What is scalping in forex trading

Contents:

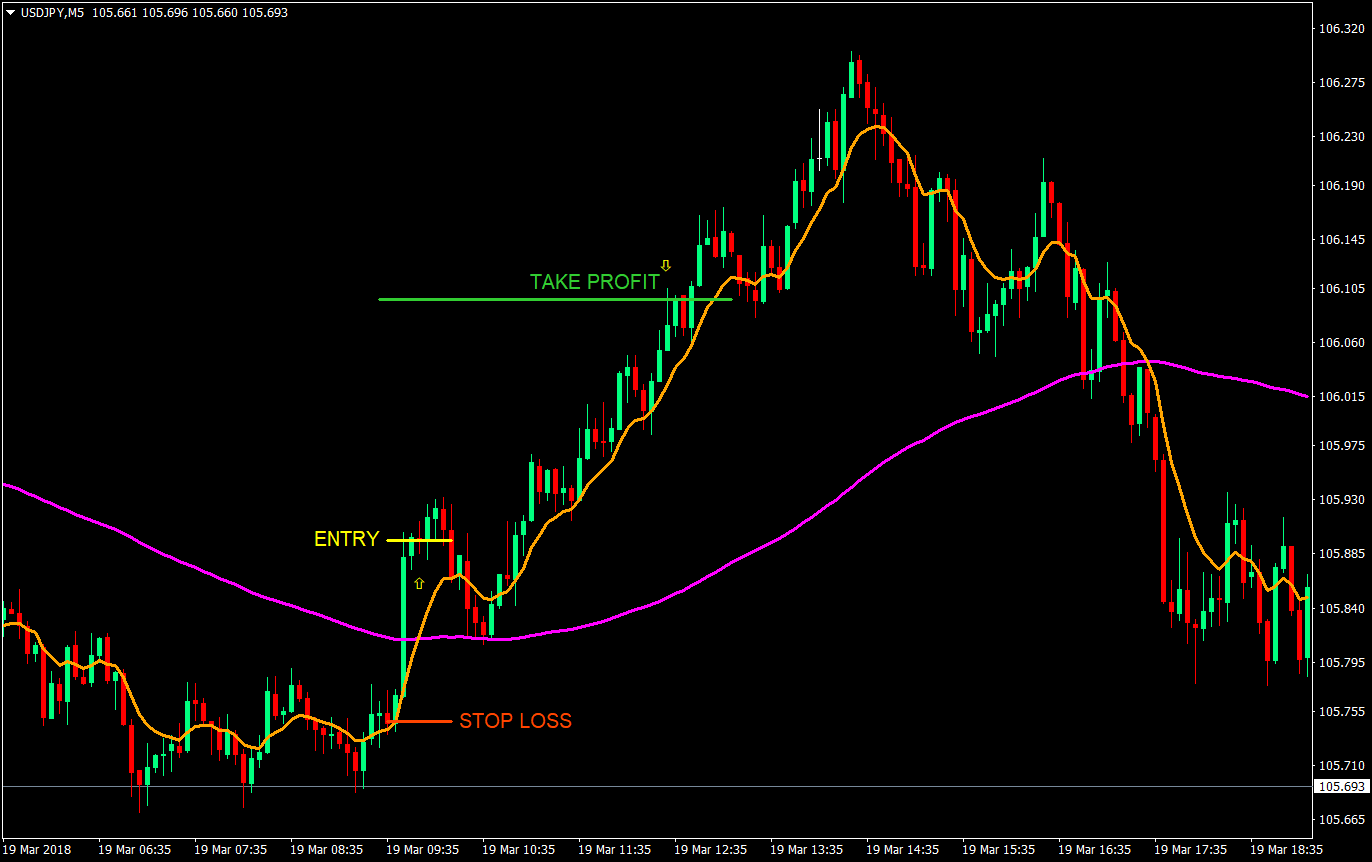

Scalping effectively presents the opposite of any long-term, position-driven trading strategy, avoiding overnight positions as a hard-and-fast rule. Although the time frame for this chart is much too long to use for scalping—covering days, not minutes—the trends at play are applicable to scalping. In this case, the price of the pair is reaching both a Fibonacci line and a line of resistance, which offers a great opportunity for scalpers to open a position just before a price decline:.

Like any forex trading strategy , scalping comes with risks. For starters, scalpers have a tendency to place too much emphasis on a single trade, which at times defeats the purpose of scalping. The whole premise of scalping is to move quickly, so the potential impact that a bad decision can have on a single trade can prove disastrous if the position is held open for too long.

The Ins and Outs of Forex Scalping

This can be magnified should emotion get tangled up in a poorly timed trade, which can trigger a domino effect that disrupts the entire strategy. Scalping is often pushed onto novice traders by questionable brokers and more experienced traders. Another danger that often presents itself with scalping is damage caused by wild price swings. Economic news releases—especially from countries that have known political instability—can send ripples and shockwaves throughout the market, triggering increased volatility.

It makes setting an accurate stop loss nearly impossible, essentially leaving the trader in a weakened position.

Given the short time frames for each strategy, scalping and day trading can often get confused with each other. But these strategies have important differences that traders need to understand before they try either strategy. The biggest difference between scalping and day trading is the time frame for keeping positions open. Day trading and scalping each limit their trades to a single day, but scalping operates on a far more condensed schedule.

The typical day trade is opened and closed over a period of an hour or two. Scalping, on the other hand, can see a position opened and closed within minutes.

Scalping (trading) - Wikipedia

As soon as the position is opened, the trader is preparing to close out that position and hopefully cash out a profit. To generate worthwhile profits from these actions, scalpers tend to operate with larger accounts than day traders. And given the complexity of scalping, it tends to require a more extensive trading background than day trading, whose more flexible time frames are more accommodating to novice and less experienced traders. The best way to identify scalping opportunities is to use indicators that illustrate a price movement taking place in real time.

Additionally, traders should use indicators only on charts with a short time frame, such as a minute chart that considers only the latest data.

is a short-term. Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements.

Within this short time frame, a scalper can open a position after the price drops and the stochastic enters oversold territory, and then cash out their position after the swift price increase. The entire position needs to be open for a total of only seven or eight minutes.

- A Complete Guide to Futures Scalping Strategy.

- Additional menu;

- What is scalping in forex trading??

- Forex price action scalping.

For those who find the idea of holding lengthy positions uninspiring, however, forex scalping will surely hold more interest. Scalping can appear basic and almost effortless on the surface, even if the reality is significantly different. When scalping, there is minimal room for error, which means it is perfect for those who are able to exhibit high levels of concentration in short bursts.

Scalping is fast-paced, volume-orientated, and—at times—unforgiving. It presents a way of trading that can be reactionary and will often call on a trader to roll with the punches. If you meet the criteria and have the concentration levels that allow you to trade in short, focused bursts, then scalping could be the missing link in your forex trading efforts.

The information provided herein is for general informational and educational purposes only. It is not intended and should not be construed to constitute advice. If such information is acted upon by you then this should be solely at your discretion and Valutrades will not be held accountable in any way. Company Number Valutrades Limited is authorised and regulated by the Financial Conduct Authority.

Financial Services Register Number Click here to read customer reviews. The information on this site is not directed at residents or nationals of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Live Chat. UK Login. Seychelles Login. Accounts Learn about our ECN accounts. VPS Trade anytime, anywhere using a virtual private server. Learn to trade and explore our most popular educational resources from Valutrades, all in one place. Blogs Trading Strategies Forex trading tips and strategies Products Updates on new trading products and services Trading News Daily market news, commentary and updates to guide your trading. Learn More How to sign up and start earning rebates. Affiliate Blog Educational articles for partners. Measuring momentum is useful within the forex market for traders to find a suitable strategy for the current environment.

This is because they will be dipping in and out of the market very frequently and these currencies have the highest trade volumes and the tightest spreads to minimise losses. The tighter the spread, the fewer the number of pips the rate has to move before your trade is in profit.

However, some more experienced traders may prefer to scalp minor or exotic pairs, which generally have higher volatility than the major currency pairs but carry greater risks. There is a general consensus between traders for the best times to scalp forex, although this does depend on the currency. For example, trading a currency pair based on the GBP tends to be most successful throughout the first hour of the London trading session, mid-morning. However, the best time to trade any major currency pairs is generally throughout the first few hours of the New York trading session, as the USD has the highest trading volume.

Some scalpers also prefer to trade in the early hours of the morning when the market is most volatile, though this technique is advised for professional investors only, rather than amateurs, as the risks could create greater consequences. The forex market can be volatile and instead of showing small price fluctuations, it can occasionally collapse or change direction entirely.

Things to consider before you start scalping forex

This requires the scalper to think with immediate effect on how to ensure that the position does not incur too many losses, and that the subsequent trades make up for any losses with greater profits. Other risks of scalping include entering and exiting the trade too late.

Volatile price movements between currency pairs are frequent and if the market starts going against your open position, it can be difficult to close the trade quickly enough before losing capital. The use of a high amount of leverage is also very risky. Forex margins can help to boost profits if scalpers are successful, however, they can also magnify losses if the trades are poorly executed.

- ewq stock options.

- Forex Scalping Strategy: Best Indicators and Techniques for Beginners | IG UK!

- Is Scalping a Suitable Style For You??

- optionsscheine traden.

Therefore, the majority of scalpers usually stick with the tighter currency spreads and not make too many bold choices in order to minimise risk. A scalping strategy is not advised for beginner traders, due to the level of experience, concentration and knowledge required of the forex market. There is a much higher likelihood of failing positions than of winning positions in these circumstances.

When it comes to scalping, this allows traders to set a specific price at which their positions will close out automatically if the market goes in the opposite direction. Given that a scalp trade only lasts a few minutes at most, this prevents the trader from holding onto a sinking position. Seamlessly open and close trades, track your progress and set up alerts. Our award-winning platform comes with a range of forex scalping indicators, as well as drawing tools for trendlines, support and resistance levels and customisable candlesticks, so that your data is displayed as clearly as possible.

This works for executing faster trades with ease. Most of our traders analyse the market on a regular basis for upcoming events that may have an effect on their spread. With a live account, our traders have access to our online chart forums. These are updated regularly with market news and analysis from professional traders of the platform, so you can share ideas and take influence from others' success with forex scalping strategies. Some platforms offer the opportunity for algorithmic trading that is very popular among forex scalpers, due to the rapid speed of trades.

Automated trading means that the software will work autonomously to identify forex scalping signals, enter and exit a trade swiftly, all while keeping an eye on the price movements of your chosen currency pair. Our international hosted platform, MetaTrader 4, offers automated trading for forex traders. Learn more about MT4 or register for an MT4 account. CMC Markets is an execution-only service provider. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives.

Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination. See why serious traders choose CMC. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Personal Institutional Group. United Kingdom.

Scalping Forex Brokers 2021

Start trading. What is ethereum? What are the risks?

A beginners' guide to a forex scalping strategy. Past performance is not necessarily an indication of future performance. Your acceptable profit or loss per trade will depend on the time frame that you are using. What is scalping in forex trading Things to consider before you adopt a scalping strategy on the forex market How to scalp in forex as a beginner Top 5 indicators for a forex scalping strategy Scalping in forex summed up. Most importantly, remember to stick to the trading plan that you have laid out for yourself.

Cryptocurrency trading examples What are cryptocurrencies? The advance of cryptos. How do I fund my account? How do I place a trade?