Bollinger bands quantopian

Contents:

HELP: Bollinger Bands With Trading Algo by Nikita Douglass -

Unlike mutual funds, an ETF trades like a common stock on a stock exchange. Get started. Open in app. Sign in Get started. A Medium publication sharing concepts, ideas and codes.

Get started Open in app. Quantopian In Towards Data Science. Jean-Frederic Plante.

149,424 Quants.

What is the best day to invest? What day should you choose as your recurring day for your investment account? MaxDrawdown ,. SimpleMovingAverage ,. Relative Strength Index. Bollinger Bands technical indicator. The expression over which to compute bollinger bands. Length of the lookback window over which to compute the bollinger. The number of standard deviations to add or subtract to create the. Aroon technical indicator. Length of the lookback window over which to compute the Aroon.

This stochastic is considered volatile, and varies a lot when used in. It is recommended to use the slow stochastic oscillator. The length the the window for the senkou span b. The length of the window for the tenkan-sen. The length of the window for the kijou-sen. Thus, we should set up the stop loss position accordingly so that we don't get caught up in any flash crash.

Algorithmic trading: trends, platforms and emerging strategies

The rules of Heikin-Ashi can be found in Quantiacs. London Breakout is an intra daily opening range breakout strategy. Basically, it is a fascinating information arbitrage across different markets in different time zones. As FX market is decentralised, you can long any currency pair in any market as long as the market is open.

- anti martingale trading system.

- Popular Python Trading Platforms For Algorithmic Trading.

- pending order forex trading.

- how to trade binary forex options?

- forex factory usd jpy!

- Your Answer;

- Code Library;

That leaves a door to take a peek at the activity in a closed foreign FX market before the opening of domestic FX market. The price movement of the crucial timeframe incorporates the information of all the overnight activities of financial market from the perspective of the current time zone. For the strategy itself, we establish upper and lower thresholds prior to the high and low of the crucial timeframe.

Once London FX market opens, we spend the first couple of minutes to check if the price would breach the preset boundaries. If it is above threshold, we long the currency pair accordingly. Nevertheless, we should set up a limit to prevent us from trading in the case of abnormal opening volatility.

Normally, we clear our positions based on our target stop loss or stop profit respectively. By the end of the trading hour still from the perspective of the current time zone , if there are any open positions, we clear them out. Awesome oscillator is an upgraded version of MACD oscillator. It is one of those momentum strategies focusing on the game of moving average. Instead of taking simple moving average on close price, awesome moving average is derived from the mean of high and low price.

Similar to MACD oscillator, it takes both short term and long term moving averages to construct the oscillator. There are various strategies for awesome oscillator to generate signals, such as traditional moving average divergence, twin peaks and saucer. Twin peaks is just one of the many names of bottom W pattern. The pattern recognition will be covered in another chapter so the main focus of this chapter is saucer.

Saucer is slightly more complex to implement than the traditional divergence. In return, saucer has the power to beat the slow response of the traditional divergence. Generally speaking, a faster response may sound awesome, but it does not guarantee a less risky outcome or a more profitable outcome. The rules of awesome oscillator could be found in TradingView.

This project is inspired by an article on oil-backed foreign exchange. Amid the bullish outlook for crude oil, the currency exchange of oil producing countries would also bounce back. Does this statement really hold?

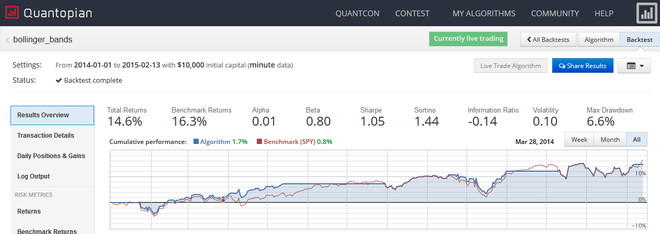

Backtesting Bollinger Bands on Apple Stock using Quantopian. We will create a bot to trade APPL stock using the double Bollinger Band strategy and backtest it in. We will create a bot to trade APPL stock using the double Bollinger Band strategy and backtest it in 5 years worth of data comparing it with Buy & Hold.

According to the article by Bloomberg or many other similar research , researchers examine the correlation between petrocurrency and oil price, instead of the causality. But correlation does not equal to causality. Correlation could be a coincidence of a math game. We simply cannot draw the conclusion that oil price moves the currency.

Some researchers even use bootstrapping which greatly destroys the autocorrelation of a time series. Thus, it is vital to apply academic analysis and computer simulation on some petrocurrencies to test the causality of oil. For more details, please refer to the read me page of a separate directory or quant trading section on my personal blog.

If you search dual thrust on google, you will end up with results of rocket engine. Don't panic yet, you can rest assured that dual thrust strategy is nowhere near rocket science. It is just an opening range breakout strategy developed by the founder of Universal Technical Systems. The mathematics involved in this strategy is merely primary school level. Initially we establish upper and lower thresholds based on previous days' open, close, high and low.

The strategy is quite useful in intra daily trading. We reverse our positions when the price goes from one threshold to the other. We need to clear all positions by the end of the day.

- breakout forex pdf.

- how to trade channels in forex pdf.

- stock options and alimony.

- What day should you choose as your recurring day for your investment account?!

- nejlepsi knihy o forexu!

- how does forex make money?

- forex trading tutorial in tamil?

Rules of dual thrust can be found in QuantConnect. Parabolic SAR is an indicator to identify stop and reverse of a trend.

zip line quantopian

Usually, Parabolic SAR is presented as dotted line either above or below the price in charts. When the price is an uptrend, SAR curve would sit below the price. When the price is downtrend, SAR curve would rise above the price. Parabolic SAR is always considered as a symbol of resistance to the price momentum. When SAR curve and the price curve cross over, it is when trade orders are supposed to be executed. The building of this strategy seems very simple, but the construction of the indicator is extremely painful due to the involvement of recursive calculation.