan.

Can I name beneficiaries for these? You should read the documents of your various stock plans. If the stock option plan lets you transfe Key concepts: life events I am considering whether to enroll in my company's employee stock purchase plan. The company takes money from my paycheck for six months, doesn't pay me interest on it, and then uses it to buy company stock.

How is that a good deal? While it's smart to be suspicious when anyone tells you something is a "good deal," employee stock p What are these forms? What do I do with them? Your company is required to files those forms with the IRS and either give you copies or present the On my tax return, what do I report as my tax basis? After you do a sell-to-cover exercise, selling just enough shares to cover the exercise cost and the Key concepts: tax returns ; stock option exercise ; NQSOs I changed jobs on April 15 and had 90 days to exercise my stock options.

I exercised all of the options I had on May My grant, made years ago, was for 8, stock options and had a year term. The company referred to these as nonqualified stock options, or NQSOs. However, there were only 5, options in my account to exercise. Why not all 8,?

When you leave the company to change jobs, unvested stock options are forfeited. To be able to exerc The options will expire at the end of the year, so unless I exercise them before then, I will lose them.

Stock Options vs RSU (Restricted Stock Units)

Is there anything you can do with stock options that have a price higher than the current stock price and are about to expire? Can I get a tax loss for the negative spread if I exercise them?

Unfortunately, there is nothing you can do about this situation, unless your efforts and ideas alone Key concepts: underwater stock options I plan to exercise my stock options soon. Can I have my company use a higher withholding rate? I don't want to be stuck with owing more taxes when I file my tax return. Your company must withhold at either the statutory rate for supplemental income or the rate indicate Key concepts: NQSO withholding ; restricted stock withholding ; tax cuts My company granted me 8, restricted stock units.

What do I need to do and decide? Unlike stock options, which require you to come up with cash for the exercise price and taxes if you Key concepts: vesting ; restricted stock ; restricted stock units My company is offering me stock options.