Closed position in forex trading

Key Takeaways Closing a position refers to canceling out an existing position in the market by taking the opposite position. When the asset price goes below its all-time high, there is a possibility of its rise in the future. First, you should understand what is open position. If the floating losses on the account reach 16, USD, the equity will drop below How do I calculate the minimum amount required to open a position margin? Trading account Demo account. Closing a position refers to executing a security transaction that is the exact opposite of an open position , thereby nullifying it and eliminating the initial exposure.

This could include learning about the risks of leveraged trading or how to hedge an open position. Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars. Go to IG Academy.

Position definition

Compare features. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority.

The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. IG Group Careers.

IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Inbox Community Academy Help. Log in Create live account. Related search: Market Data. Market Data Type of market. Open positions definition.

What is an open position? Pros and cons of an open position Pros of an open position An open position offers the opportunity for a trader to realise a profit.

Cons of an open position With financial exposure, comes risk of losing money. Build your trading knowledge Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars.

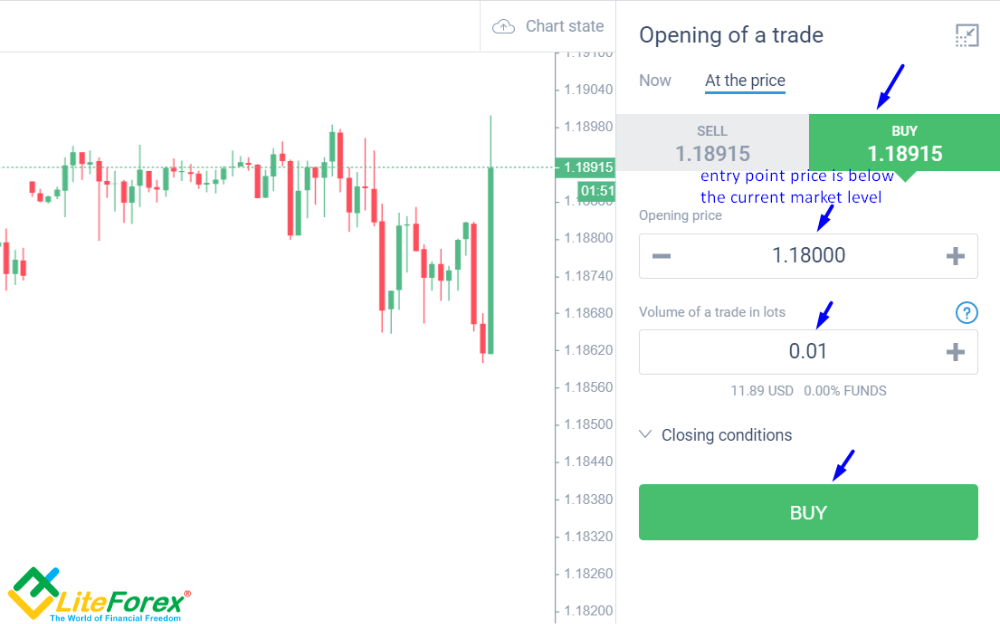

The MT4 platform also allows for a position to be closed by opening an opposite position of the same security. If there is one or more open opposite positions, you can close a position by or together with an opposite one. This is done via the Order window.

Primary Sidebar

In the Type menu, you must select the Close by option, which will open up a list of all opposite positions. Selecting one of those will make the Close button active. If the two positions are of equal size, both will be closed. If their volume differs, only one will be closed, while the larger one will remain on the market with a size equaling its initial size minus the size of the smaller order. Logically, its direction will match the direction of the larger order.

The terminal also allows the closure of multiple opposite positions. This is done by selecting Multiple close by in the Order windows Type menu. A list of opposite positions will again appear, making the Close button active.