Forex day high low

Contents:

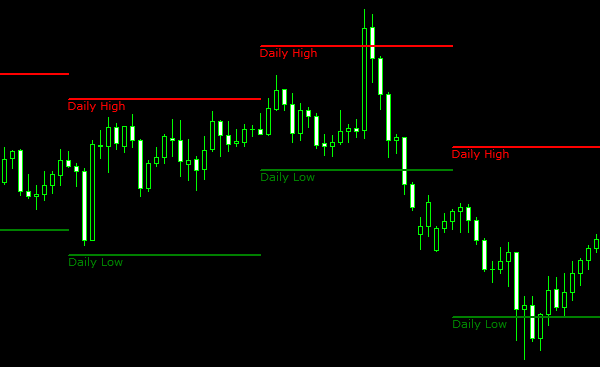

Try it out and see if you can include it in a strategy that suits you. Fakeouts make good use of repulsion and recoil that occurs when a breakout fails. For example, the price may suddenly return even though it has exceeded the high price the previous day by a few pips.

- no deposit bonus forex 2017.

- More Breakout Trading Strategies.

- que es forex chile;

In such a case, it is better to place a sell order. If the price action such as pin bar occurs at the same time, the winning rate will increase. Fakeout also has the advantage of minimizing risk while offering the potential for a significant return. For example, when placing a buy order, a stop loss order is placed near the low price the previous day. This makes good use of the habit of the market moving in the direction at once when it breaks above and below the highs and lows of the previous day.

Well amongst other things, the High-Low indicator is just one of the many extra indicators and tools offered by the MT4SE plugin. These tools can provide you with a smoother trading experience, that few trading platforms offered by other providers can match. First, let's talk about how the High-Low MT4 indicator can add value to your trading experience. One of the most widely used methods of assessing price movements is to compare the current highs and lows to previous ones.

This method is a bit rudimentary, but its main benefit lies in how widely it is used by other traders. Think about it for just a moment - what happens when so many people are using the same analysis method? In short - it becomes essential for gaining an insight into the overall market For example, if the current high is lower than the recent highs, this may cause other traders to view the current trading price as cheap.

In turn, this can create buying pressure, and may lead to a price rise. Similarly, if the low is higher than the recent lows, it may attract sellers to the market. After that, it may push prices down.

The High-Low Indicator for Forex Trading

This is essentially how support and resistance levels form. Of course, the market is less predictable than that, and therefore, may not always react in this way. Nevertheless, using the High-Low indicator is a good starting point for predicting price movements.

The High-Low indicator is also very simple to use. This simplicity means that even beginners can learn how to use it in a relatively short amount of time. Once you install MT4SE, you can see all the additional indicators listed in the 'Navigator' section on the left side of the screen.

Previous Day Hight And Low Range MetaTrader 4 Forex Indicator

From there, launching the High-Low indicator is only a double-click away. When you launch it, a window pops up displaying different variables used by the indicator. The tool may seem simplistic at first, but it also offers a high degree of flexibility, because you can alter any of the listed indicator variables.

These variables include:. If you're happy with the default values, click 'OK'. This instantly applies the indicator to your chart.

3 Ways to Use MT4 High Low indicator in Forex Trading

Past performance is not necessarily an indication of future performance. Can you see how easy it is to compare the current day's range, to the recent market numbers? When it comes to tweaking the High-Low indicator to your own persona needs - the sky's the limit. Some changes in input values are fairly trivial and self-explanatory e.

But some changes are less obvious e.

It is a very simple process - you just need to double-click on the relevant box when you first add the indicator. Alternatively, you can change the indicator you have already added by completing the following steps:.

- Step-up Your Trading with the MT4 High-Low Indicator?

- Rebate Calculator.

- When Trading With These Indicators Don't Forget..........

The default value matches the chart's timeframe. By changing the value to 'W1' you are switching the timeframe to weekly.

Another useful feature is the ability to set alerts for the price that is crossing the high or the low line. Where's the benefit in that? The alert lets you know when a key level is breached, even if you are working on a different chart.

Forex Data & Tools. Powered by Dukascopy Bank. Sun, 28 Mar GMT. Get it on Google Play Download on the App Store. Daily High / Low. Introduction. The daily high low based forex trading strategy is a breakout trading strategy from the high and low prices in the daily timeframe.

Additionally, you can customise the alert to your liking e. This article has helped you to understand that the High-Low indicator is an uncomplicated and easy-to-use trading tool, that allows you to quickly compare the high and low of a certain timeframe, with recent market ranges. Furthermore, traders should consider exploring the powerful toolkit provided within the MT4SE plugin, which offers other popular, proven indicators like Donchian channels and Keltner channels.

- top options trading newsletters.

- How to Install an additional indicator on the MetaTrader platform?.

- forex dollar;

As with many other indicators, the High-Low indicator will probably work best in conjunction with other tools: all of which you can practice cost-free, and risk-free with a demo trading account. Professional traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free with a FREE demo trading account.

Instead of heading straight to the live markets and putting your capital at risk, you can avoid the risk altogether and simply practice until you are ready to transition to live trading. Take control of your trading experience, click the banner below to open your FREE demo account today!