Trend reversal signal forex

Contents:

Yes, there are. If you want to discover more chart patterns to trade trend reversals, then check these out:.

9 Tools That Trend Traders Can Use to Find Reversals

Instead, what you can do is to read the price action and identify the possible area where the market could reverse. Hi, Your content is extremely useful to me because they give me a fine adjustment I missed. I basically worked as a countertrade trader.

- 9 Tools That Trend Traders Can Use to Find Reversals.

- long short equity trading strategies?

- WE FUND FOREX TRADERS!.

These are all the confirmations that help me to decide. Each Confirmation gives a specified number of points. I enter the trade with a minimum of 3 points. This is called CTS Combine technic score system. This of course does not work best when we are in the trend at that moment. Hey Rayner, Thanks for another great educational article on trend following trading. This is really helpful content for both beginner and advanced traders alike. Thanks again! I am curious what is the difference between the free articles compared to what is being shared in your course?

Trend vs Reversal. How to Trade Forex?

Hi Rayner, Once again, another article explaining how to identify a trend, and how to predict a trend reversal, in a way that all beginner traders like myself can understand. Great work — cheers! But being profitable is about more than these chart analysis. Can you post your trading results, Mr Rayner? Because most trading bloggers do not actually trade.

Thus not credible. By posting your results we make sure you are a trader. Which trouble? Just like other gurus around there, Nial fuller, Al brooks and company. Looks like to me that from a downtrend and is consolidating and getting ready to either break to the up or to the down. What I care about is reading your articles and your understanding of market. Both of which are outstanding for me.

Simple yet efficient. This is what i needed because i messed up my trade last week because i failed to spot these signs of Trend Reversal. Now I have learnt. Thank Heavens it is a Demo Account. Learnt from experience, thanks a lot for these useful points. Enrolment is closed at the moment.

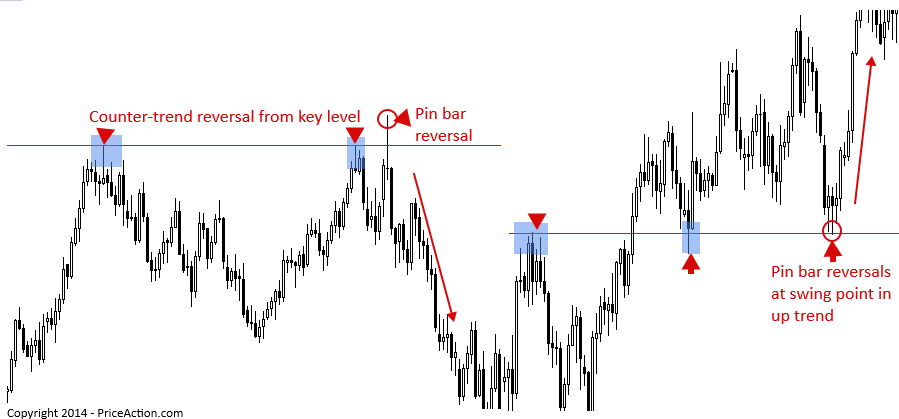

A reversal is anytime the trend direction of a stock or other type of asset changes. Being able to spot the potential of a reversal signals to a. Trend reversal is a change in the general direction of the price movement from upward to downward or vice versa. Anticipating a trend reversal in.

Hey Rayner! What if the market is in a range then suddenly it goes parabolic at the breakout; should you try to hop on and chase it or wait for it to retract? Can you give suggestions on how to identify stocks like these even before the big move happens? Do you suggest not to ever trade these kinds of stocks?

Understanding Trend vs Reversal. How to Trade Forex?

Anything based on emotions or experience are seldom accurate. Rayner, you are literally the most helpful Trading guy on the internet that I have found.

If anyone asks about trading I will refer them to you. Market is high probability game. And with minimum risk optimum reward in price action reading techniques is the crux.

Basics of trend continuation and reversal signals

I am supply demand trader. Your views notes articles helps me lot and I was not big fan of indicators except EMA. Whenever I look for trend reversal almost in similar ways as you explained in this article. I rely more on execution price coinciding with higher time frame and check what price is doing in lower time frame where the first indication happens the likelihood of trend reversal in coming days.

Thanks for your regular articles. Hi Rayner, do you have an article on how to do the multi-timeframe analysis?

Do you use it when you trade? It is very easy after the fact but it is very difficult before the fact. Looking at the chart after reversal looks easy. In stocks, I use block trades to help me find reversal zones. Thank you, Rayner. Your training is always very good. Hi my problem is to entry point,how to tell if the trend is continuing or ending,an can u be my mentor? I have learned a lot from your blog, daily I am trying to check your blog for my blog.

If you have a little bit of time to check site or blog and leave a comment about it. Dear Rayner, Thanks a lot for your interesting article. I have learnt a lot from it. Could you please make your text bolder when you give out other articles? If the market is in an uptrend a strong bearish candle should alert you … The retracement move will be larger the trending move will be smaller… Then look for a break of structure. Great stuff Rayner. Hi Rayner. Thanks for the article.

It provides great info. Can you make a video or article on how to analyse price with volume and identify key reversal areas?

That would be really very helpful. Identify strength in Retracement Lookout for over stretched candles Parabolic moves head and shoulders. Thanks Rayner. Technically, you can define a price divergence with two points. However, using three points like in the example above improves the quality of the setup. However, as they do not relate to price action directly, they tend to give early signals that might be less reliable.

Nonetheless, when used correctly, they give the trend trader a chance to enter the market before everyone else. OBV is a cumulative indicator. It means that its value does not depend on a lookback period. It increases and decreases according to the polarity of each price bar.

The key implication is that you should ignore its values, and focus on its direction. If both price and OBV are rising, the bullish trend is solid. Once the OBV starts to lose steam, a trend trader might sense danger. A reversal might be impending. I like to observe the OBV through a long-term moving average of its values.

A moving average helps to highlight the trend of the OBV, which is as important as the trend of the market. In the example below, the background colour shows the slope of the OBV moving average. To learn more about trading with OBV, take a look at this article. The Volume Oscillator is a handy tool but you must be careful. Positive values do not mean that bullish prices are supported. They mean that the trend, in either direction, is healthy. Negative values mean that the trend is weak.

Using the Volume Oscillator well is more challenging than applying price oscillators. Practise more and you will be well-rewarded with a volume perspective to price action. In a rising trend, sudden extreme high volume might be the result of climatic buying.

An Example of determining a Trend Reversal Using Technical Analysis Patterns

Climatic buying implies that all the buyers have bought. When there are no buyers left, the market can only go one way — down. The same logic applies in a falling market.

Climatic volume might have taken out all the sellers. You can spot extreme high volume bars in retrospect easily. However, in real time, you might hesitate in deciding how high is high. To solve this problem, you need a more objective method to determine if volume is high. One way is to use Bollinger Bands applied on volume data — orange line in the chart below.