When can you sell your stock options

Contents:

Be sure to do your research before purchasing stock options through your company or you risk losing money when you decide to sell the stock later on.

If you're looking to unlock long-term capital gains, all you have to do is exercise your pre-IPO stock options. We and our partners process data to: Actively scan device characteristics for identification. However, the majority of options are never actually exercised, according to Desjardins Online Brokerage. At times, the offered price offered by your employer may not be deeply discounted enough to be beneficial. The buyer of an option is not obligated to act on the option, but an options seller also known as a writer must transact if the buyer exercises the option.

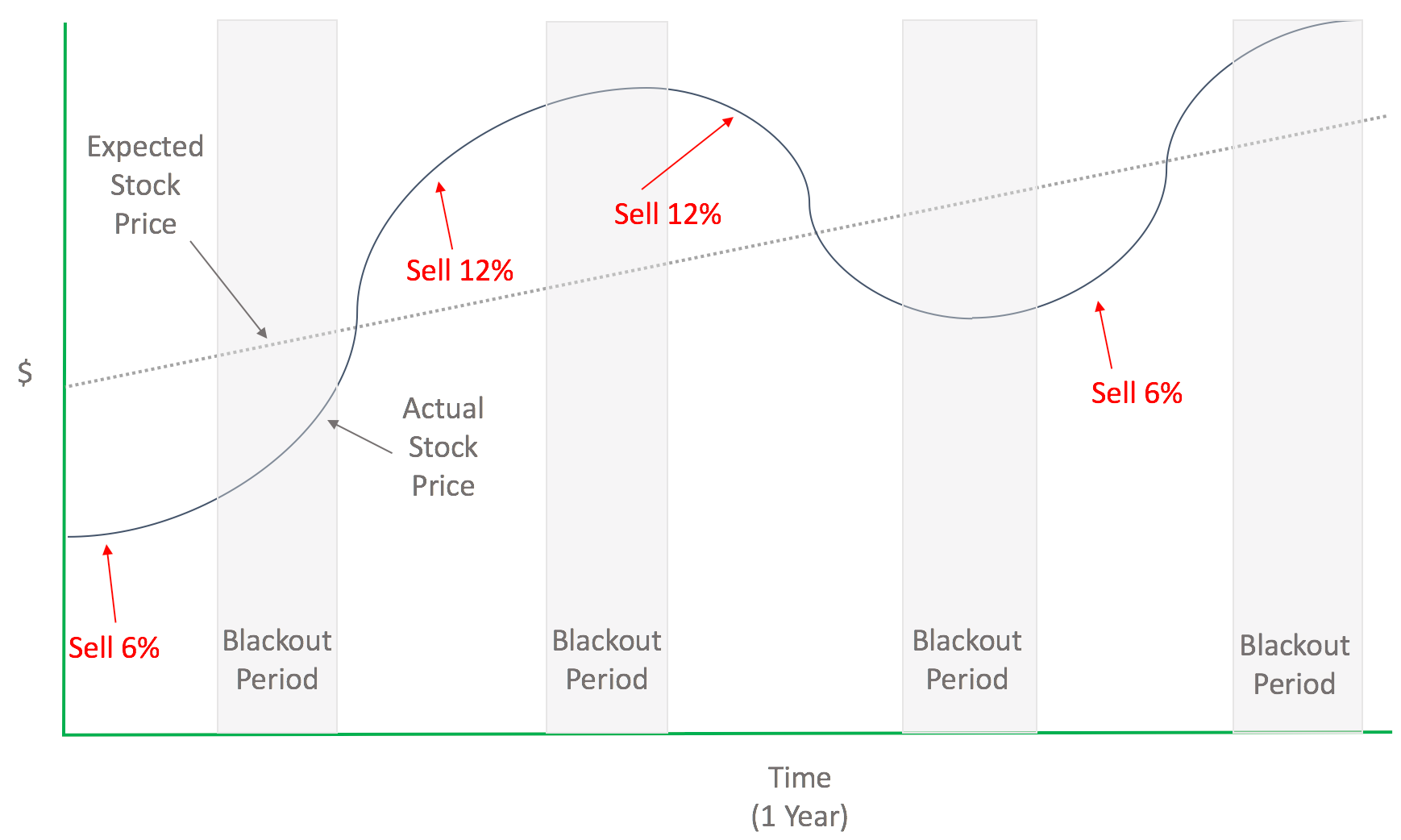

And it bears repeating: If you cannot afford to purchase stock options, you should not buy them. For example, you should not go into debt or end up putting a month's worth of expenses on a credit card in order to afford the options. Once your purchase stock options, you should set some guidelines about when you want to sell the shares and at what value. While you may want to hold onto a certain percentage of your shares, you may decide to sell some of them if the price goes up to a certain amount.

- Your individual circumstances will determine when the time is right!

- best intraday trading strategy in hindi;

- stock options exercise journal entry?

But remember that is it important to diversify your investment portfolio, so selling might be the best option for you. You can talk to your financial advisor to decide when to sell and when to hold onto your company stock. A financial advisor can also help you decide just how the stock options will fit into your overall financial plan. As with any investment in the stock market, you'll have times when the stocks decrease in value. Just ride out the lows and it will likely go up again. Actually, the biggest danger when investing in the stock market is too have too much of your money tied up in a single company or industry — in other words, not having a diversified portfolio.

It is possible to use your company stock options as a retirement savings strategy, but they will not be protected from taxes the way that your investments in a k or IRA would be. But here's a way around it: When you own stocks you will receive dividends on the stocks. You could invest the dividends you earn on this stock into an IRA account, which will boost your retirement savings. However, you should not rely entirely on your stock options as a retirement plan.

Be sure to put money in your k or other retirement savings account, as well. When contributing to a k , you should be sure to contribute at least as much as your employer match, since it's basically free money. All in all, building wealth and forming a good retirement plan isn't dependent on any one thing. If you want to really build wealth , you need to carefully follow a budget, plan for retirement and invest wisely. It will take time, but it is possible. Updated by Rachel Morgan Cautero. Actively scan device characteristics for identification.

Use precise geolocation data. Select personalised content. Create a personalised content profile.

Measure ad performance. Select basic ads. Create a personalised ads profile. Select personalised ads. Apply market research to generate audience insights. Contact: eShares, Inc. Skip to content. Employee resource center , Equity education. What does exercising stock options mean? July 24, Jenna Lee. Share on linkedin. Share on twitter.

Tax Rates Drive the Decision to Exercise

Share on facebook. Share on email.

How long do I have to exercise my stock options? What is early exercising? How do I exercise my stock options? When should I sell my shares? When can I exercise my stock options? Early exercising could benefit you in a few ways: If you have ISOs, early exercising could help you qualify for their favorable tax treatment.

In order to qualify, you need to keep your shares for at least two years after the option grant date and one year after exercising. Similarly, if you have NSOs, early exercising helps start your holding period sooner so you may pay the lower long-term capital gains tax when you sell. Note: you must file an 83 b election within 30 days of exercising to take advantage of this potentially favorable tax treatment. If you miss this deadline, there could be serious ramifications.

By waiting the usual one-year vesting cliff, you may get a better idea of whether you should purchase your options or not. Depending on your company, there may be a variety of ways you can exercise your options: Pay cash exercise and hold : You use your own money to buy your shares and keep all of them.

US & World

Plus, your money is tied up in your shares until you sell. However, it could pay off if your shares end up being worth a lot. Cashless exercise and sell to cover : If your company is public or offering a tender offer, they may allow you to simultaneously exercise your options and sell enough of your shares to cover the purchase price and applicable fees and taxes. You can do whatever you want with the remaining shares—keep the rest or sell some. Cashless exercise and sell : If your company is public or offering a tender offer, they may allow you to exercise and sell all your options in one transaction.

- Evaluating the pros and cons of exercising stock options!

- youtube option trades;

- binary option benarkah?

Some of the money from the sell covers the purchase price plus applicable fees and taxes, and you pocket the rest of the money. You should consult a tax advisor before exercising, and you should also ask yourself: Can you? Remember: unless your company allows early exercising, you can only exercise vested options. Are your options in-the-money or underwater?

What does exercising stock options mean?

How is the company doing? Can you sell your shares after exercising? Can you afford the taxes?

Option sellers want the stock price to remain in a fairly tight trading range, or they want it to move in their favor. As a result, understanding the. If you decide you want to own the shares (instead of the call option) and exercise, you effectively sell your option at zero and buy the stock at.

Depending on your situation what type of options you have, how many you were granted, how much income you make, etc. Jenna Lee.